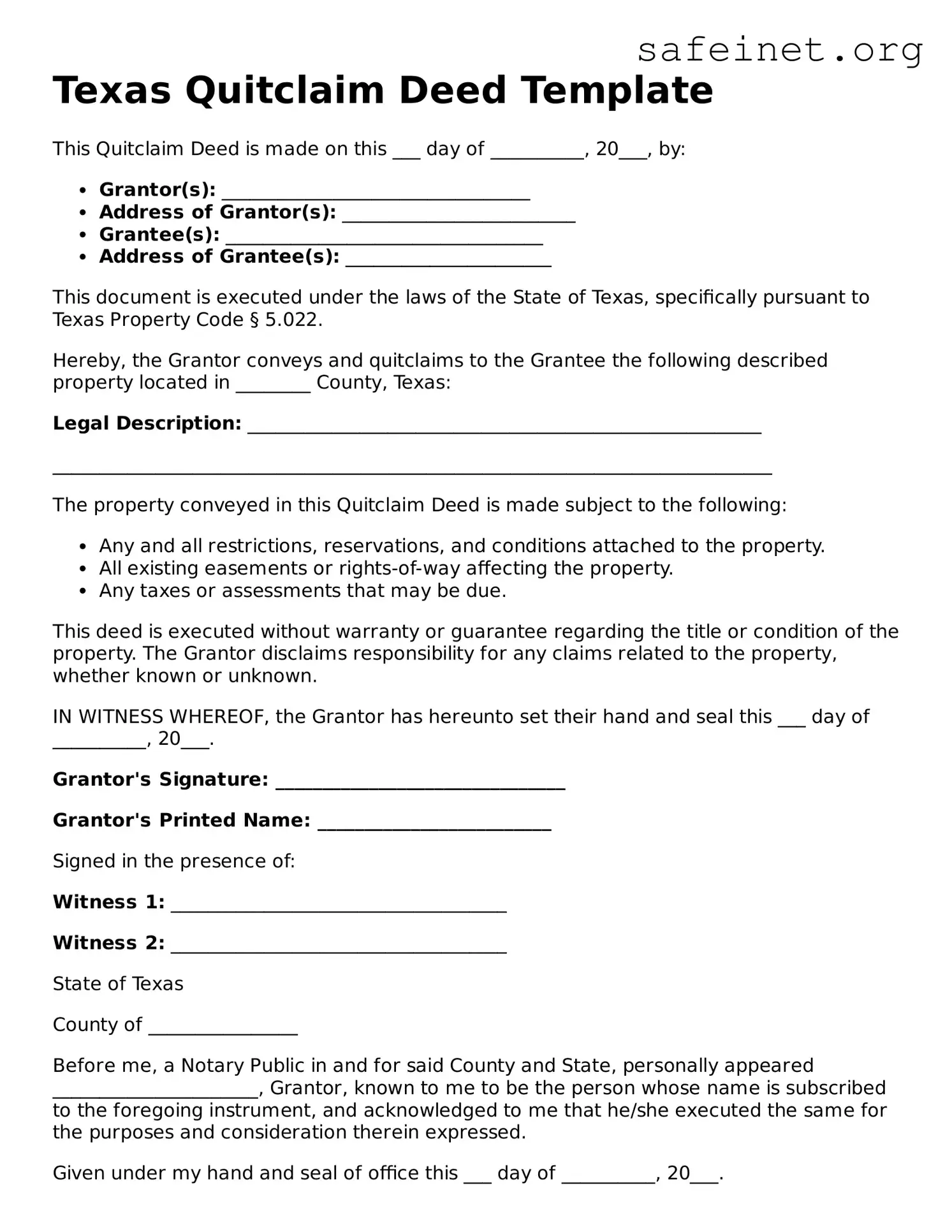

Texas Quitclaim Deed Template

This Quitclaim Deed is made on this ___ day of __________, 20___, by:

- Grantor(s): _________________________________

- Address of Grantor(s): _________________________

- Grantee(s): __________________________________

- Address of Grantee(s): ______________________

This document is executed under the laws of the State of Texas, specifically pursuant to Texas Property Code § 5.022.

Hereby, the Grantor conveys and quitclaims to the Grantee the following described property located in ________ County, Texas:

Legal Description: _______________________________________________________

_____________________________________________________________________________

The property conveyed in this Quitclaim Deed is made subject to the following:

- Any and all restrictions, reservations, and conditions attached to the property.

- All existing easements or rights-of-way affecting the property.

- Any taxes or assessments that may be due.

This deed is executed without warranty or guarantee regarding the title or condition of the property. The Grantor disclaims responsibility for any claims related to the property, whether known or unknown.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand and seal this ___ day of __________, 20___.

Grantor's Signature: _______________________________

Grantor's Printed Name: _________________________

Signed in the presence of:

Witness 1: ____________________________________

Witness 2: ____________________________________

State of Texas

County of ________________

Before me, a Notary Public in and for said County and State, personally appeared ______________________, Grantor, known to me to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that he/she executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office this ___ day of __________, 20___.

Notary Public Signature: ___________________________

Notary Public Printed Name: _____________________

My Commission Expires: _________________________