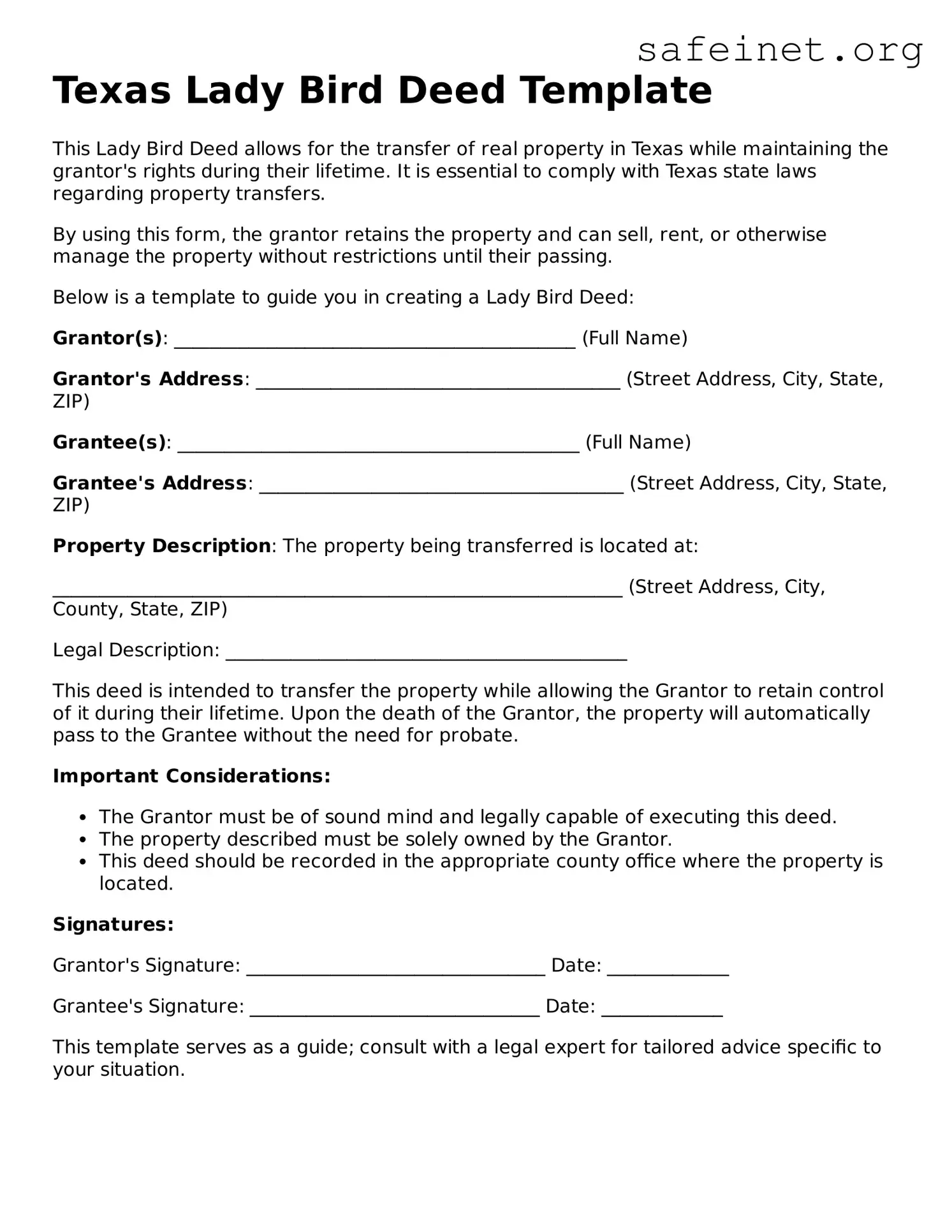

Texas Lady Bird Deed Template

This Lady Bird Deed allows for the transfer of real property in Texas while maintaining the grantor's rights during their lifetime. It is essential to comply with Texas state laws regarding property transfers.

By using this form, the grantor retains the property and can sell, rent, or otherwise manage the property without restrictions until their passing.

Below is a template to guide you in creating a Lady Bird Deed:

Grantor(s): ___________________________________________ (Full Name)

Grantor's Address: _______________________________________ (Street Address, City, State, ZIP)

Grantee(s): ___________________________________________ (Full Name)

Grantee's Address: _______________________________________ (Street Address, City, State, ZIP)

Property Description: The property being transferred is located at:

_____________________________________________________________ (Street Address, City, County, State, ZIP)

Legal Description: ___________________________________________

This deed is intended to transfer the property while allowing the Grantor to retain control of it during their lifetime. Upon the death of the Grantor, the property will automatically pass to the Grantee without the need for probate.

Important Considerations:

- The Grantor must be of sound mind and legally capable of executing this deed.

- The property described must be solely owned by the Grantor.

- This deed should be recorded in the appropriate county office where the property is located.

Signatures:

Grantor's Signature: ________________________________ Date: _____________

Grantee's Signature: _______________________________ Date: _____________

This template serves as a guide; consult with a legal expert for tailored advice specific to your situation.