What is a Transfer-on-Death Deed in Texas?

A Transfer-on-Death Deed (TOD) in Texas is a legal document that allows a property owner to designate a beneficiary to receive the property upon the owner's death. This deed operates outside of probate, which means the property can transfer directly to the beneficiary without going through the lengthy and often complicated probate process.

Who can create a Transfer-on-Death Deed?

Any individual who owns real estate in Texas can create a Transfer-on-Death Deed. The property owner must be of legal age and mentally competent to understand the implications of the deed. Joint owners can also execute a TOD deed for their respective interests in the property.

What are the benefits of using a Transfer-on-Death Deed?

The primary benefit of a Transfer-on-Death Deed is the avoidance of probate. Upon the owner's death, the designated beneficiary can inherit the property more quickly and with less cost. Additionally, the property owner retains full control over the property during their lifetime, and they can revoke or change the deed at any time before death.

How do I execute a Transfer-on-Death Deed?

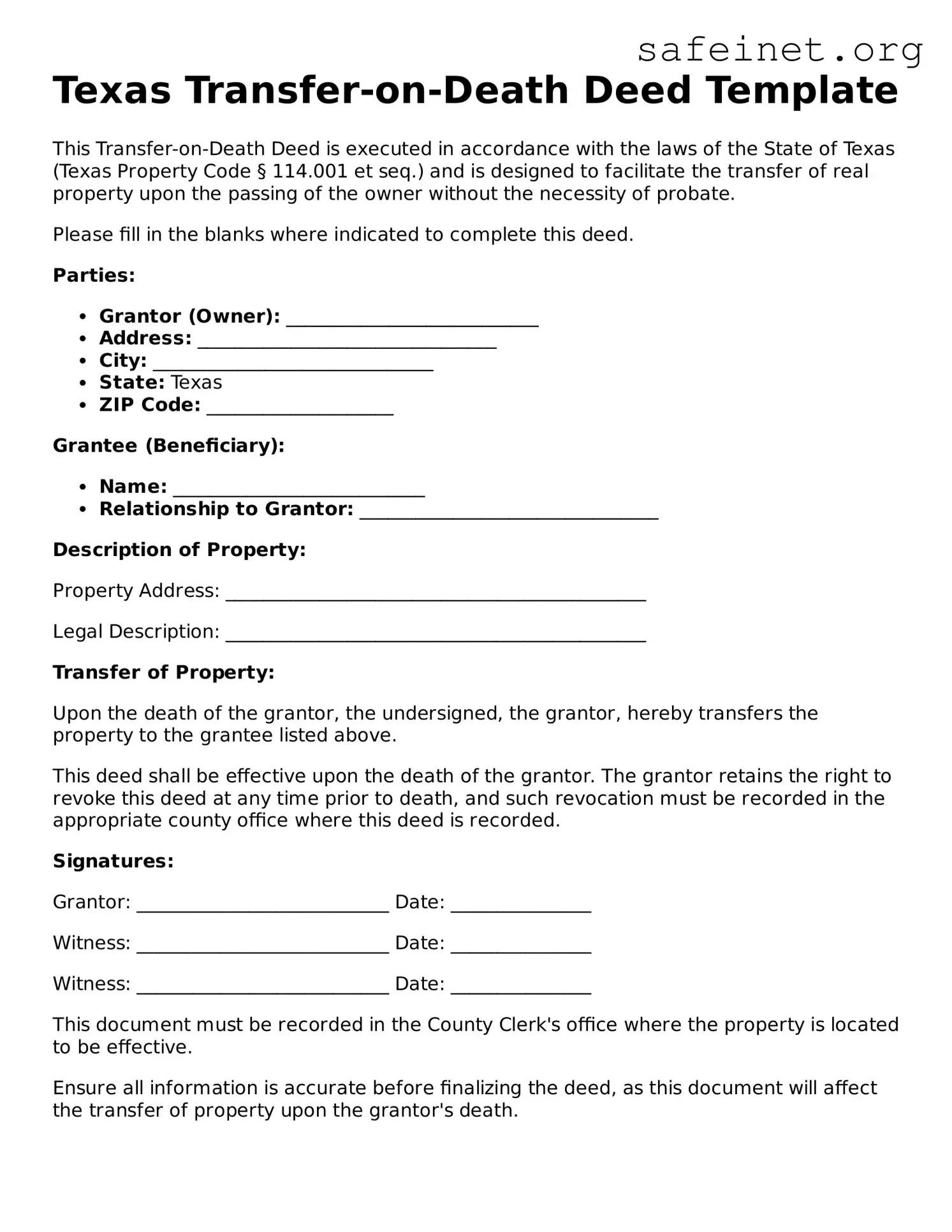

To execute a Transfer-on-Death Deed in Texas, the property owner must complete the deed form with the correct information, including a legal description of the property and the name of the beneficiary. The deed must then be signed by the owner in the presence of a notary public. After notarization, it must be filed with the county clerk in the county where the property is located.

Can I revoke or change a Transfer-on-Death Deed after it's been executed?

Yes, a Transfer-on-Death Deed can be revoked or modified at any time by the property owner. This can be done by completing a new TOD deed that either changes the beneficiary or explicitly states the revocation of the previous deed. It's important to file any new or revoked deeds with the county clerk to ensure proper record-keeping.

Are there any limitations on who can be a beneficiary?

Generally, any individual, including a family member, friend, or charitable organization, can be named as a beneficiary in a Transfer-on-Death Deed. However, it’s important to ensure that the beneficiary is someone who can coordinate the transfer of the property after the owner's death. Naming multiple beneficiaries is allowed, as well, but clear instructions should be provided for what happens if one beneficiary predeceases the owner.

Is a Transfer-on-Death Deed the same as a will?

No, a Transfer-on-Death Deed is not the same as a will. While both are ways to transfer property after death, a TOD deed takes effect immediately upon the owner's death and bypasses probate. A will, on the other hand, must go through the probate process for a judge to validate it and ensure the property is distributed according to the deceased’s wishes.