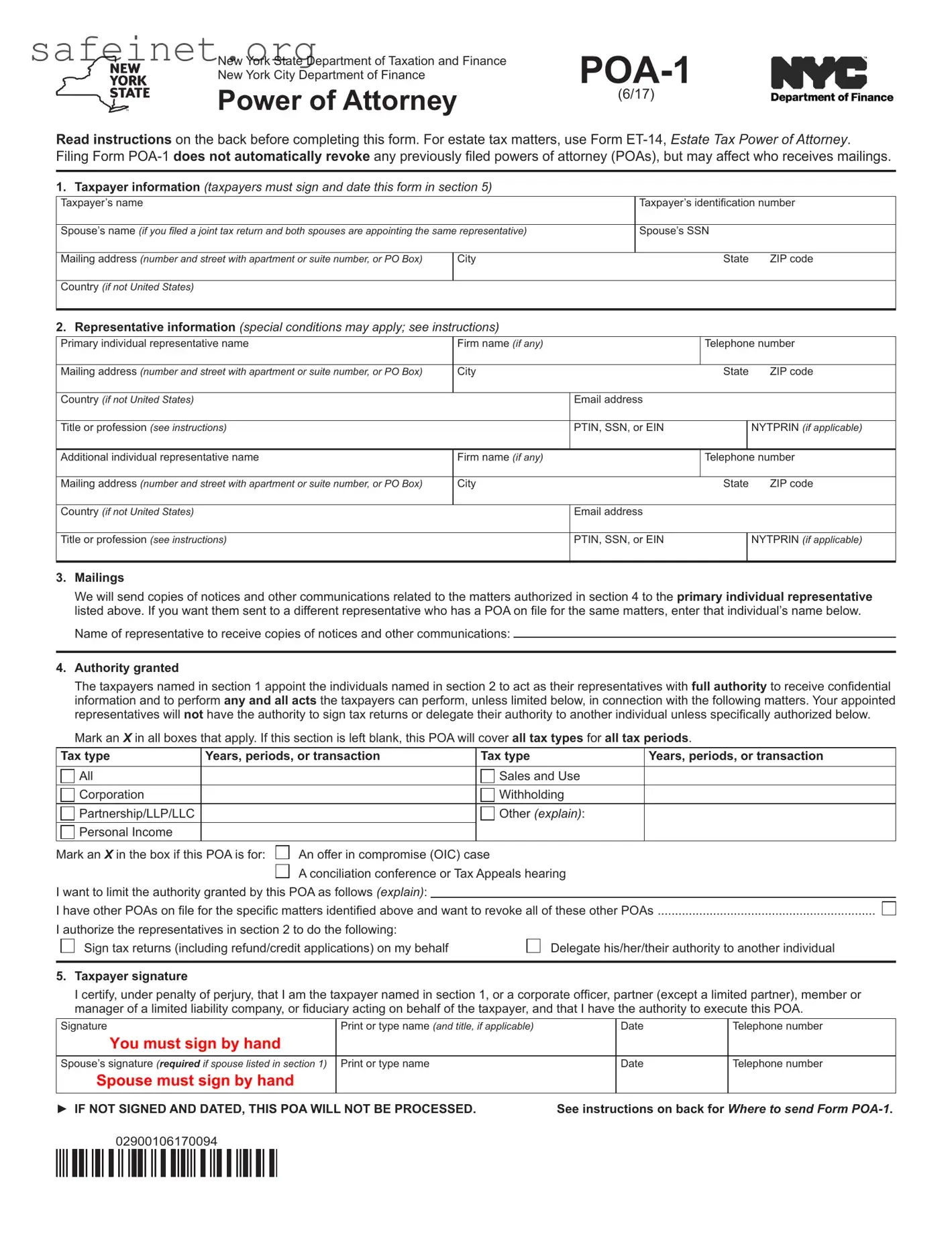

General information

Use Form POA-1, Power of Attorney, when you want to give one or

more individuals the authority to obligate or bind you, or appear on your behalf. You may only appoint individuals (not a firm) to represent you. Note: Authorizing someone to represent you does not relieve you of your

tax obligations.

Use this form for all matters (except estate tax) imposed by the Tax Law or another statute administered by the New York State (NYS) Department of Taxation and Finance (Tax Department) and the New

York City (NYC) Department of Finance. If you and your spouse filed a joint tax return but have different representatives, you must each file a

separate Form POA-1.

Unless you limit the authority you grant (see section 4), your appointed representative will be authorized to perform any and all acts you can perform, including but not limited to: receiving confidential information

concerning your taxes, agreeing to extend the time to assess tax, and agreeing to a tax adjustment.

You do not need Form POA-1 to authorize someone to appear with you or with someone who is already authorized to act for you or to authorize

someone to provide information, or prepare a report or return for you.

Only certain types of professionals may act on your behalf before the NYS Bureau of Conciliation and Mediation Services (BCMS), the NYC Department of Finance Conciliation Bureau or at Tax Appeals. Visit the Tax Department’s POA webpage (at www.tax.ny.gov/poa) for more information.

Revocation and withdrawal – New: This POA will remain active until you (the taxpayer) revoke it or your representative withdraws from representing you. Representatives may not revoke a POA.

For information on ways to revoke a POA, or how a representative

can withdraw, see the Tax Department’s POA webpage (at www.tax.ny.gov/poa).

Specific instructions

For additional information on how to complete Form POA-1, including

who must sign as the taxpayer, visit the Tax Department’s POA webpage (at www.tax.ny.gov/poa).

Section 1 – Taxpayer information

The taxpayer identification number may be a social security number (SSN), employer identification number (EIN), individual taxpayer identification number (ITIN) issued by the Internal Revenue Service, or a tax identification number issued by the NYS Tax Department.

Section 3 – Mailings

If you want copies of notices and other communications sent to someone other than the primary individual representative listed in section 2 of this POA, enter the name of that representative on the line provided. This

representative must be someone who is listed as a representative for the matters covered by this POA on this or another valid POA on file.

If you do not want copies of notices and other communications sent to any representative, enter None.

Example: On 2/1/2016 you appoint Mr. Smith as your representative for all tax matters for 2015. Mr. Smith will receive copies of mailings for these matters. On 8/15/2016, you appoint Ms. Jones as your representative for all tax matters for 2015. Ms. Jones will now receive copies of mailings for these matters. However, if you want Mr. Smith to continue to receive mailings, you must list Mr. Smith’s name in section 3 of the POA appointing Ms. Jones. Ms. Jones will not receive mailings.

Section 4 – Authority granted

Use this section to specify the matters covered by this POA. By default, this POA will cover all tax types for all tax periods. If you select a tax type, but do not enter a tax period, this POA will cover the tax type selected for all tax periods. If you enter a tax period, but do not select a tax type, this POA will cover the tax period entered for all tax types. For

tax periods other than calendar years, enter the beginning and ending dates for the periods. For taxes based on a specific transaction, enter

the transaction date.

If your tax type is not listed, or if you are granting authority for a special assessment or fee administered by an agency, mark an X in the Other box and explain. To identify a specific audit case or assessment, mark the Other box and enter a case or assessment ID number.

If you want to limit your representative’s authority, explain the limitation.

For example, you can limit your representative’s authority to only receive confidential information, but make no binding decisions for you. If you

need more space to explain the limitation, attach a sheet. The attached sheet must be signed and dated by each taxpayer named in section 1.

Section 5 – Taxpayer signature

You or someone who is authorized to act for you must sign and date Form POA-1. The authorized person who signs Form POA-1 may need to provide identification and evidence of authority to sign this POA.

If a joint tax return was filed and both spouses will be represented by the

same representatives, both spouses must sign and date Form POA-1 unless one spouse authorizes the other, in writing, to sign for both. In that case, attach a copy of the authorization.

II

II

I IIIIII I Ill I IIII

I IIIIII I Ill I IIII

II II

II II