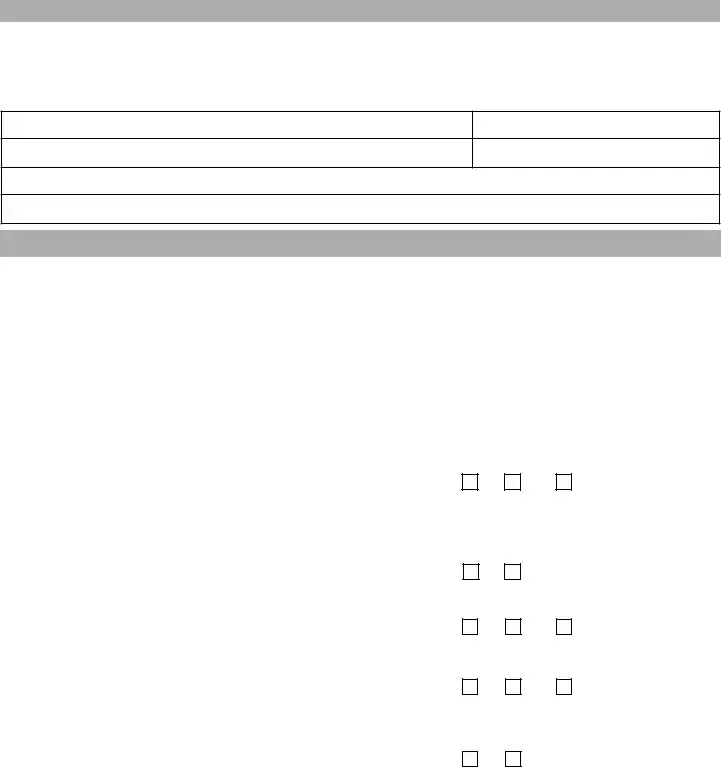

What is the UIA 1772 form?

The UIA 1772 form is used in Michigan to report changes to unemployment insurance information. It is required even when a business is not currently employing workers. This form helps the Unemployment Insurance Agency determine if you continue to be liable for unemployment taxes under state law.

When should I complete the UIA 1772 form?

You should complete and submit the UIA 1772 form whenever your business experiences certain changes, such as discontinuing payroll, transferring assets, or changing ownership. It is also necessary when you have equity transfers, mergers, or reorganizations that affect your unemployment insurance status.

What information do I need to provide on the form?

On the UIA 1772 form, you will need to provide your employer account number, federal employer ID, mailing address, and telephone number. Additionally, you must disclose details about the owners or corporate officers, reasons for discontinuing or transferring payroll, and the latest payroll date. If applicable, details regarding new ownership and acquisition information will also be needed.

What happens if I don’t submit the UIA 1772 form?

If you fail to submit the UIA 1772 form when required, the Unemployment Insurance Agency may make determinations based on available information, which might not be accurate. This could lead to penalties under state law for not complying with reporting requirements.

Is there a deadline for submitting the UIA 1772 form?

There isn't specifically a "due date" for the UIA 1772 form, but it should be submitted promptly upon any change that impacts your unemployment tax liability. Delays can complicate your status and may lead to penalties.

How do I submit the UIA 1772 form?

You can submit the UIA 1772 form through your Michigan Web Account Manager (MiWAM) account. If you prefer faxing, you can send it to 1-313-456-2130. If mailing is necessary, send the form to the Unemployment Insurance Tax Office at the designated postal address in Royal Oak, Michigan.

What penalties might I face for not providing accurate information?

If the information on your UIA 1772 form is not accurate, you may face significant penalties. These can include fines up to four times the amount of any unpaid unemployment taxes and possible imprisonment for up to five years, depending on the severity of the inaccuracies.

Can I ask for help with filling out the UIA 1772 form?

Yes, if you have questions or need assistance with the UIA 1772 form, you can contact the Office of Employer Ombudsman (OEO) through your MiWAM account or call them directly. They are available to help clarify any aspects of the form or process that may be confusing.

Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No