What is a Texas Operating Agreement?

A Texas Operating Agreement is a key document that outlines the management structure and operational procedures of a Limited Liability Company (LLC) in Texas. It serves to define the roles and responsibilities of members, how profits and losses are distributed, and the procedures for making decisions within the business. Although Texas does not legally require this document, it is highly recommended as it helps prevent misunderstandings and disputes among members.

Who should create an Operating Agreement?

Every LLC, regardless of its size or membership structure, should have an Operating Agreement. Whether your company has multiple members or just one owner, having this document in place is beneficial. It provides a clear framework for how the business operates and helps establish expectations from the outset.

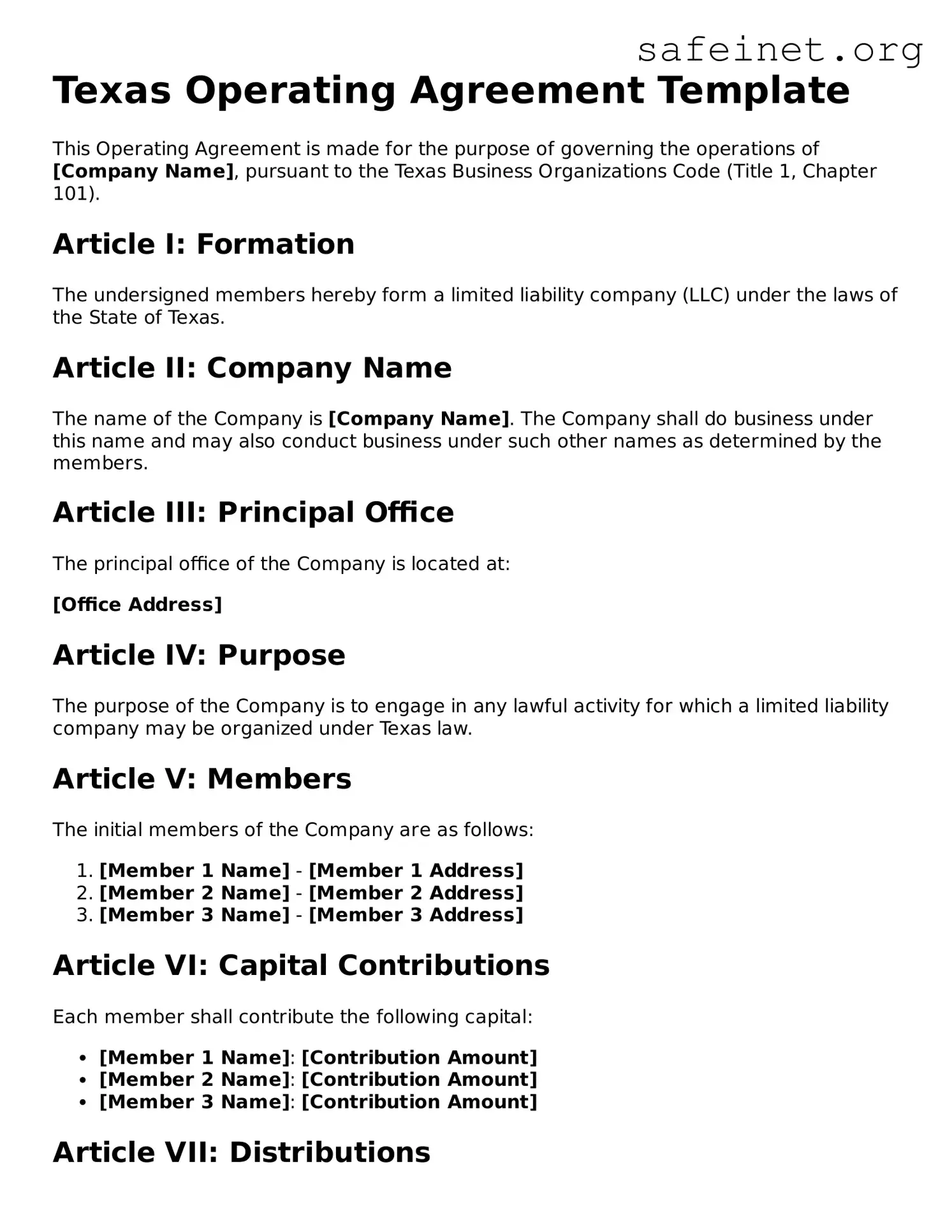

What are the key components of a Texas Operating Agreement?

Typically, a Texas Operating Agreement includes several important sections. These may cover the organization of the LLC, roles and responsibilities of members, capital contributions, profit distribution, decision-making processes, and procedures for adding or removing members. Additionally, it might outline what happens if business dissolution becomes necessary. Each section ensures that everyone is on the same page regarding the business's operation.

Is an Operating Agreement required to form an LLC in Texas?

No, Texas law does not require an Operating Agreement to officially form an LLC. However, it is highly advisable to have one as it adds clarity and structure to the business. In the absence of this document, state default rules will apply, which may not align with the specific needs or intentions of your company.

What happens if our LLC does not have an Operating Agreement?

If your LLC lacks an Operating Agreement, the state’s default rules will apply to the management and operation of the business. This reliance on standard laws can lead to complications and disputes, especially concerning profit distribution and decision-making. Putting a comprehensive Operating Agreement in place allows you to tailor the guidelines to fit your unique business model.

Can we change the Operating Agreement once it is created?

Yes, an Operating Agreement can be amended as needed. It is important to include a section in the original document outlining the procedure for making changes. This often requires a majority vote from members or written consent. Documenting amendments formally ensures that all parties are aware of the changes and can agree to them.

Should we consult a lawyer when drafting an Operating Agreement?

While it is possible to create an Operating Agreement on your own, consulting a lawyer can provide added confidence that your document meets all legal requirements and effectively captures your business intentions. A lawyer can also help customize the agreement to address unique circumstances and mitigate potential risks down the line.

How do we execute the Operating Agreement?

Execution of the Operating Agreement is typically a straightforward process. All members should sign the document to indicate their agreement to the terms laid out. It's a good practice to have copies made for each member and to store the original in a safe place along with your other important business documents. This helps ensure that you have easy access to it whenever needed.