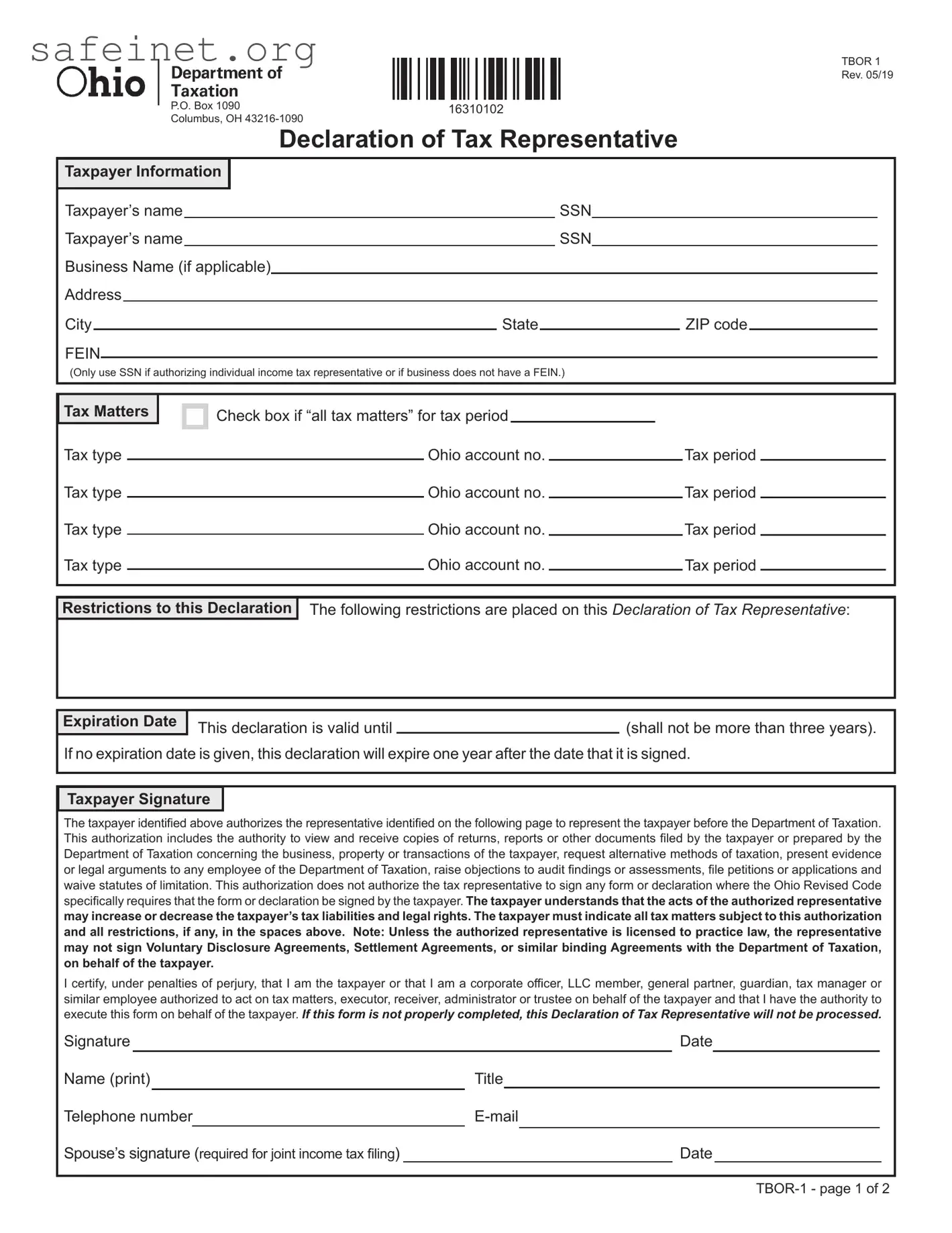

What is the Tax POA tbor-1 form?

The Tax POA tbor-1 form is a Power of Attorney form specifically designed for tax matters. It allows an individual or entity to designate another person to represent them before the tax authorities. This includes the ability to access information, communicate regarding tax issues, and handle other tax-related affairs on behalf of the individual or entity granting the power.

Who can be appointed as an agent using the Tax POA tbor-1 form?

Any individual or entity can be appointed as an agent as long as they are qualified to represent yourself or your business before tax authorities. This can include attorneys, accountants, or other tax professionals. You may also appoint a family member or friend, provided they meet the basic requirements for representation.

How do I complete the Tax POA tbor-1 form?

To complete the form, fill in the required fields such as your name, address, and taxpayer identification number. Next, include the name and contact details of the person you are appointing as your agent. Be sure to specify the scope of authority you want to grant. After filling in all the necessary information, sign and date the form to validate it.

Do I need to submit the Tax POA tbor-1 form to the tax authorities?

Yes, you must submit the Tax POA tbor-1 form to the relevant tax authority. After you complete the form, ensure that it is filed properly with the appropriate department. It’s advisable to keep a copy for your records. Depending on jurisdiction, you may also need to notify your appointed agent that the form was submitted.

Is there a fee associated with filing the Tax POA tbor-1 form?

Typically, there is no fee associated with filing the Tax POA tbor-1 form itself. However, if you are utilizing the services of professionals to prepare or file the form, they may charge a fee for their assistance. It’s wise to inquire about any potential costs before proceeding.

Can I revoke the Power of Attorney after submitting the form?

You can revoke the Power of Attorney at any time after submitting the Tax POA tbor-1 form. To do so, you must provide written notice to the appointed agent as well as the tax authority. This can be done using a separate revocation form or a simple written letter that includes your details and a statement revoking the agent's authority.

How long does the Tax POA tbor-1 form remain in effect?

The effect of the Tax POA tbor-1 form generally continues until you revoke it or until the tax matter it addresses is resolved. If you specify a limited duration on the form, it will expire at that time. Always keep track of any actions taken under this authority to ensure you are aware of when it may be relevant to revoke it.

What should I do if my agent can no longer serve?

If your designated agent can no longer serve for any reason, you may need to appoint a new agent. Submit a new Tax POA tbor-1 form with the updated information regarding your new agent. Additionally, consider revoking the authority granted to the previous agent to prevent any confusion in the future.

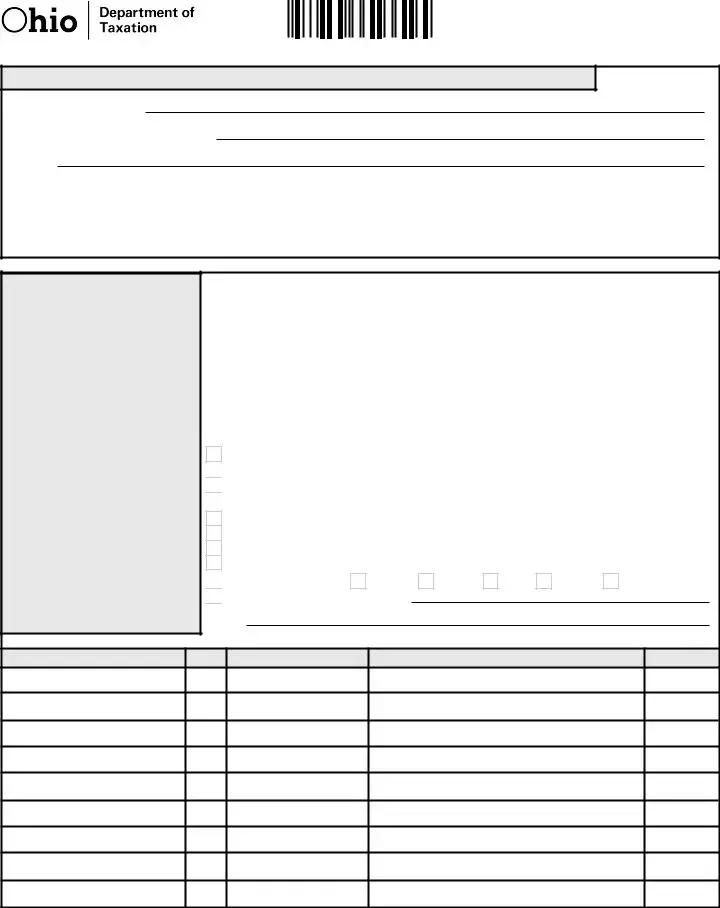

2. Certified public accountant or public accountant – duly qualified practice in the jurisdiction shown below.

2. Certified public accountant or public accountant – duly qualified practice in the jurisdiction shown below.

7. Other – provide explanation

7. Other – provide explanation