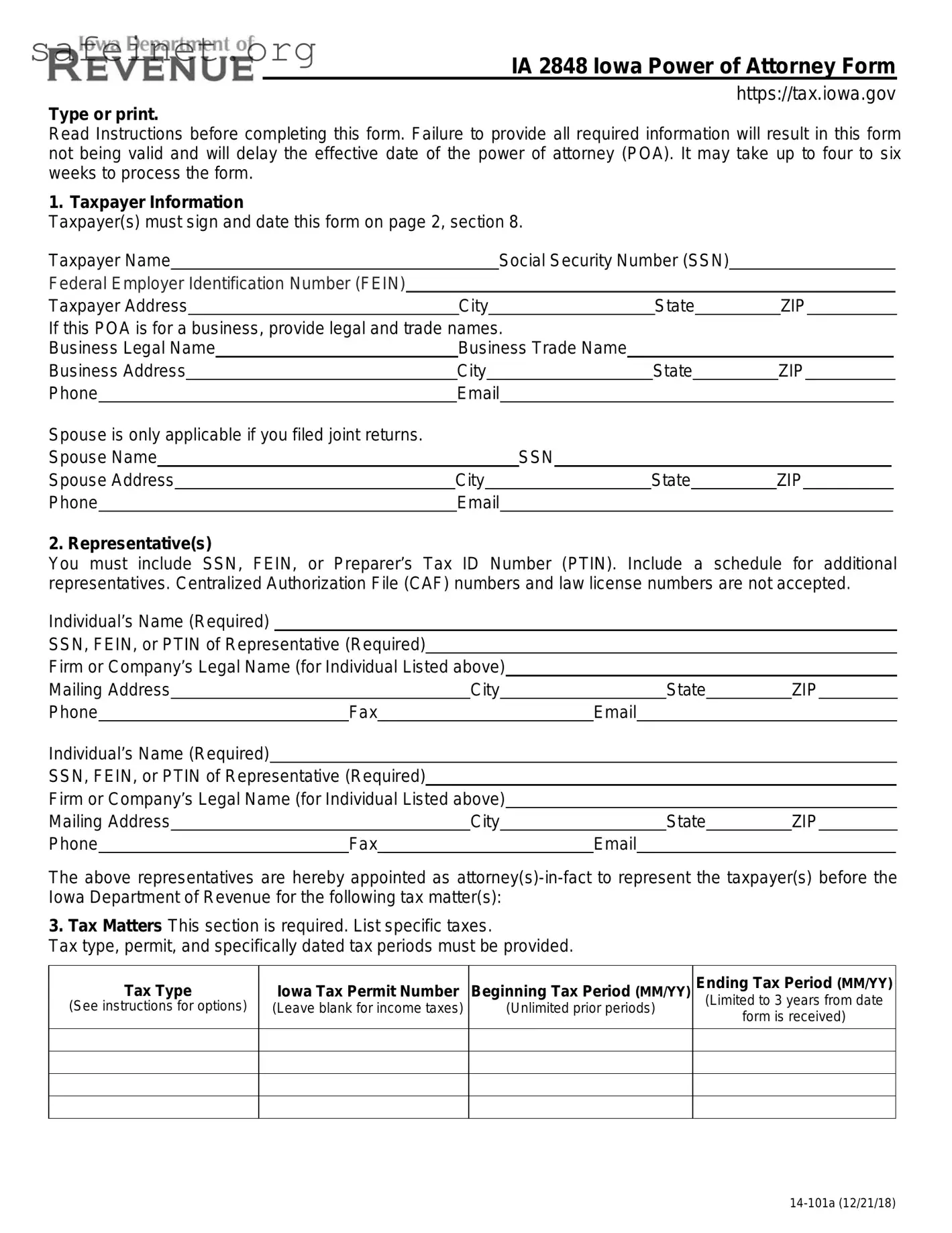

What is Form 2848, the Tax Power of Attorney?

Form 2848, the Tax Power of Attorney, allows a taxpayer to authorize another individual to represent them before the IRS. This can include the power to receive confidential tax information, sign documents, and act on behalf of the taxpayer in certain matters. This designation is crucial for those who cannot manage their tax affairs personally.

Who can be appointed as a representative on Form 2848?

The form allows taxpayers to designate an individual, like an attorney, accountant, or any other person, as their representative. The appointee must hold a valid tax identification number and may need to be a professional with tax-related qualifications in some situations. Non-professionals can also be designated if they serve as a trustworthy representative.

How do I complete Form 2848?

To complete Form 2848, taxpayers must fill out their information, including their name, address, and taxpayer identification number. The taxpayer must then list the representative’s information, including their name, address, and preparer tax identification number (PTIN). The form requires signatures from both parties. Make sure all information is accurate to avoid delays.

Do I need to submit Form 2848 each year?

Form 2848 does not need to be submitted annually. Once it is filed and accepted, it remains in effect until the authority is revoked, the taxpayer cancels the appointment, or the IRS determines the representative is no longer eligible. However, it is important to update the form if there are any changes in circumstances or representatives.

How is Form 2848 submitted to the IRS?

Form 2848 can be submitted to the IRS by mailing, faxing, or in some cases, electronically filing it. The appropriate submission method depends on the type of authorization and specific IRS guidelines. Always check the latest instructions provided by the IRS to ensure proper submission and to avoid any processing issues.

Can I revoke a Power of Attorney granted via Form 2848?

Yes, revocation of power granted through Form 2848 is possible. The taxpayer can revoke the authority granted by submitting a written statement indicating the revocation to the IRS. It's essential to also inform the representative of the revocation to prevent any misunderstandings regarding authority.

What if my representative doesn't follow my instructions?

In a situation where a representative does not adhere to the taxpayer’s instructions, the taxpayer retains the right to revoke the Power of Attorney. This should ideally be done in writing. Taxpayers should keep careful records of all communications with their representatives to address potential disputes effectively.

Is there a fee for using Form 2848?

Filing Form 2848 with the IRS does not require a fee. However, if the representative providing assistance is a professional, they may charge for their services per their standard rates. Taxpayers should discuss any potential fees with their representatives upfront to avoid unexpected costs.