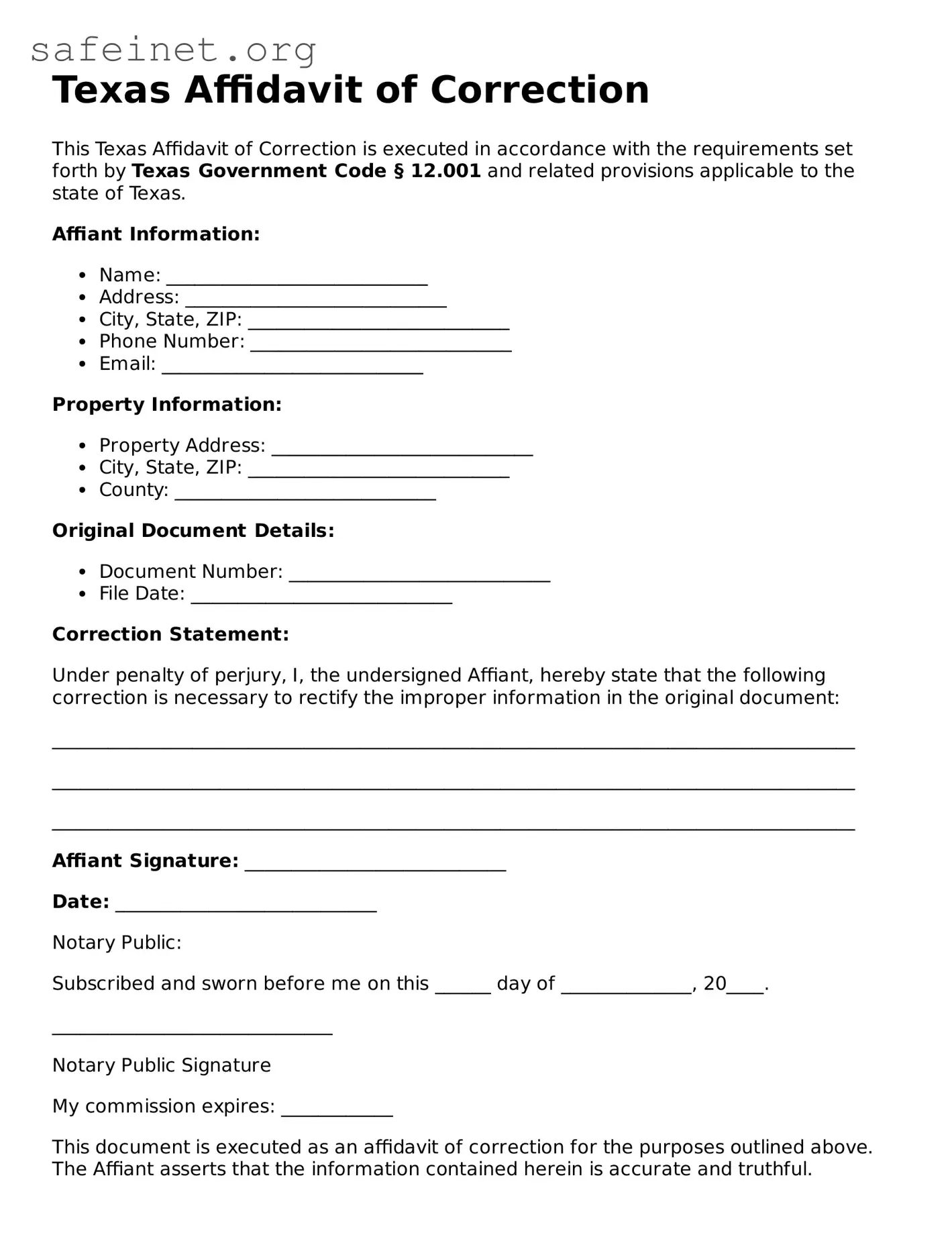

Texas Affidavit of Correction

This Texas Affidavit of Correction is executed in accordance with the requirements set forth by Texas Government Code § 12.001 and related provisions applicable to the state of Texas.

Affiant Information:

- Name: ____________________________

- Address: ____________________________

- City, State, ZIP: ____________________________

- Phone Number: ____________________________

- Email: ____________________________

Property Information:

- Property Address: ____________________________

- City, State, ZIP: ____________________________

- County: ____________________________

Original Document Details:

- Document Number: ____________________________

- File Date: ____________________________

Correction Statement:

Under penalty of perjury, I, the undersigned Affiant, hereby state that the following correction is necessary to rectify the improper information in the original document:

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

Affiant Signature: ____________________________

Date: ____________________________

Notary Public:

Subscribed and sworn before me on this ______ day of ______________, 20____.

______________________________

Notary Public Signature

My commission expires: ____________

This document is executed as an affidavit of correction for the purposes outlined above. The Affiant asserts that the information contained herein is accurate and truthful.