What is a Texas Gift Deed?

A Texas Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. It is a way for the owner, known as the grantor, to give property to another person, referred to as the grantee, as a gift.

Do I need a Texas Gift Deed form for a verbal gift?

Yes, a verbal agreement is not enough to legally transfer property. To make a gift valid and enforceable, a Texas Gift Deed must be executed in writing and properly recorded in the county where the property is located.

Can I use a Gift Deed for any property?

Generally, a Gift Deed can be used for real estate property, such as land or a house. However, it is essential to ensure that the property is eligible for gift transfer and that any existing liens or mortgages are handled appropriately.

Is there any tax obligation when using a Gift Deed in Texas?

While there are no immediate tax implications for the grantee, the grantor may be subject to federal gift tax rules. It is advisable to consult a tax professional to understand any potential tax obligations before completing the Gift Deed.

What are the required elements of a Texas Gift Deed?

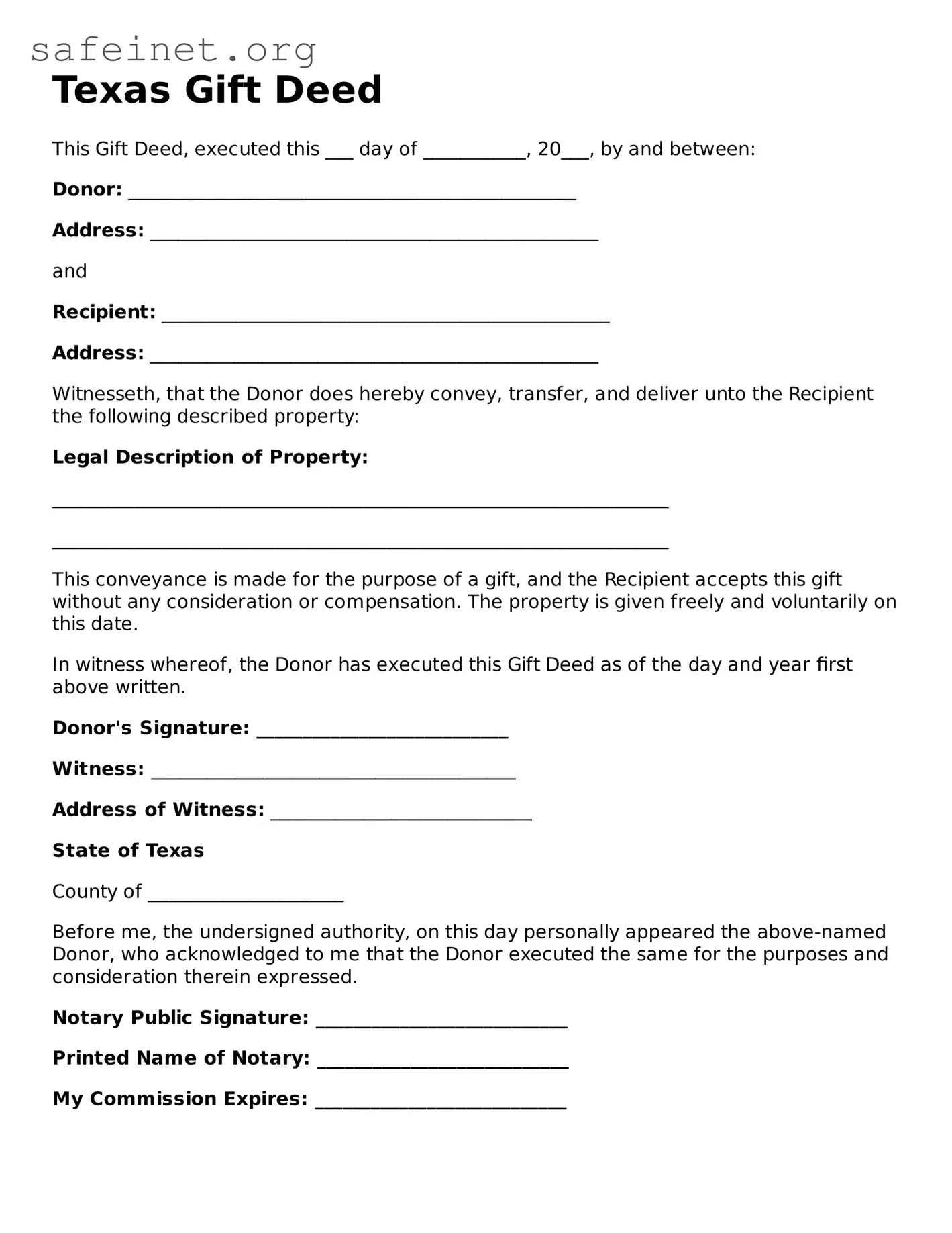

A valid Texas Gift Deed must include the names of the grantor and grantee, a clear description of the property being gifted, a statement declaring the transfer is a gift, and signatures of the grantor. Notarization and recording the deed with the county clerk are also necessary steps.

Can I revoke a Texas Gift Deed?

Once a Texas Gift Deed is executed and delivered, it generally cannot be revoked. The grantor loses ownership rights. If you are concerned about revoking a gift, it's best to seek legal advice before executing the deed.

Do I need a lawyer to prepare a Gift Deed?

It is not legally required to have a lawyer draft a Gift Deed, but having legal assistance can be beneficial. A lawyer can ensure that the deed complies with Texas laws and that all necessary elements are appropriately addressed.

Can I gift property to multiple people with one Gift Deed?

Yes, you can. If you wish to give property to multiple recipients, a Gift Deed can include all the names. Just ensure that the deed clearly states the ownership percentages or shares each recipient will hold.

What happens if the property has a mortgage?

If the property has a mortgage, the lender usually needs to be informed. The new owner—once a gift is made—will be responsible for the mortgage payments. Some lenders may have restrictions on transferring a property, so it's essential to check the loan agreement.

How do I record the Texas Gift Deed?

After completing the Gift Deed, you need to file it with the county clerk’s office in the county where the property is located. Recording the deed makes the transfer official and protects the new owner's rights.