What is a Transfer-on-Death (TOD) Deed?

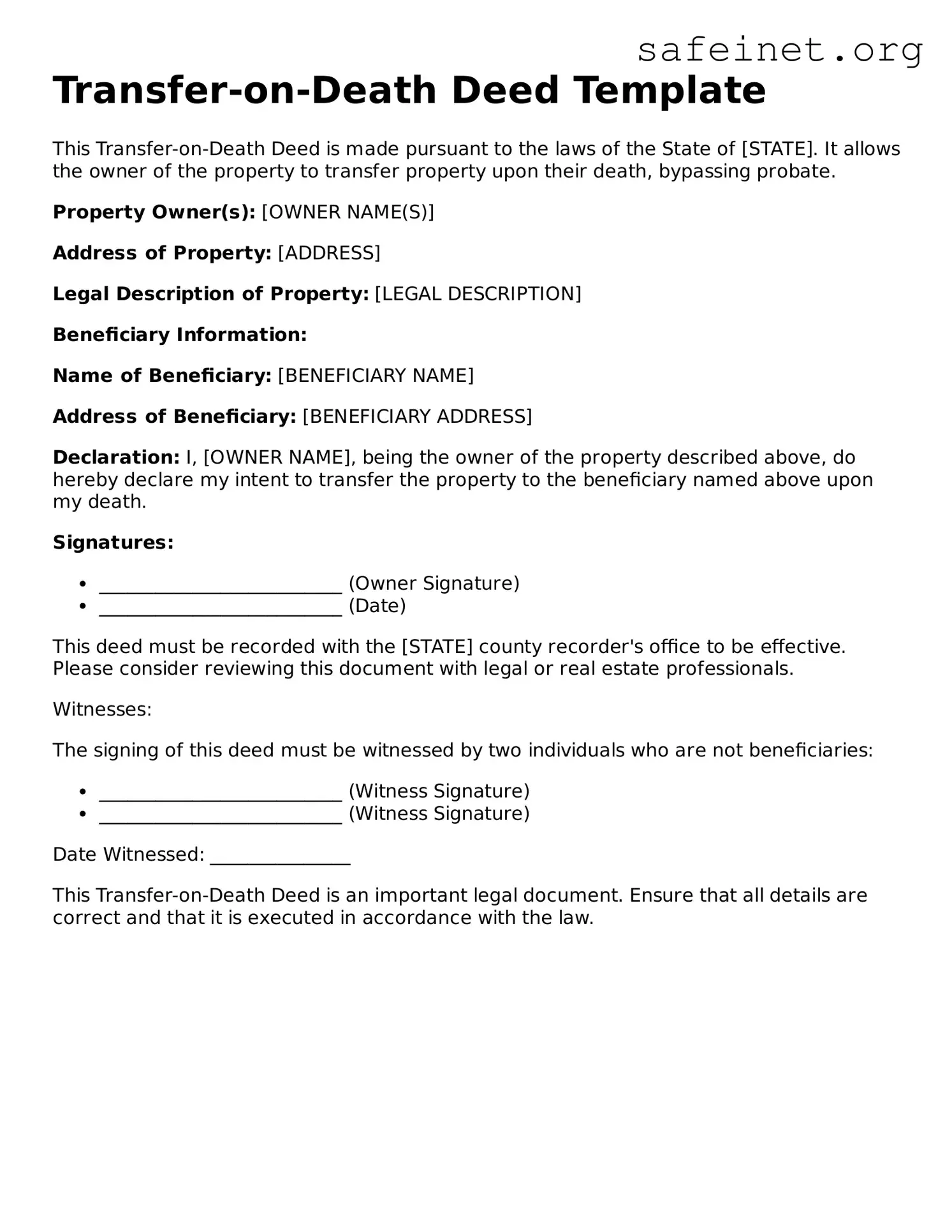

A Transfer-on-Death Deed is a legal document that allows property owners to designate a beneficiary who will receive their real estate upon the owner's death. This type of deed helps avoid the probate process, making it easier and faster for beneficiaries to inherit the property. It's a straightforward way to transfer ownership and can provide peace of mind for property owners who want to ensure their assets are passed on as intended.

How does a Transfer-on-Death Deed work?

When a property owner completes and files a Transfer-on-Death Deed, the title to the property does not change during their lifetime. The owner retains full control over the property and can sell, reassign, or revoke the deed at any time. Upon the owner's death, the specified beneficiary receives the property automatically, without needing to go through probate. This simplicity makes it an attractive option for many individuals planning their estate.

Are there any restrictions on who can be a beneficiary?

Yes, there are certain restrictions regarding beneficiaries. Typically, the beneficiary can be a person, a charitable organization, or a trust, but they cannot be a fictitious entity or a business. Additionally, if the beneficiary does not survive the owner, it is essential to have contingent beneficiaries named in the deed to ensure the property eventually passes to someone else.

Can a Transfer-on-Death Deed be revoked or changed?

Absolutely. A property owner has the right to revoke or change a Transfer-on-Death Deed at any time while they are alive. To revoke the deed, the owner must execute a new deed stating the revocation or formally document their intent to extinguish the earlier deed. In either case, filing the new documentation with the appropriate county office is crucial to ensure that the changes are legally recognized.

What are the potential disadvantages of using a Transfer-on-Death Deed?

While the Transfer-on-Death Deed offers several advantages, there are potential drawbacks to consider. One concern is that the deed does not address debt obligations attached to the property, which could complicate matters for beneficiaries if there are outstanding debts. Additionally, the property owner may not receive the full protection of a will, as a TOD deed only covers the specific property mentioned. Consulting with an estate planning professional is advisable to navigate these nuances.

Is a Transfer-on-Death Deed recognized in all states?

Not all states recognize Transfer-on-Death Deeds. As of October 2023, many states allow for this type of deed, but the rules governing it can vary significantly. Some states may have specific forms or eligibility criteria. It is vital to check the laws in your state to understand how a Transfer-on-Death Deed functions and to ensure compliance with local regulations before proceeding.