What is a Texas Deed?

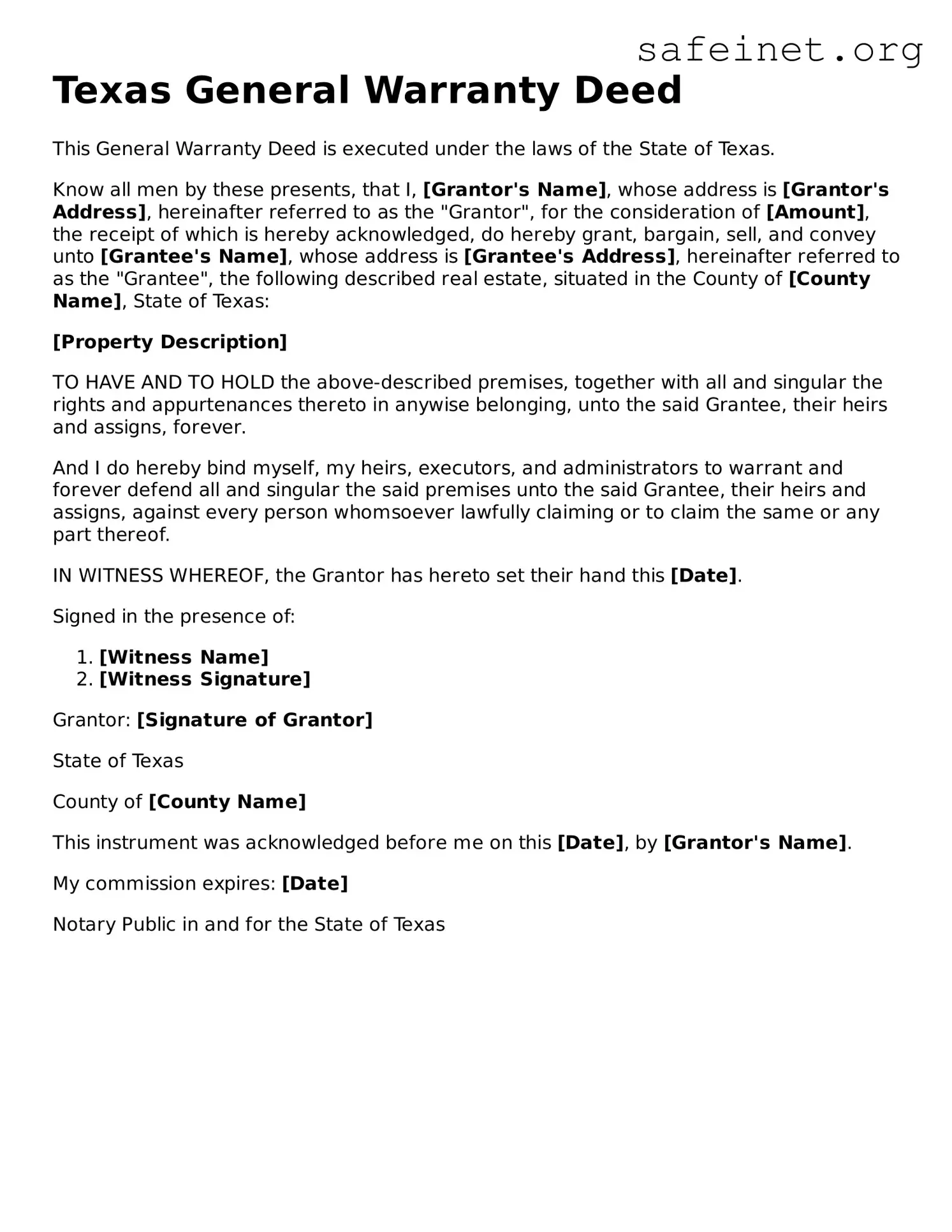

A Texas deed is a legal document that transfers ownership of real estate in Texas. It serves as a record of the transfer between the seller (grantor) and the buyer (grantee). This document typically includes the names of the parties involved, a description of the property, and the signature of the grantor.

What are the different types of deeds in Texas?

There are several types of deeds in Texas, each serving a unique purpose. Common types include Warranty Deed, Special Warranty Deed, and Quitclaim Deed. A Warranty Deed offers the highest level of protection to the buyer, ensuring that the seller fully warrants the title. A Special Warranty Deed limits the seller's liability to only issues that arose during their ownership. A Quitclaim Deed transfers whatever interest the seller has in the property, without making any guarantees about the title.

What information should be included in a Texas Deed?

A Texas Deed should include the following information: names of the grantor and grantee, a detailed description of the property (including legal description), consideration (the amount paid for the property), and the signatures of the grantor. It may also include the date of the transfer and any conditions or restrictions on the property.

Do I need to have my Texas Deed notarized?

Yes, a Texas Deed must be signed in front of a notary public. The notary verifies the identities of the parties signing the document and provides an official seal. This step helps protect against fraud and ensures the document is legally binding.

How do I file a Texas Deed?

To file a Texas Deed, you must take the signed and notarized document to the county clerk's office in the county where the property is located. After filing, the clerk will record the deed, making it a public record. There may be a filing fee, so it’s wise to check with the county office ahead of time.

Are there any tax implications when transferring property with a Texas Deed?

Yes, transferring property can have tax implications. The buyer may be responsible for paying the Texas Transfer Tax, which varies by county. Additionally, property taxes may also need to be addressed. It is advisable to consult a tax professional for specific questions regarding property taxes and transfers.

What happens if I lose my Texas Deed?

If you lose your Texas Deed, you can obtain a certified copy from the county clerk's office where the deed is recorded. The certified copy serves as an official record of your property ownership. Always keep important documents in a safe place to prevent loss in the future.

Can a Texas Deed be changed after it is signed?

Once a Texas Deed is signed and recorded, it typically cannot be changed. If you need to make changes, you may need to create a new deed. It is important to consider the accuracy of the information before signing to avoid complications later.

What is the difference between a deed and a title?

A deed is the physical document that transfers ownership of property, while a title refers to the legal rights and ownership of that property. Having a deed shows that you have received ownership, but holding a clear title confirms your right to the property free from issues or claims from others.

Do I need a lawyer to prepare a Texas Deed?

While you are not required to hire a lawyer to prepare a Texas Deed, it can be beneficial to seek legal advice, especially if the transaction is complex or if you have specific questions. A lawyer can ensure that the deed meets all legal requirements and help protect your interests during the transfer.