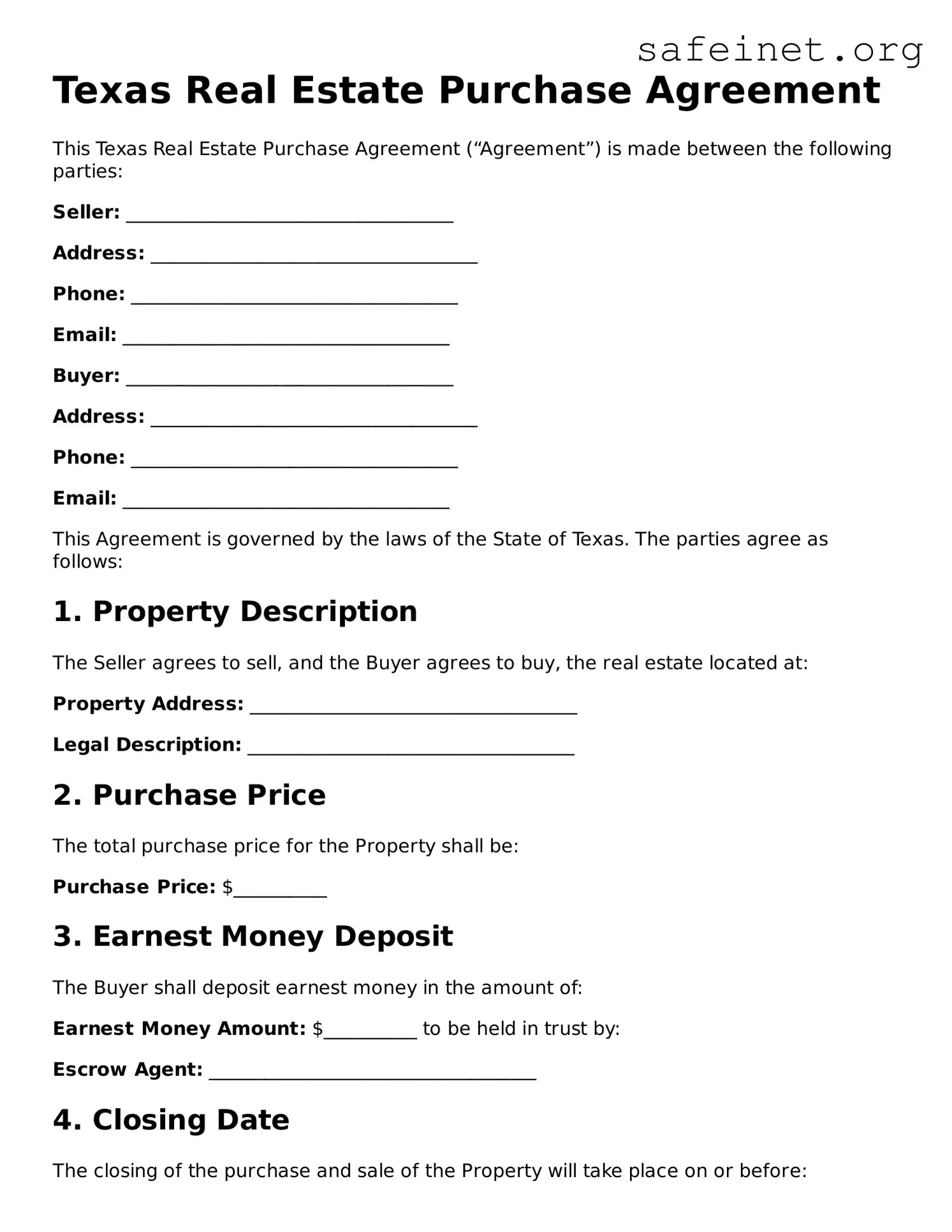

Texas Real Estate Purchase Agreement

This Texas Real Estate Purchase Agreement (“Agreement”) is made between the following parties:

Seller: ___________________________________

Address: ___________________________________

Phone: ___________________________________

Email: ___________________________________

Buyer: ___________________________________

Address: ___________________________________

Phone: ___________________________________

Email: ___________________________________

This Agreement is governed by the laws of the State of Texas. The parties agree as follows:

1. Property Description

The Seller agrees to sell, and the Buyer agrees to buy, the real estate located at:

Property Address: ___________________________________

Legal Description: ___________________________________

2. Purchase Price

The total purchase price for the Property shall be:

Purchase Price: $__________

3. Earnest Money Deposit

The Buyer shall deposit earnest money in the amount of:

Earnest Money Amount: $__________ to be held in trust by:

Escrow Agent: ___________________________________

4. Closing Date

The closing of the purchase and sale of the Property will take place on or before:

Closing Date: _____________

5. Contingencies

This Agreement is contingent upon:

- Buyer obtaining financing.

- Satisfactory home inspection.

- Clear title to the Property.

6. Possession

The Buyer shall be entitled to possession of the Property on:

Possession Date: _____________

7. Disclosures

The Seller shall provide the Buyer with the following disclosures:

- Lead-based paint disclosure (if applicable).

- Seller's Disclosure Notice.

8. Governing Law

This Agreement shall be governed by the laws applicable in the State of Texas.

9. Signatures

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the ___ day of __________, 20__.

Seller's Signature: __________________________

Date: _____________

Buyer's Signature: __________________________

Date: _____________

This template serves as a basic framework for a real estate agreement in Texas. Ensure to fill in the required fields and review it thoroughly before use.