1. What is a Last Will and Testament in Texas?

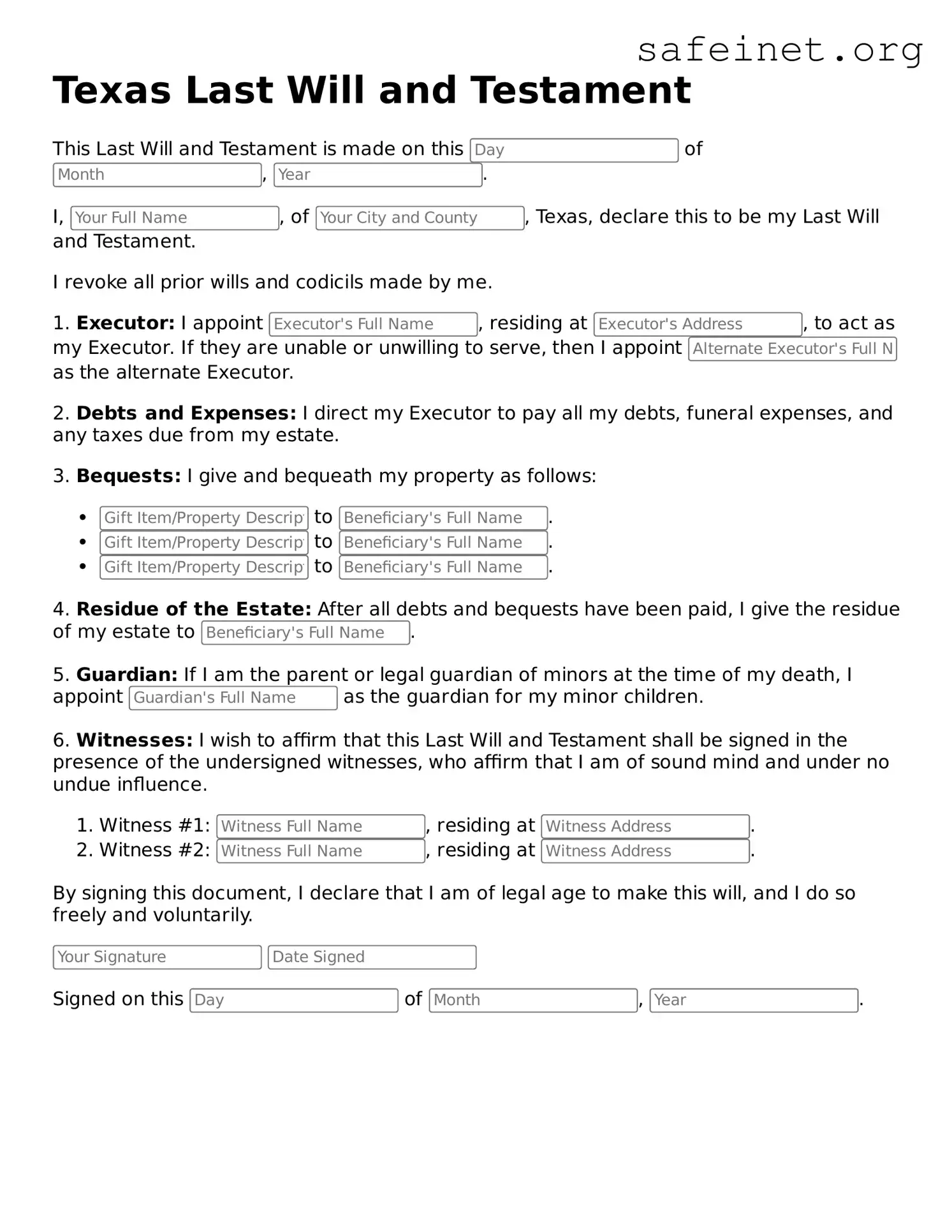

A Last Will and Testament is a legal document that outlines how a person's assets and liabilities should be managed and distributed after their death. In Texas, it allows the testator, or the person creating the will, to specify beneficiaries who will receive property, appoint an executor to manage the estate, and detail any specific wishes regarding guardianship of minor children or burial arrangements.

2. Do I need a lawyer to create a Will in Texas?

While it is possible to create a Last Will and Testament without a lawyer, consulting with one is often recommended. A lawyer can help ensure that your will complies with Texas law, properly addresses your wishes, and avoids potential disputes among beneficiaries. However, individuals can use templates or online services to draft a simple will if they prefer a more cost-effective approach.

3. What are the requirements for a valid will in Texas?

In Texas, a Last Will and Testament must meet several requirements to be considered valid. The testator must be at least 18 years old, of sound mind, and must declare the document to be their will. The will must be signed by the testator, and, in most cases, witnessed by at least two disinterested witnesses who are not beneficiaries of the will. For handwritten or "holographic" wills, the signature and the material provisions must be in the testator’s handwriting.

4. Can I change or revoke my will in Texas?

Yes, you can change or revoke your will at any time as long as you are of sound mind. To change your will, you can create a new will that expressly revokes the previous one or enact a codicil, which is an amendment to the existing will. Similarly, if you wish to revoke your will, you should destroy it or create a new one that indicates your intention to revoke the old will.

5. What happens if I die without a will in Texas?

If you pass away without a will, Texas law dictates how your estate will be distributed. This process is known as “intestate succession.” Generally, assets will be divided among surviving family members according to statutory guidelines. For instance, a spouse and children typically inherit a significant portion of the estate, but without a will, there may be disputes or complications that arise, potentially leading to delays and increased legal costs.

6. Can I disinherit someone in my will?

In Texas, it is possible to disinherit someone, but it is essential to be clear about your intentions in your will. You should explicitly state that you are choosing not to leave anything to the person you wish to disinherit. In some cases, if the disinherited person is a spouse or child, you may be required to follow specific procedures or include reasons for disinheritance to avoid claims against your estate.

7. How do I make my will self-proving?

A self-proving will simplifies the probate process by minimizing the need for witnesses to testify about the will's validity. To create a self-proving will in Texas, during the signing process, the testator and witnesses must sign a self-proving affidavit, which attests that the will was executed properly according to Texas laws. This affidavit should be notarized and included with the will when it is filed for probate.

8. Is it necessary to have witnesses for my will?

Yes, in most cases, Texas requires at least two disinterested witnesses to sign your will for it to be valid. Disinterested means that the witnesses should not be beneficiaries of the will. If you choose to create a handwritten will, the requirement for witnesses may not apply, but having witnesses is generally advisable to prevent future disputes and ensure the will’s validity.

9. How do I ensure my will is valid after I create it?

To ensure your will is valid, keep it in a safe place and inform your executor and family members of its location. Ensure compliance with the legal requirements, including proper signing and witnessing procedures. Regularly review and update your will as life circumstances change, such as marriage, the birth of children, or significant changes in your financial situation. Consulting a lawyer for periodic reviews can help you maintain the validity of your will over time.