What is a Texas Loan Agreement form?

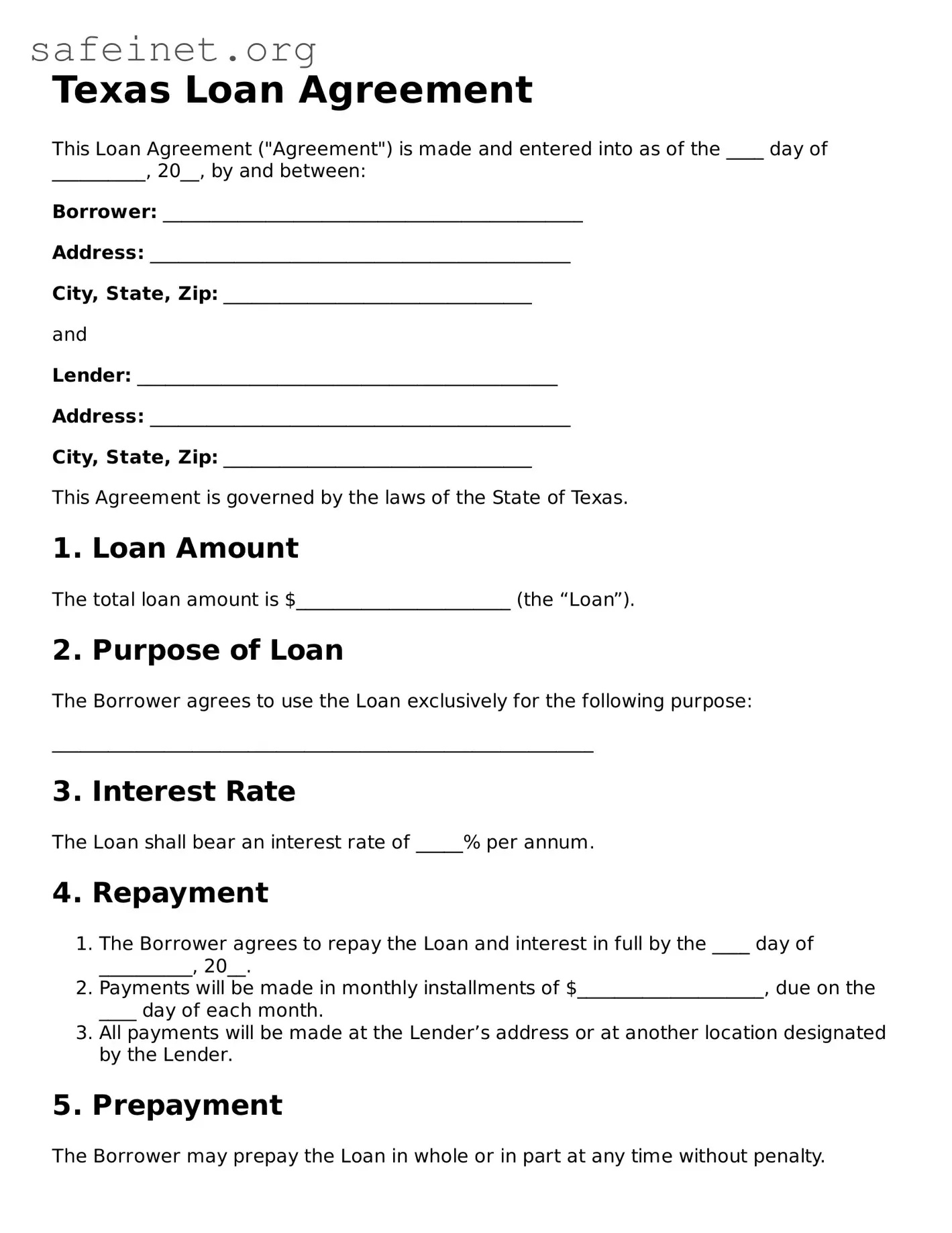

A Texas Loan Agreement form is a written document that outlines the terms and conditions under which one party lends money to another party in Texas. It serves to protect the interests of both the lender and the borrower by detailing the amount borrowed, the interest rate, repayment schedule, and any applicable fees.

Who needs a Texas Loan Agreement form?

This form is beneficial for individuals or businesses that plan to enter into a lending arrangement in Texas. Lenders that wish to formalize the loan process and borrowers who want to ensure that their obligations are clearly defined should consider using this form.

What are the essential components of a Texas Loan Agreement?

Key components include the names and addresses of the parties involved, the loan amount, the interest rate, the repayment schedule, and any collateral securing the loan. Additionally, terms regarding default, prepayment, and governing law should also be included to provide clarity on all expectations.

Is a Texas Loan Agreement required to be notarized?

While notarization is not required for a loan agreement in Texas, it is advisable. Having the document notarized can add an extra layer of verification and may prevent disputes over signatures and terms in the future.

Can a Texas Loan Agreement be modified after it is signed?

Yes, a Texas Loan Agreement can be modified after it is signed, but both parties must agree to the changes in writing. This ensures that the modifications are legally enforceable and that both parties understand their new obligations.

What happens if a borrower defaults on a Texas Loan Agreement?

In the event of a default, the lender is typically entitled to take action as specified in the agreement. This may include demanding immediate payment of the remaining balance or initiating legal proceedings to recover the owed funds, depending on the terms outlined in the agreement.

Are there any legal requirements for interest rates in Texas loan agreements?

Texas law does regulate the maximum interest rates that lenders can charge, depending on the type of loan. It is important for both parties to be aware of these limits to avoid any potential violations that could invalidate the agreement.

Can the loan amount in a Texas Loan Agreement be less than $500?

Yes, there is no minimum loan amount outlined in Texas law for loan agreements. Borrowers and lenders can agree on any amount, whether it is less than, equal to, or greater than $500, as long as both parties are in agreement.

Where can I obtain a Texas Loan Agreement form?

A Texas Loan Agreement form can be obtained from various sources, including online legal document services, local stationery stores, or through consultations with legal professionals. It is crucial to ensure that the form complies with Texas law and meets the specific requirements of the loan arrangement.