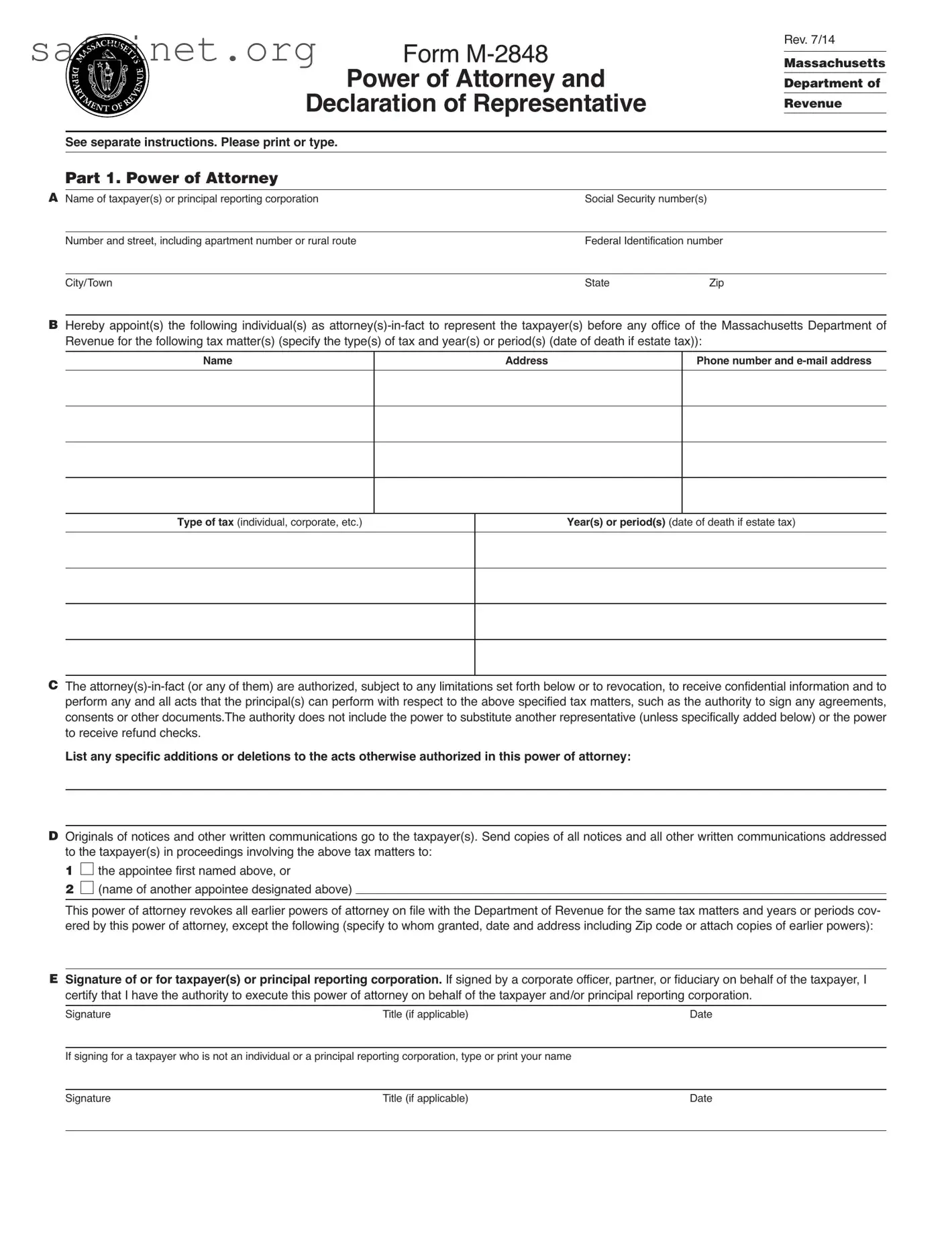

What is the IRS Form 2848?

IRS Form 2848, also known as the Power of Attorney and Declaration of Representative, allows you to authorize someone to represent you before the IRS. This person can be an attorney, a certified public accountant, or an enrolled agent. By filling out this form, you empower them to handle your tax matters, communicate with the IRS, and receive information on your behalf.

Who can I appoint as my representative on Form 2848?

You can appoint an individual or individuals to represent you, including attorneys, CPAs, or enrolled agents. However, each representative must have a valid PTIN (Preparer Tax Identification Number) or an active enrollment status with the IRS. Be sure to verify that your chosen representative meets these criteria before submitting the form.

How do I fill out Form 2848 correctly?

To complete Form 2848, provide your name, address, and Social Security Number (or Employer Identification Number). Next, list the representative's name, address, and PTIN or CAF (Centralized Authorization File) number. Finally, specify the tax matters for which you’re granting authority and sign the form at the bottom. Make sure all information is accurate to avoid any delays or issues.

How long is the authorization valid?

The authorization granted by Form 2848 generally remains in effect until you revoke it, withdraw it, or when the representative is no longer able to act on your behalf. Additionally, the IRS retains the right to revoke any authorization if deemed necessary. You may also state a specific expiration date if you wish to limit the duration of the authorization.

Where do I send Form 2848?

Form 2848 can be submitted to the IRS by mailing it to the appropriate address indicated in the instructions of the form. Alternatively, you may fax the completed form to the IRS, depending on your specific situation. Be sure to check the latest IRS guidelines to confirm you are sending it to the correct location.

Can I revoke a previously granted Power of Attorney?

Yes, you can revoke a Power of Attorney at any time. To do so, you must submit a written statement to the IRS that clearly indicates your intent to revoke the previous Form 2848. You should also provide a copy of the previous authorization for reference. Keeping a record of your revocation is important for your own records.

Can I submit Form 2848 electronically?

Currently, Form 2848 is not eligible for electronic submission directly to the IRS. It must be printed and mailed or faxed. However, if you are working with a tax professional, they may be able to submit the form on your behalf using their own processes. Always confirm with your representative if additional steps are necessary.

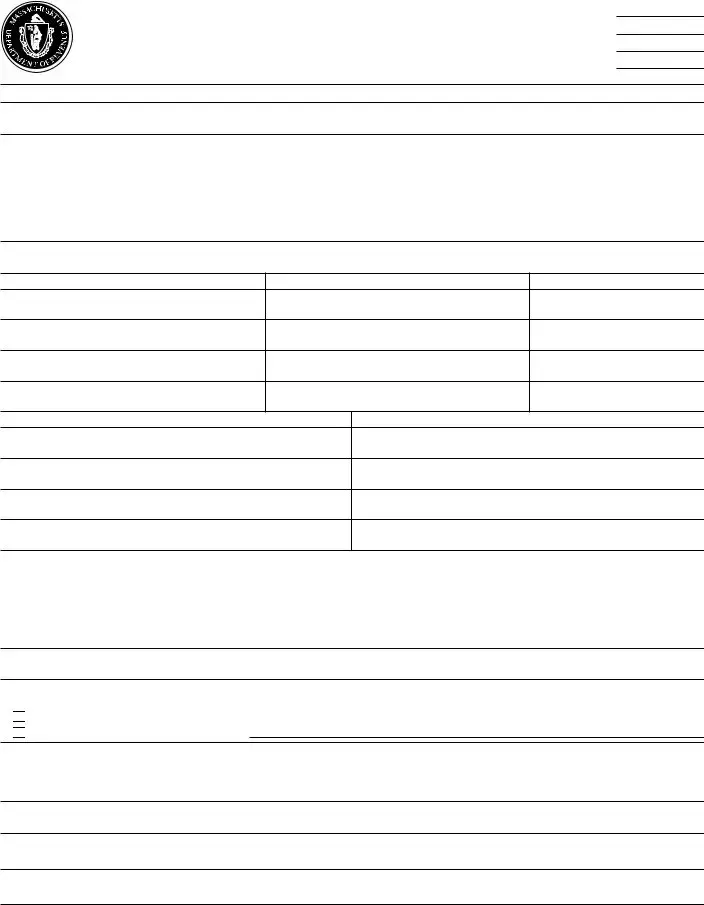

the appointee first named above, or

the appointee first named above, or

(name of another appointee designated above)

(name of another appointee designated above)

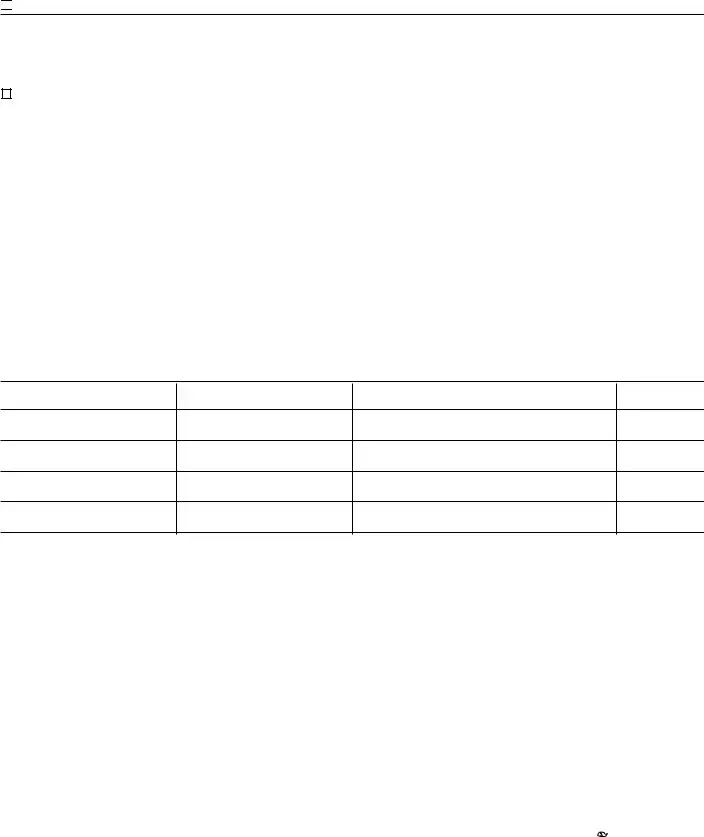

is/are known to and signed in the presence of the two disinterested witnesses whose signatures appear here:

is/are known to and signed in the presence of the two disinterested witnesses whose signatures appear here: printed on recycled paper

printed on recycled paper