What is a Texas Golf Cart Bill of Sale form?

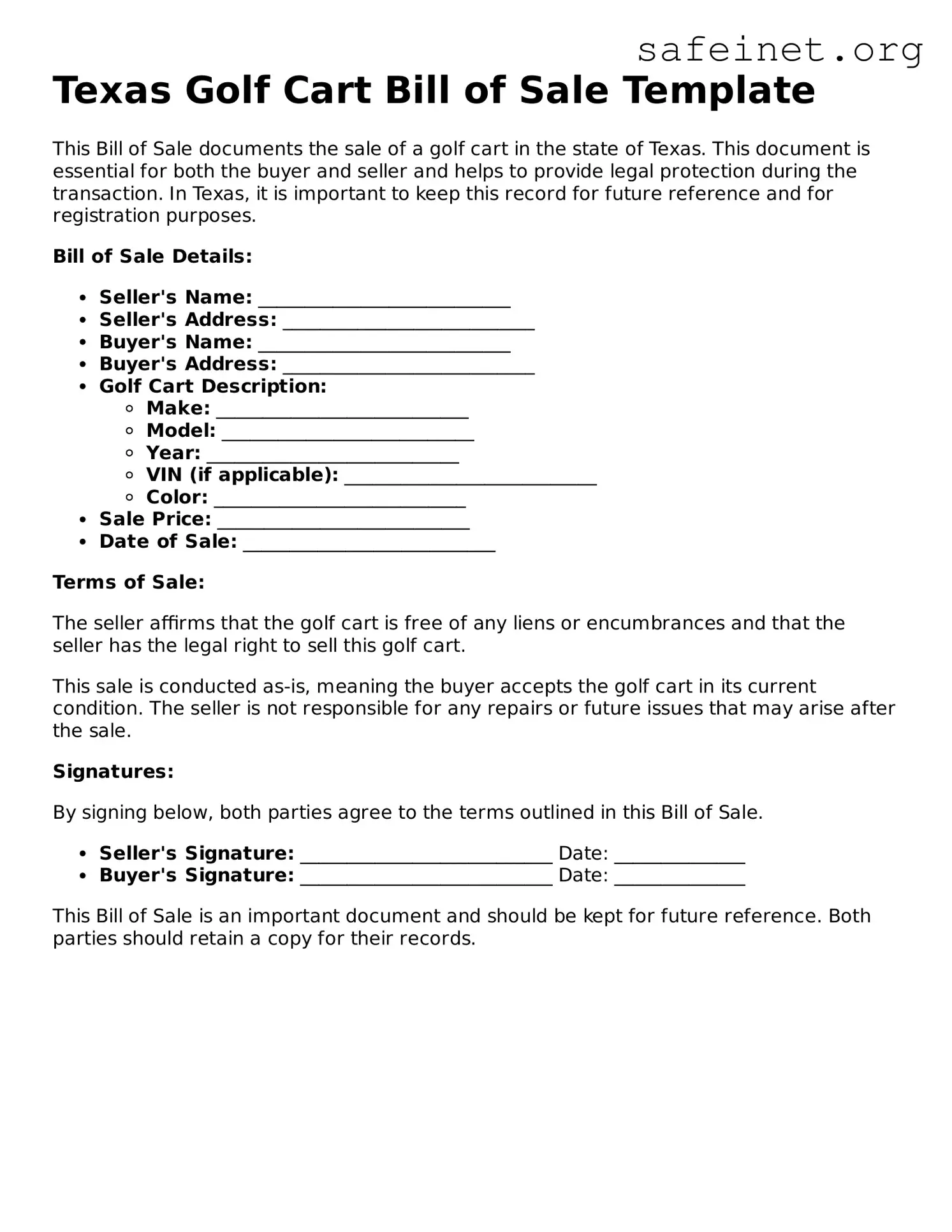

A Texas Golf Cart Bill of Sale form is a legal document that records the transfer of ownership of a golf cart from one party to another. It includes important information such as the details of the buyer and seller, the description of the golf cart, and the sale amount. This document serves as proof of the transaction and may be necessary for registration purposes.

Who needs a Golf Cart Bill of Sale?

Anyone who is purchasing or selling a golf cart in Texas should use a Golf Cart Bill of Sale. It protects both the buyer and seller by clearly establishing the terms of the sale. Additionally, it can be used to register the golf cart with the appropriate state authorities.

What information is typically included in the Bill of Sale?

A Texas Golf Cart Bill of Sale usually contains the following details: names and addresses of both parties, a description of the golf cart (including make, model, and vehicle identification number), the sale price, and the date of the transaction. It may also include signatures from both parties to validate the agreement.

Is the Texas Golf Cart Bill of Sale required for registration?

While a Golf Cart Bill of Sale is not always mandated for registration, it is highly recommended. Having this document can facilitate the registration process and ensure that ownership is clearly established. Local regulations may vary, so it is wise to check with local authorities for specific requirements.

Can a Golf Cart Bill of Sale be created without a formal template?

Yes, a Golf Cart Bill of Sale can be created without a formal template as long as it contains all essential information. However, using a standard template ensures all necessary details are included, making the document more professional and reducing the risk of future disputes.

What should I do if I lose the Bill of Sale?

If the Bill of Sale is lost, it is advisable to create a new document that includes the same information as the original. Both parties should sign this new document to validate it. In some cases, a notary may be recommended to provide additional authentication.

Can I use a Golf Cart Bill of Sale for a used cart?

Yes, a Golf Cart Bill of Sale can and should be used for both new and used golf carts. This document is essential in either case to confirm ownership transfer and to protect the rights of both the buyer and seller.

Is there a specific format that must be followed for the Bill of Sale?

There is no specific statutory format required for a Golf Cart Bill of Sale in Texas. However, it is important that all necessary details are clearly stated and that both parties understand and agree to the terms. Clarity in the document will help prevent any misunderstandings in the future.