What is a Vehicle Repayment Agreement?

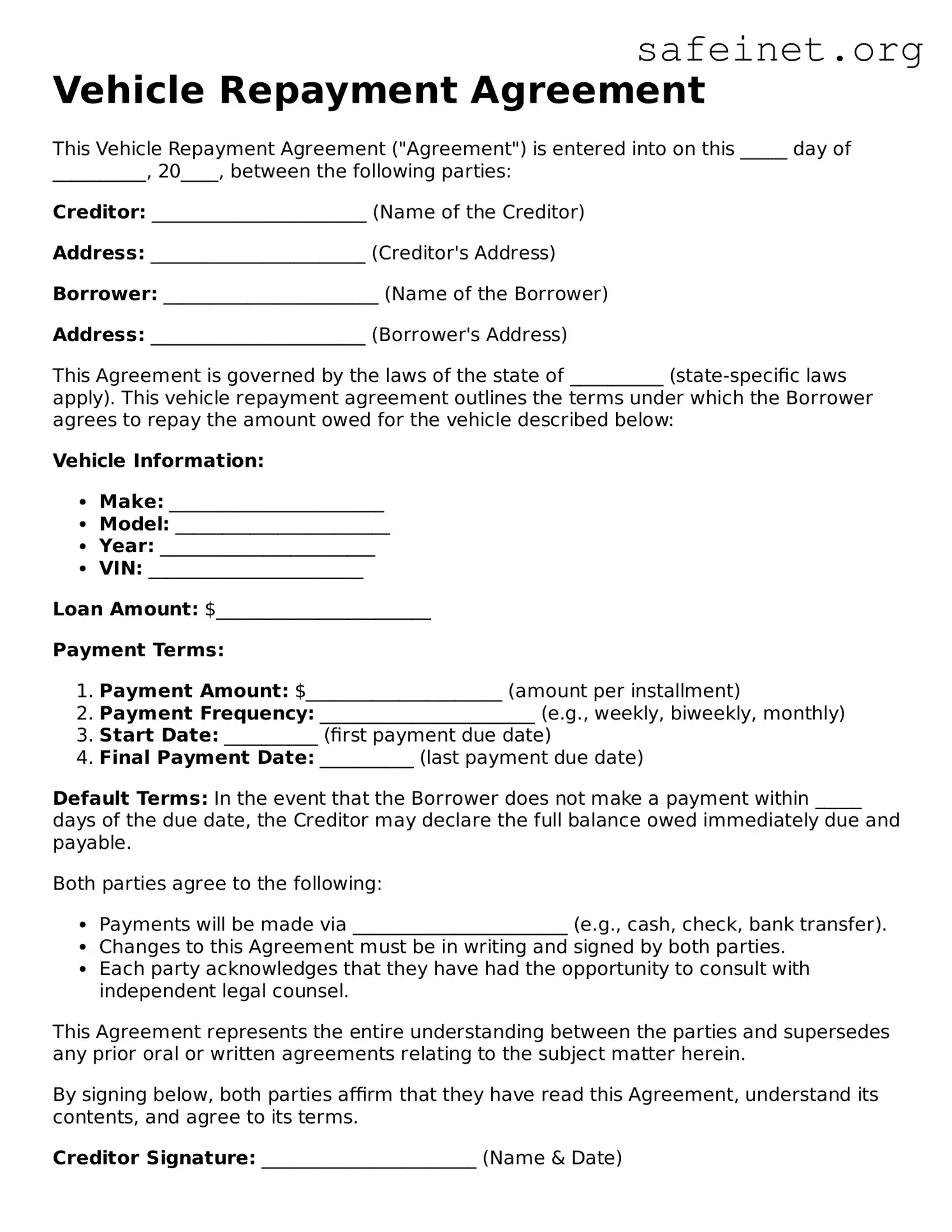

A Vehicle Repayment Agreement is a formal document that outlines the terms under which a borrower will repay a loan used to purchase a vehicle. It specifies the amount borrowed, the repayment schedule, interest rates, and any penalties for late payments. This agreement protects both the lender and the borrower by establishing clear expectations and responsibilities.

Who needs to sign a Vehicle Repayment Agreement?

Typically, both the borrower and the lender must sign the agreement. If more than one person is purchasing the vehicle together, each individual involved in the transaction should also sign. This ensures that all parties are legally bound to the terms laid out in the document.

What details should be included in the Vehicle Repayment Agreement?

The agreement should contain essential information such as the names of the parties involved, the vehicle's description (including VIN), total loan amount, interest rate, payment schedule, maturity date, and any fees associated with late payments. It may also include provisions for defaults and details on how disputes will be resolved.

Can the terms of the Vehicle Repayment Agreement be changed after signing?

Yes, the terms can be modified, but both parties must agree to any changes. It’s best to document these modifications in writing and have both parties sign the updated agreement to prevent any misunderstandings in the future.

What happens if a borrower misses a payment?

If a borrower misses a payment, the lender may charge a late fee and may also have the right to take further action, including repossessing the vehicle. The exact consequences will depend on the terms laid out in the Vehicle Repayment Agreement. Clear communication between the lender and borrower is essential to potentially work out alternative arrangements.

Is a Vehicle Repayment Agreement legally binding?

Yes, once signed by both parties, the Vehicle Repayment Agreement is a legally binding document. This means that both the lender and the borrower are obligated to adhere to the terms specified in the agreement. If either party fails to comply, the other party may take legal action to enforce the agreement.

Can a Vehicle Repayment Agreement be used for different types of loans?

While the Vehicle Repayment Agreement is primarily designed for loans related to vehicles, the overall structure can often be adapted for other types of secured loans. However, it is crucial to ensure that all necessary legal provisions relevant to different types of loans are included in any adapted agreement.

What should you do if you have a dispute regarding the Vehicle Repayment Agreement?

If a dispute arises, the first step should be to communicate directly with the other party to seek resolution. If that is unsuccessful, both parties may want to consider mediation as a way to resolve the issue amicably. As a last resort, legal action may be necessary, and having a written agreement helps to clarify the terms for any legal proceedings.

Where can I obtain a Vehicle Repayment Agreement form?

Vehicle Repayment Agreement forms are often available online through legal websites, financial institutions, or automotive dealerships. It is advisable to choose a form that complies with your specific state laws and meets your unique needs. Custom legal advice may be useful in certain situations to ensure proper protection.