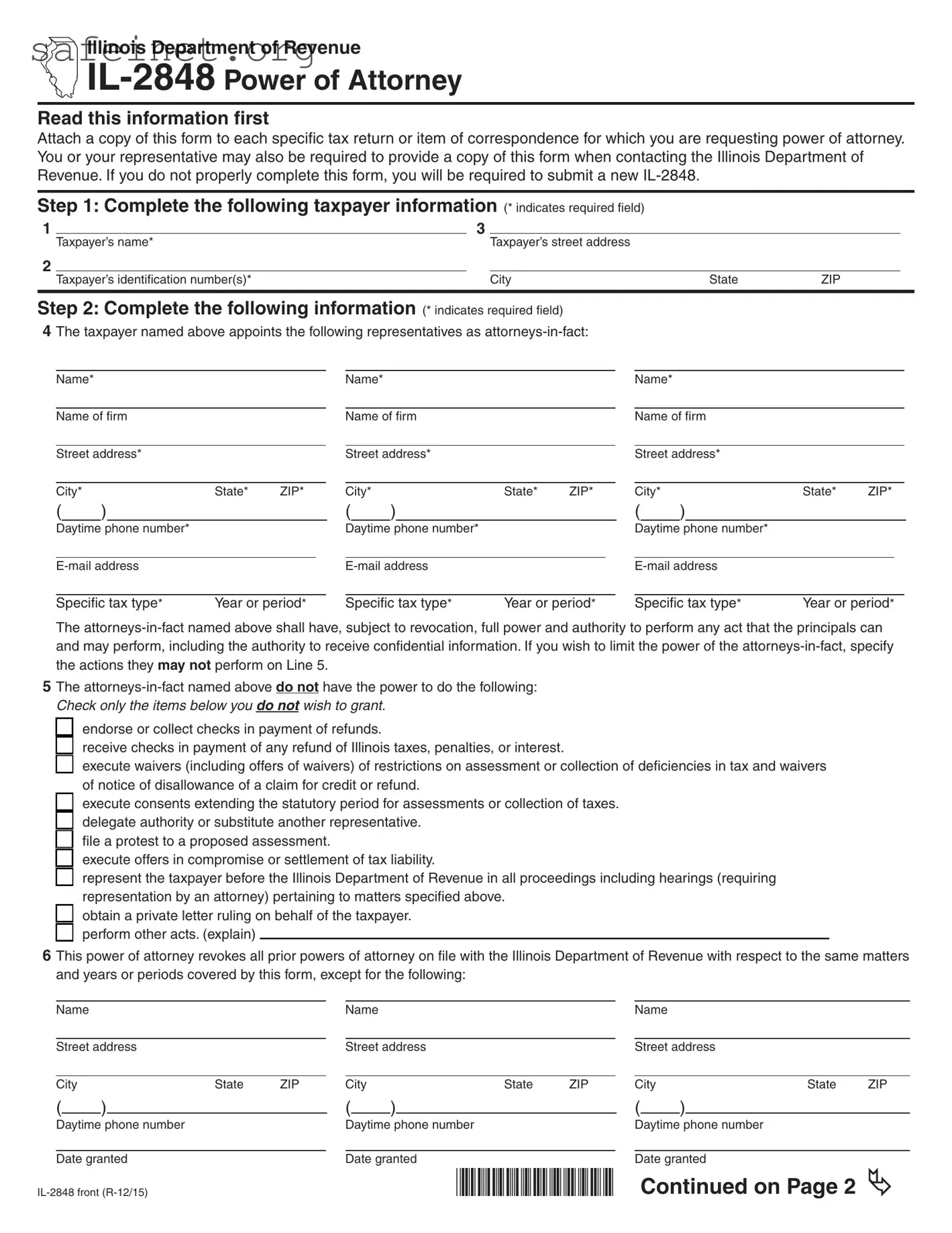

What is the Tax POA IL-2848 form?

The Tax POA IL-2848 form, or Power of Attorney, is a document used in the state of Illinois. It allows an individual, known as the "taxpayer," to appoint another individual, known as the "representative," to act on their behalf regarding tax matters. This form is essential for allowing someone else to handle your tax filings, communicate with tax authorities, and access your tax information.

Who can be appointed as a representative using the IL-2848 form?

Any individual can serve as a representative as long as they are competent and reliable. This could be a family member, friend, accountant, or attorney. The form does not specify any qualifications or certifications for the representative, so it is crucial to choose someone trustworthy and knowledgeable about your tax needs.

How do I complete the IL-2848 form?

Completing the IL-2848 form requires filling in the taxpayer's information, the representative's details, and specifying the type of tax matters the representative is authorized to handle. Be sure to include your Social Security Number or Tax ID, and both your signature and that of your representative. Providing clear information helps facilitate the process and avoids delays.

Can I limit the powers granted to my representative?

Yes, you can limit the powers granted to your representative. The IL-2848 form provides options to specify which tax matters and periods you want your representative to handle. If you only want them to manage a certain tax year or type of tax, you can clearly indicate that on the form. Specifying these boundaries helps protect your interests.

Is the IL-2848 form valid for federal tax purposes?

No, the IL-2848 form is specific to Illinois state tax matters. For federal tax purposes, you would need to use Form 2848, which serves a similar purpose but is applicable at the federal level. If you have tax obligations in both Illinois and at the federal level, you will need to complete both forms.

How long is the IL-2848 form valid?

The IL-2848 form remains valid until you revoke it, or until the representative is no longer able to serve in that capacity. It’s important to keep your information updated. If your circumstances change, or if you wish to appoint a different representative, you should complete and submit a new form.

Where do I submit the IL-2848 form once it's completed?

You can submit the completed IL-2848 form to the Illinois Department of Revenue (IDOR). It’s advisable to send it via certified mail or another traceable method to ensure it is received. In some cases, the form may also be filed electronically, depending on procedures established by the IDOR.

What happens if I don’t submit the IL-2848 form?

If you do not submit the IL-2848 form, your chosen representative will not have the legal authority to act on your behalf regarding Illinois tax matters. This can lead to complications if you need assistance with tax filings, negotiations, or audits. Without the form, tax authorities might not allow your representative to access your financial information.

Can I revoke my representative's authority after completing the IL-2848 form?

Yes, you can revoke your representative's authority at any time. To do this, you should submit a written notice to the Illinois Department of Revenue, indicating that you are revoking the IL-2848 form. It’s good practice to inform your representative about this change as well to ensure clarity moving forward.

What if I have further questions about the IL-2848 form?

If you have additional questions or need assistance with the IL-2848 form, you can visit the Illinois Department of Revenue’s website or contact their customer service directly. They can provide guidance and resources to ensure you complete the form correctly and understand your options.

endorse or collect checks in payment of refunds.

endorse or collect checks in payment of refunds.

execute consents extending the statutory period for assessments or collection of taxes.

execute consents extending the statutory period for assessments or collection of taxes.

delegate authority or substitute another representative.

delegate authority or substitute another representative.

fle a protest to a proposed assessment.

fle a protest to a proposed assessment.

execute offers in compromise or settlement of tax liability.

execute offers in compromise or settlement of tax liability.

represent the taxpayer before the Illinois Department of Revenue in all proceedings including hearings (requiring representation by an attorney) pertaining to matters specifed above.

represent the taxpayer before the Illinois Department of Revenue in all proceedings including hearings (requiring representation by an attorney) pertaining to matters specifed above.

obtain a private letter ruling on behalf of the taxpayer.

obtain a private letter ruling on behalf of the taxpayer.

perform other acts. (explain)

perform other acts. (explain)