What is a Mobile Home Bill of Sale in Texas?

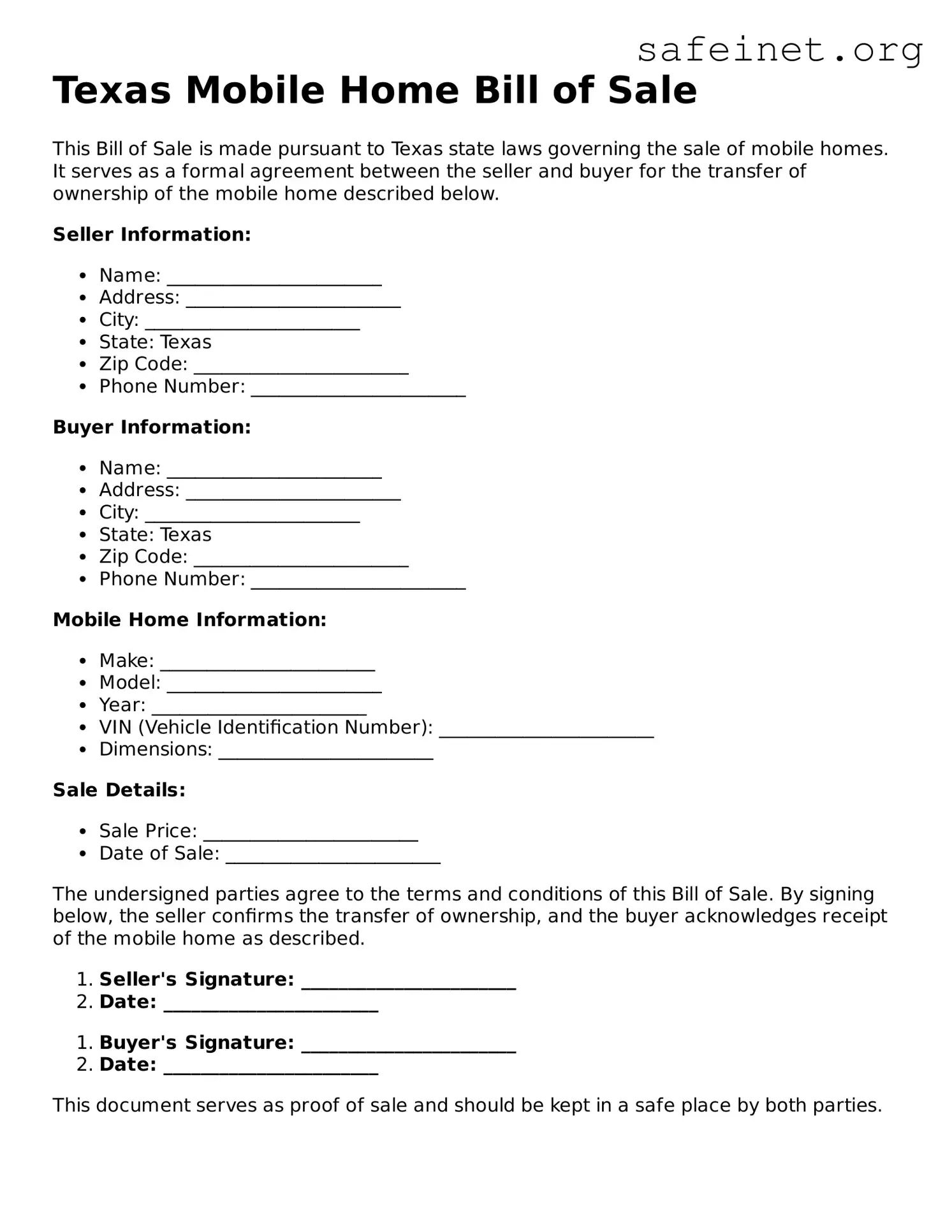

A Mobile Home Bill of Sale is a legal document that facilitates the transfer of ownership of a mobile home from one party to another in Texas. It outlines the details of the transaction, including the parties involved, the sale price, the description of the mobile home, and any warranties or conditions related to the sale.

Do I need a Bill of Sale to sell my mobile home in Texas?

While a Bill of Sale is not required by Texas law for every mobile home sale, it is highly recommended. This document serves as proof of the transaction and can protect both the seller and the buyer by clearly outlining the terms of the sale. Additionally, if you intend to transfer the title, the Bill of Sale may be required by the Texas Department of Motor Vehicles (DMV).

What information should be included in the Mobile Home Bill of Sale?

The Mobile Home Bill of Sale should include several key pieces of information: the full names and addresses of both the buyer and seller, a detailed description of the mobile home (including make, model, year, and Vehicle Identification Number (VIN)), the sale price, and the date of the transaction. It is also advisable to include any contingencies or warranties agreed upon by both parties.

Is it necessary to notarize the Bill of Sale?

Notarization of the Bill of Sale is not mandatory in Texas, but it is advisable. Having the document notarized adds an extra layer of authenticity and can help validate the agreement in the event of any future disputes. A notarized document can serve as stronger evidence in legal settings.

What should I do after completing the Mobile Home Bill of Sale?

After completing the Mobile Home Bill of Sale, both the buyer and seller should keep a signed copy for their records. The next step typically involves transferring the title at the local DMV. The buyer will need to provide the signed Bill of Sale, along with any other required documents, to finalize their ownership.

Can I use a generic Bill of Sale form for my mobile home?

While you can use a generic Bill of Sale form, it is better to utilize a specific form designed for mobile home transactions. Such forms address unique aspects of mobile home sales, ensuring that all necessary details are covered. This approach can help prevent misunderstandings and ensure compliance with Texas regulations.