What is the Texas Articles of Incorporation form?

The Texas Articles of Incorporation form is a legal document required to establish a corporation in the state of Texas. It provides fundamental information about the corporation, including its name, purpose, registered office address, and details about its stock structure, if applicable. This document must be filed with the Texas Secretary of State's office to legally create the corporation.

Who needs to file the Articles of Incorporation?

Any individual or group looking to start a corporation in Texas must file the Articles of Incorporation. This could include entrepreneurs creating a new business, existing businesses wanting to change their structure to a corporation, or organizations seeking to incorporate for liability protection and tax benefits.

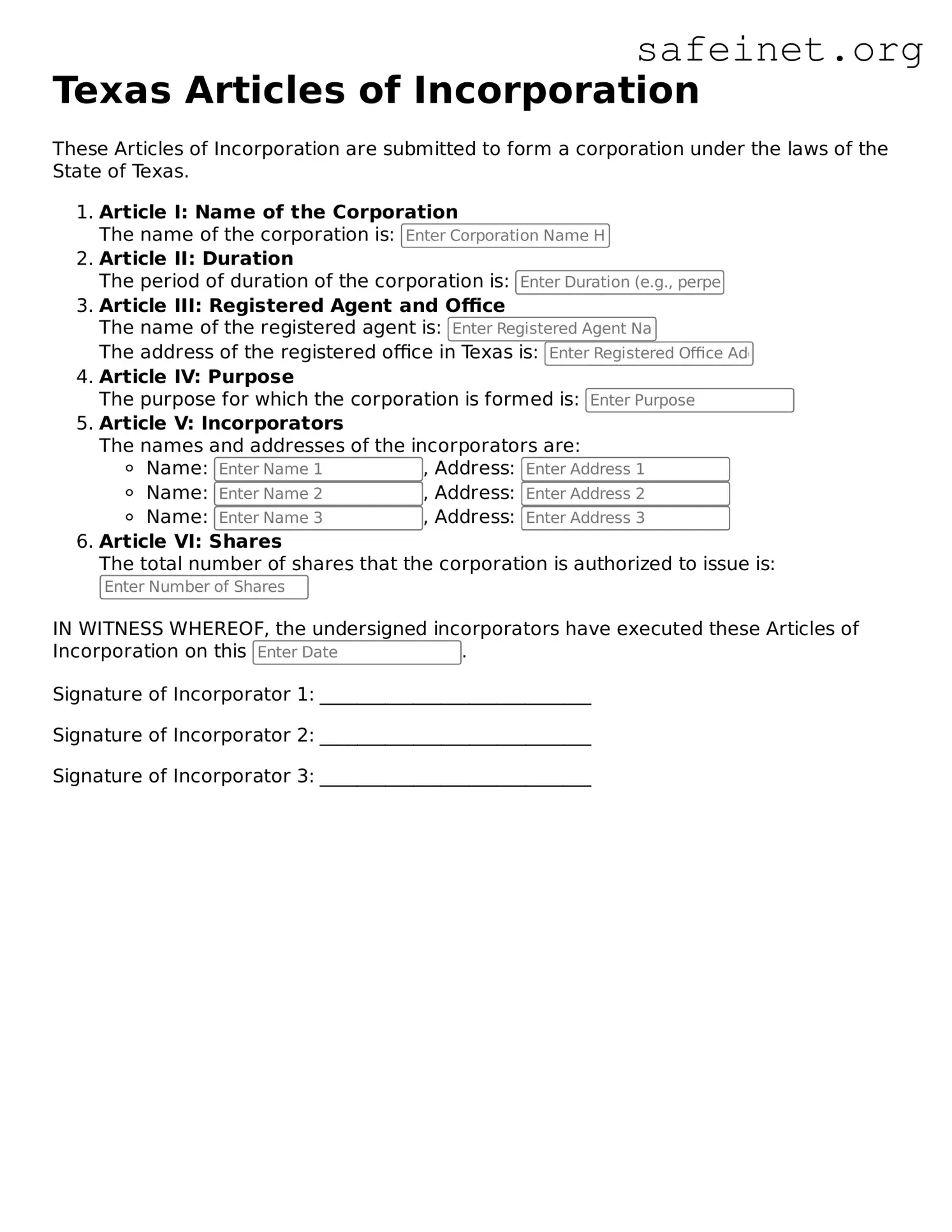

What information is required on the form?

The form typically requires the name of the corporation, the purpose for which it is being formed, the address of the registered office, and the number of shares the corporation is authorized to issue. Additionally, the names and addresses of the initial directors and incorporators may also need to be included.

How much does it cost to file the Articles of Incorporation in Texas?

The filing fee for the Texas Articles of Incorporation can vary based on the type and structure of the corporation. As of the latest information, the fee is generally around $300 for domestic corporations. It is important to check with the Texas Secretary of State for the most up-to-date fee structure.

How long does it take for the Articles of Incorporation to be processed?

Processing times for the Articles of Incorporation can vary. Generally, it may take several business days to a few weeks for the Texas Secretary of State to process the filing. Expedited services may also be available for an additional fee, reducing the processing time significantly.

Can I file the Articles of Incorporation online?

Yes, Texas allows for online filing of the Articles of Incorporation through the Secretary of State's website. This option is convenient and can speed up the submission process, allowing for immediate confirmation of receipt.

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are filed and accepted, the corporation legally exists. The Secretary of State will issue a certificate of incorporation, which serves as proof of the business's formation. Corporators are then responsible for creating bylaws and setting up the corporation’s governance structure.

Do I need a lawyer to file the Articles of Incorporation?

While it is not legally required to hire a lawyer to file the Articles of Incorporation, it may be beneficial. Legal experts can provide guidance on the process, ensure compliance with state laws, and help address any specific concerns related to your business structure and article content.

What are the consequences of not filing the Articles of Incorporation?

Failing to file the Articles of Incorporation can lead to serious consequences. Without proper incorporation, individuals conducting business may be personally liable for any debts or legal claims against the business. Additionally, the business will not enjoy the benefits of limited liability, and it may face penalties or restrictions from the state.