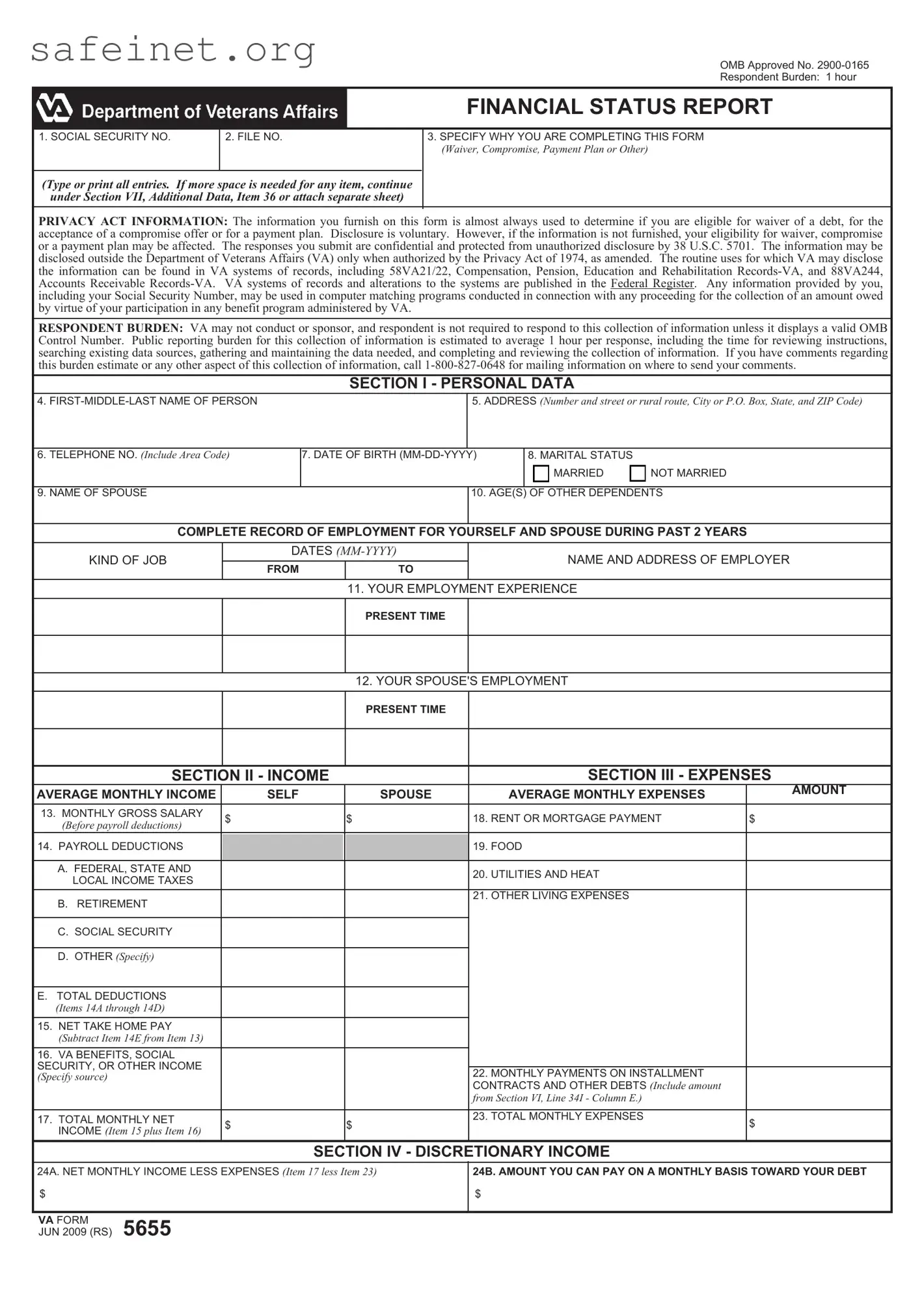

What is the VA 5655 form?

The VA 5655 form, also known as the "Financial Status Report," is a form used by veterans to provide the Department of Veterans Affairs with information about their financial situation. This information helps the VA assess a veteran’s ability to pay for debts and obligations, especially in cases relating to benefits or compensation claims. The form collects details about income, expenses, assets, and liabilities.

Who needs to fill out the VA 5655 form?

How do I obtain the VA 5655 form?

The VA 5655 form is available on the official Department of Veterans Affairs website. You can download and print it directly from there. Additionally, you may visit your local VA office to request a hard copy. It's important to ensure that you have the latest version of the form to avoid delays in processing.

What information do I need to provide on the form?

While filling out the VA 5655, you need to provide comprehensive information about your finances. This includes your monthly income, monthly expenses, assets like bank accounts and property, and any debts or loans you owe. Be honest and thorough; the accuracy of your information significantly impacts your case. Attach any necessary documentation that supports your financial claims.

How is the information on the VA 5655 form used?

The VA uses the information from the VA 5655 form to evaluate your financial situation and determine your eligibility for various benefits, debt relief options, or other forms of assistance. Accurate details help the VA make informed decisions about your case, ensuring you receive the support you need.

What happens after I submit the VA 5655 form?

Once you submit the VA 5655 form, it will be reviewed by the VA. You may receive follow-up communication if additional information or clarification is required. The length of the review process can vary based on your case's complexity and the current workload of the VA. Stay in touch with your VA representative for updates and next steps.

$

$