The Texas Medical Power of Attorney allows an individual to appoint someone to make medical decisions on their behalf if they become incapacitated. Like the general Power of Attorney, it authorizes a trusted person to act in the best interest of the principal. This medical variant specifically focuses on health-related matters, defining the extent of the agent's authority in making critical medical choices that align with the principal's wishes, particularly in emergencies or end-of-life situations.

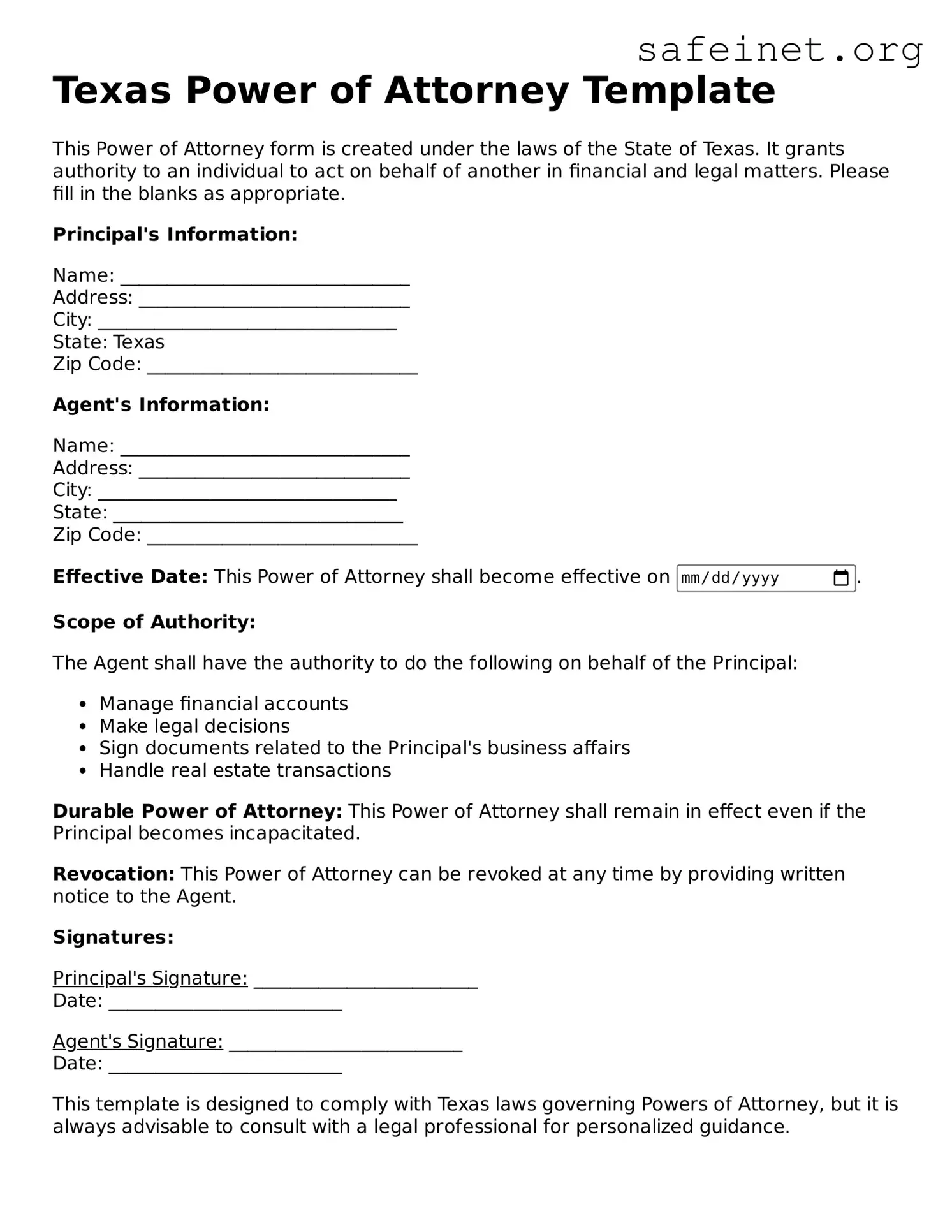

The Durable Power of Attorney, similar to the standard Power of Attorney, continues to be effective even if the principal becomes incapacitated. This document empowers an agent to manage financial affairs, handle business transactions, and make legal decisions on behalf of the principal. While the general Power of Attorney may become void upon incapacity, the durable version ensures that the appointed individual maintains authority during times when the principal can no longer make decisions independently.

A Financial Power of Attorney is closely related to the Texas Power of Attorney but focuses specifically on financial matters. Through this document, a principal designates an agent to handle tasks such as managing bank accounts, paying debts, and filing tax returns. The financial Power of Attorney simplifies the management of finances during periods of incapacity or unavailability, ensuring that the principal's financial obligations are met without interruption.

The Springing Power of Attorney activates only upon a specific event, typically the incapacitation of the principal. This document serves as a protective measure, giving the agent authority to act only when necessary. In contrast to general Powers of Attorney, which become effective immediately, the springing version allows individuals to retain control over their decisions until a predetermined situation arises.

A Living Will, also known as an advance directive, articulates an individual’s preferences regarding medical treatment, particularly in end-of-life scenarios. While a Power of Attorney designates an agent to make decisions, a Living Will lays out the specific wishes of the principal. This ensures that healthcare providers and family members understand the individual's desires concerning life-sustaining treatment, alleviating decision-making burdens during emotionally charged times.

The Healthcare Proxy functions similarly to the Medical Power of Attorney, as it appoints someone to make healthcare decisions if the principal is unable to do so. This document emphasizes communication and ensures that the designated person understands the principal's healthcare preferences. Like the Medical Power of Attorney, it focuses on medical decisions but may be governed by different state laws and regulations, underlining the importance of familiarity with local requirements.

The Revocation of Power of Attorney formally cancels any previously granted authority to an agent. This document echoes the principle of control inherent in the original Power of Attorney, allowing a principal to reassess and change their appointed agent at any time. The revocation process is crucial in situations where circumstances evolve, ensuring that decisions reflect the current wishes of the principal.

A Trust document, especially a revocable living trust, bears similarities to the Power of Attorney in that both can facilitate the management of an individual’s assets. Unlike the Power of Attorney, which designates an agent to act on behalf of the principal, a trust places assets in the control of a trustee for the benefit of the trust's beneficiaries. However, both instruments are vital tools for estate planning, ensuring that individual desires regarding asset management and distribution are respected during life and after death.

The Guardianship document, established by a court, grants an individual or entity the authority to make decisions for someone deemed incapacitated. Unlike a Power of Attorney, which is voluntarily established, guardianship often arises from legal proceedings and may involve more stringent oversight. This type of document emphasizes the need for protection and care, ensuring that those who can no longer make decisions for themselves have their rights safeguarded by a designated guardian.

The Durable Medical Power of Attorney combines elements of the Durable Power of Attorney and the Medical Power of Attorney. It enables an agent to make healthcare decisions even if the principal becomes incapacitated. This document serves as a critical tool for individuals wishing to ensure their healthcare needs are met without disruption, specifically allowing for the continuation of authority when it is most needed during an incapacitated state.