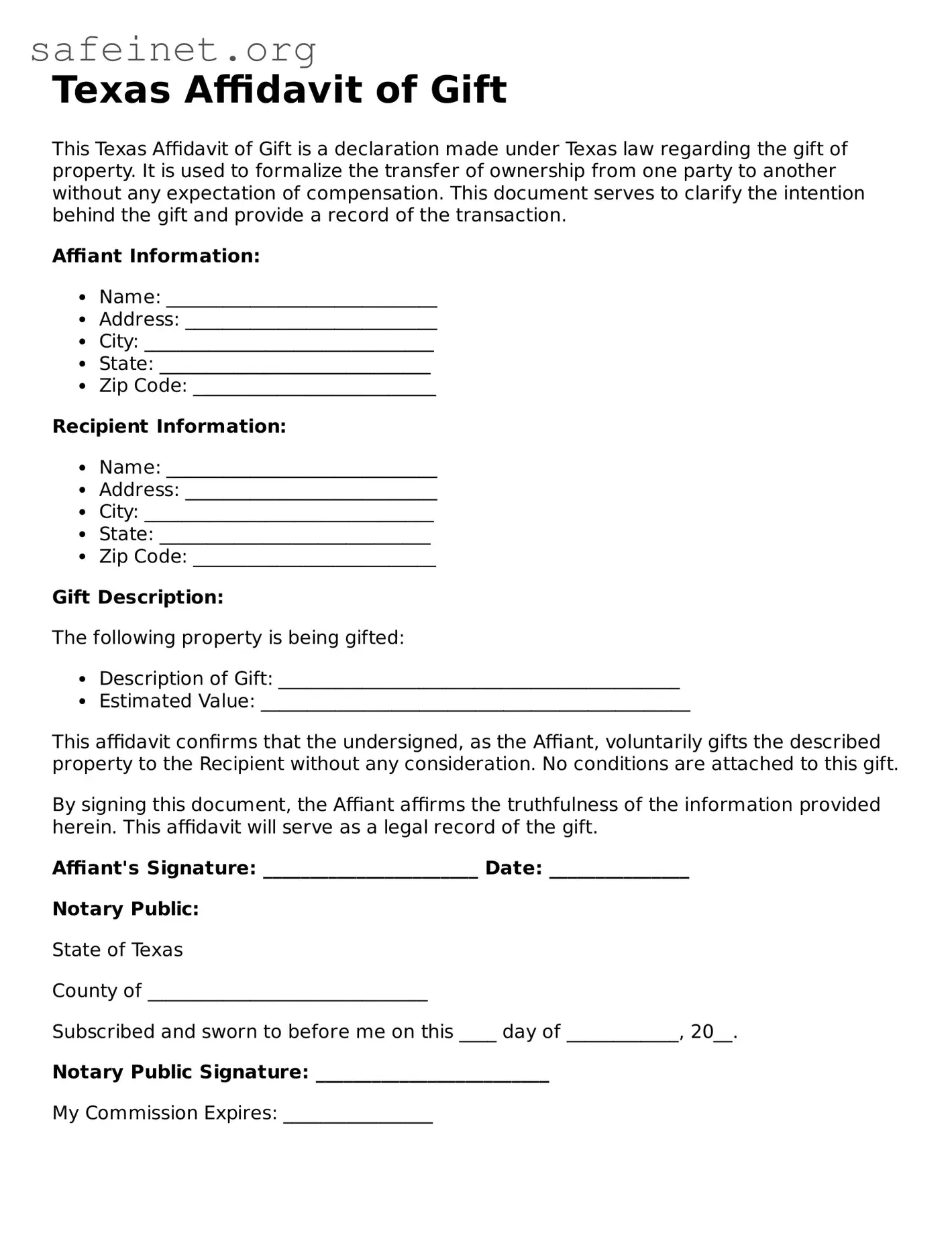

Texas Affidavit of Gift

This Texas Affidavit of Gift is a declaration made under Texas law regarding the gift of property. It is used to formalize the transfer of ownership from one party to another without any expectation of compensation. This document serves to clarify the intention behind the gift and provide a record of the transaction.

Affiant Information:

- Name: _____________________________

- Address: ___________________________

- City: _______________________________

- State: _____________________________

- Zip Code: __________________________

Recipient Information:

- Name: _____________________________

- Address: ___________________________

- City: _______________________________

- State: _____________________________

- Zip Code: __________________________

Gift Description:

The following property is being gifted:

- Description of Gift: ___________________________________________

- Estimated Value: ______________________________________________

This affidavit confirms that the undersigned, as the Affiant, voluntarily gifts the described property to the Recipient without any consideration. No conditions are attached to this gift.

By signing this document, the Affiant affirms the truthfulness of the information provided herein. This affidavit will serve as a legal record of the gift.

Affiant's Signature: _______________________ Date: _______________

Notary Public:

State of Texas

County of ______________________________

Subscribed and sworn to before me on this ____ day of ____________, 20__.

Notary Public Signature: _________________________

My Commission Expires: ________________