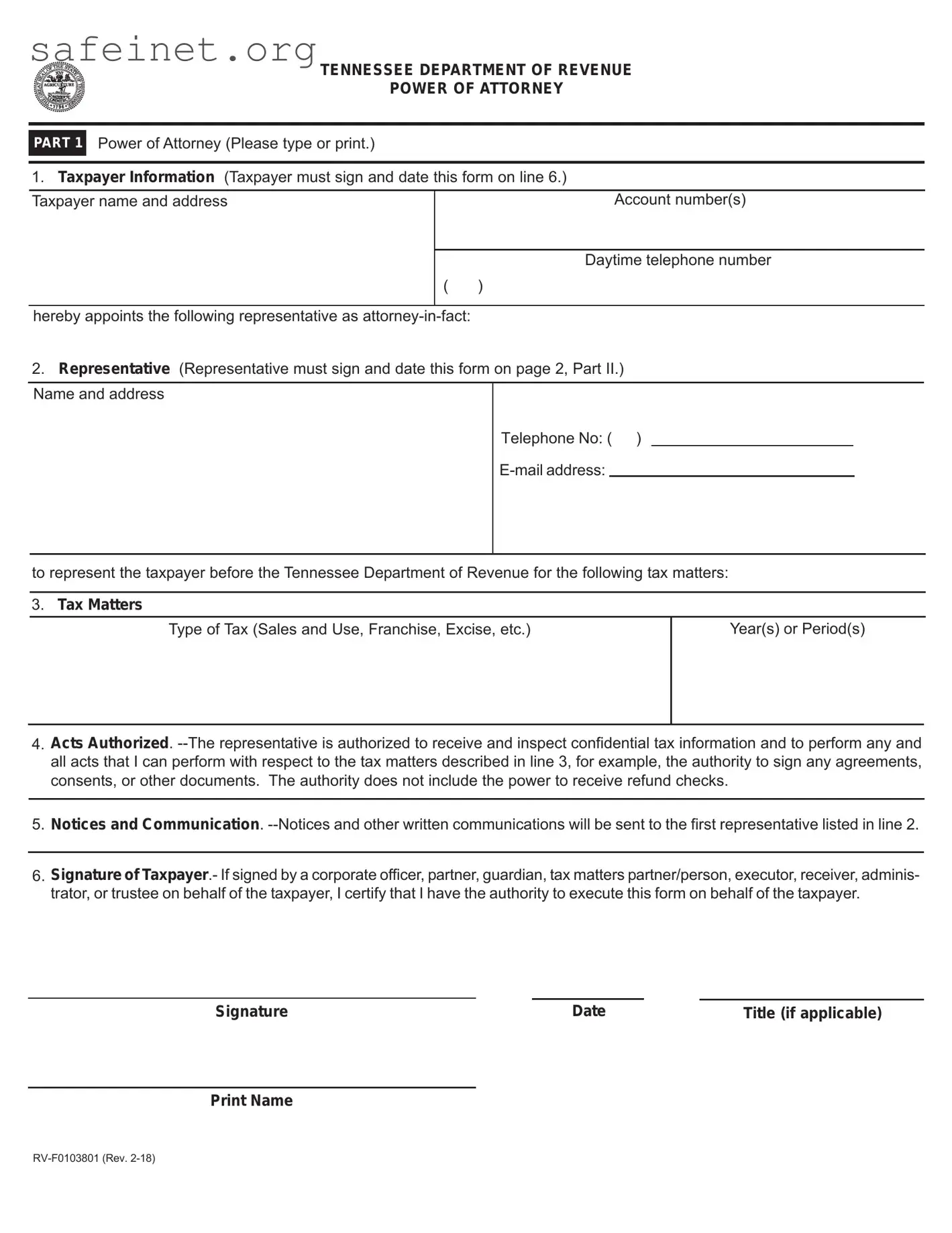

What is the Tax POA RV-F0103801 form?

The Tax POA RV-F0103801 form is a Power of Attorney document specifically designed for tax matters in the United States. It allows an individual, known as the principal, to authorize someone else, known as the agent, to represent them before the tax authority. This representation can include filing tax returns, discussing issues related to the taxpayer’s account, and making decisions on behalf of the taxpayer regarding their tax liabilities and rights.

Who can be appointed as an agent using this form?

Any individual or entity can be designated as an agent on the Tax POA RV-F0103801 form. Common choices for agents include tax professionals such as certified public accountants (CPAs), enrolled agents, or attorneys. It is crucial for the principal to choose someone trustworthy who understands tax laws and can effectively manage their tax-related matters.

How do I complete the form?

To complete the Tax POA RV-F0103801 form, the principal must provide their personal information, including name, address, and tax identification number. The form also requires details about the appointed agent, including their name and contact information. The principal must sign and date the form to validate it. Ensure that all sections of the form are filled out accurately to avoid delays in processing.

How do I submit the Tax POA RV-F0103801 form?

After completing the Tax POA RV-F0103801 form, the principal should submit it to the appropriate tax authority. This is typically done by mailing the form to the address specified for submissions on the form or on the tax authority’s website. It may also be possible to submit the form electronically, depending on the jurisdiction's requirements. Check for any specific submission guidelines applicable to your state or local tax authority.

How long is the Power of Attorney effective?

The Power of Attorney granted by the Tax POA RV-F0103801 form remains effective as long as the principal is alive and has not revoked it. The principal can revoke the Power of Attorney at any time by providing written notice to the agent and the tax authority. Once the form is revoked, the agent no longer has the authority to act on behalf of the principal regarding tax matters.