What is a Texas Independent Contractor Agreement?

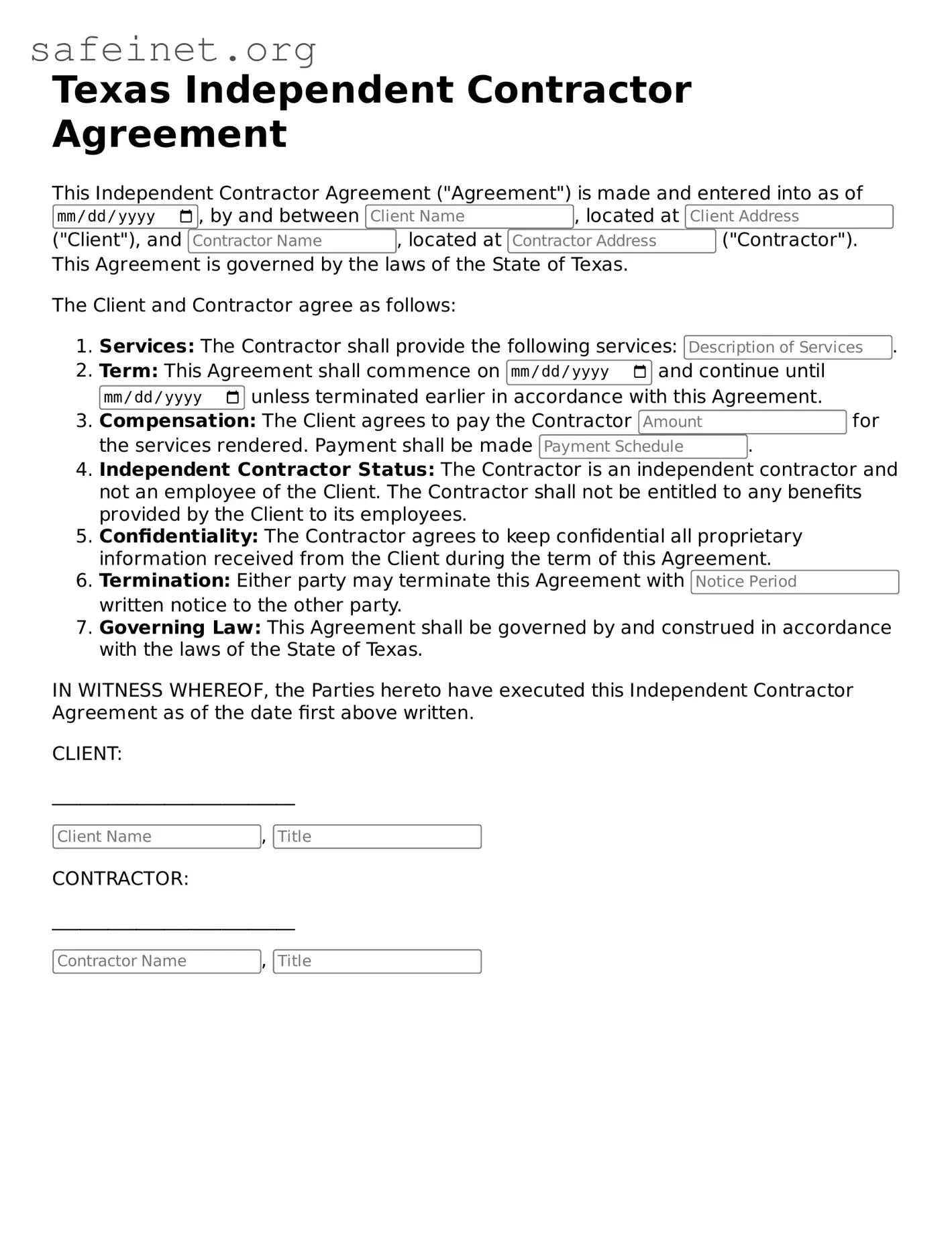

A Texas Independent Contractor Agreement is a legal document that outlines the terms and conditions between a client and an independent contractor. This agreement specifies the services to be provided, payment terms, and other important details to help clarify the professional relationship. It helps protect both parties by establishing clear expectations.

Why is an Independent Contractor Agreement important?

This agreement is crucial for defining the nature of the relationship between the parties. It provides legal protections, establishes the scope of work, and details payment terms. With a clear agreement, misunderstandings can be minimized, making for a smoother working relationship.

What are the key elements included in the agreement?

Key elements typically include the description of services, payment details, confidentiality clauses, and termination conditions. It may also outline the independent contractor’s responsibilities regarding taxes and liability. By covering these aspects, the agreement ensures both parties are on the same page.

How do I know if someone is an independent contractor or an employee?

The distinction between an independent contractor and an employee lies in the level of control exercised by the client. Independent contractors generally have more freedom to choose how and when they complete their work. Employees, on the other hand, usually follow a set schedule and are subject to more oversight. The IRS provides guidelines for determining this status, which can be helpful.

Can I modify a Texas Independent Contractor Agreement?

Yes, both parties can agree to modify the terms of the agreement, but it’s best to document any changes in writing. This can be done through an amendment that specifies what is being changed and ensures both parties sign it. Clear communication is key when making updates to avoid future disagreements.

Are there any specific legal requirements for these agreements in Texas?

While Texas law does not require a specific format for Independent Contractor Agreements, certain elements must be present for the agreement to be enforceable. These elements include mutual consent, consideration (something of value exchanged), and a lawful purpose. It's wise to ensure that everything is clear and understandable to both parties.

Is it necessary to have a lawyer draft or review the agreement?

While it's not strictly necessary to have a lawyer involved, consulting one can be very beneficial. A legal professional can help ensure that the terms are fair and compliant with Texas law. This can provide peace of mind, knowing that your interests are adequately protected.

What happens if there’s a dispute regarding the agreement?

If a dispute arises, it is often best to try to resolve it informally through discussion first. If that doesn’t work, mediation or arbitration may be considered as alternative methods before resorting to court action. Having a well-drafted agreement can also help in resolving disputes more efficiently, as it provides clarity regarding expectations and obligations.

How do I terminate an Independent Contractor Agreement?

Termination of the agreement should be handled according to the terms outlined within it. Most agreements include a clause specifying how either party can terminate the contract, including notice requirements and the reasons justifying termination. Adhering to these terms is important to avoid any potential legal repercussions.