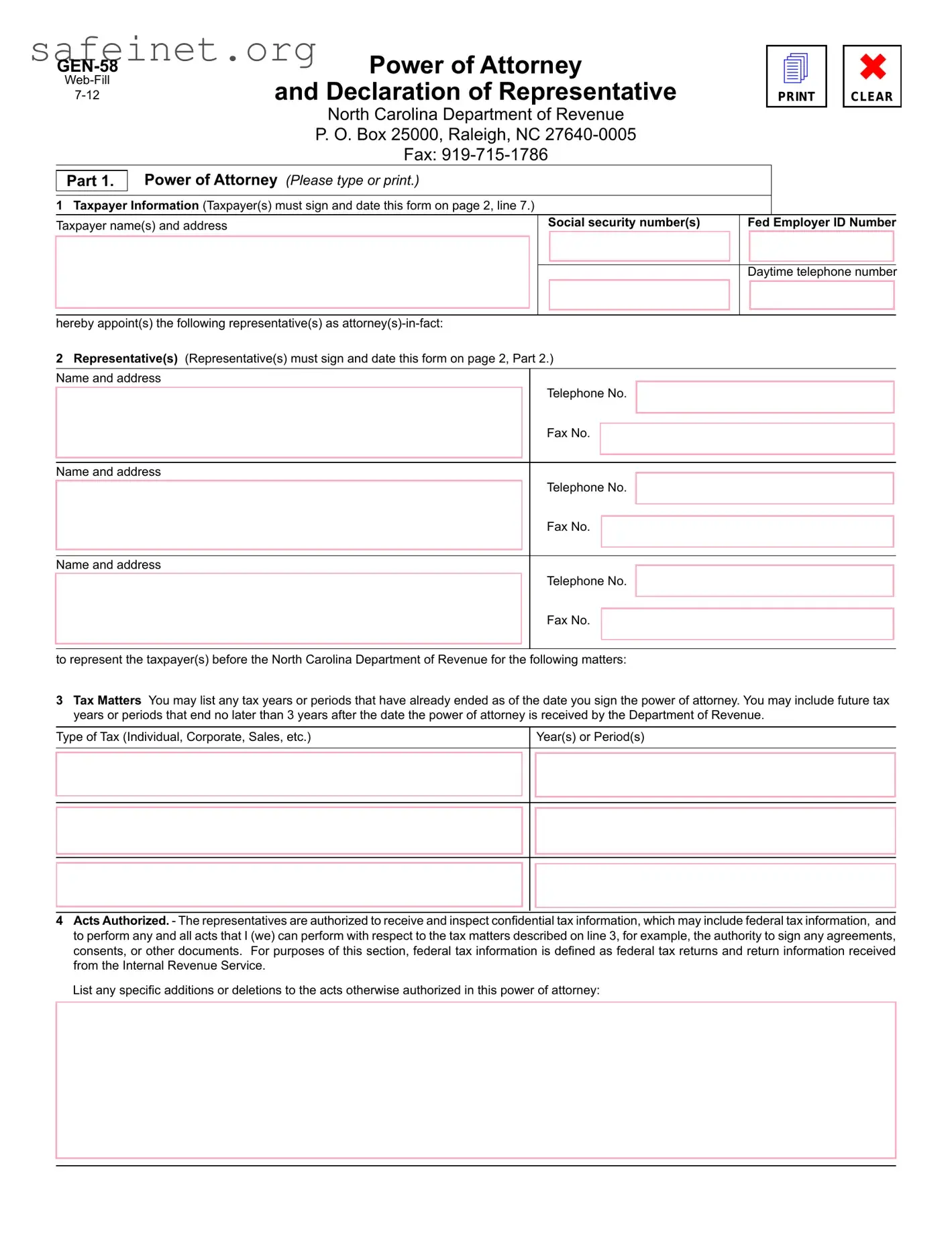

What is the Tax POA gen-58 form?

The Tax POA gen-58 form is a Power of Attorney document specifically used for tax-related matters. This form allows an individual, referred to as the "principal," to designate another person, called the "agent," to act on their behalf in dealings with the IRS or state tax authorities. It grants the agent the authority to handle certain tax matters, such as filing returns, responding to inquiries, and receiving sensitive tax information.

Who can use the Tax POA gen-58 form?

Any individual or business entity who needs assistance with tax matters can use the Tax POA gen-58 form. This includes individuals who may want to authorize a tax professional, such as an accountant or an attorney, to handle their tax affairs. Businesses may also use this form to designate someone to manage tax filings and communications.

How do I complete the Tax POA gen-58 form?

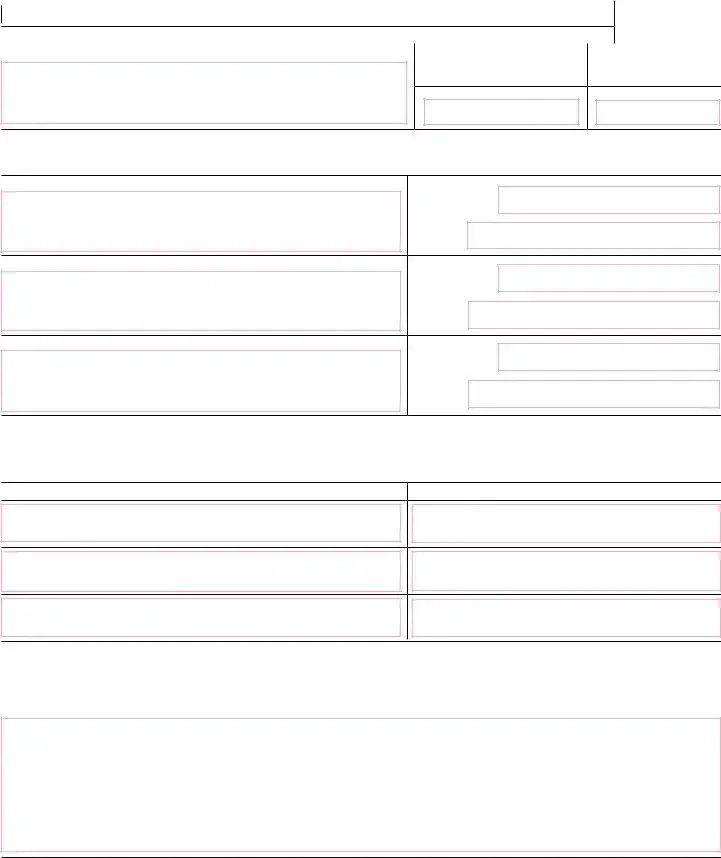

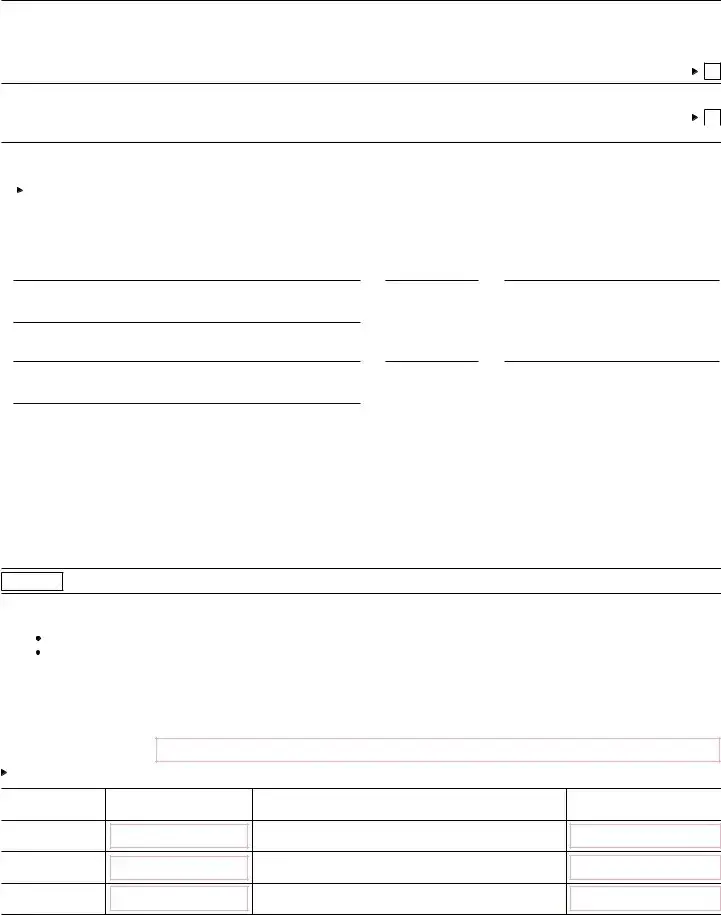

To complete the Tax POA gen-58 form, start by providing your personal information as the principal, including your name, address, and taxpayer identification number (TIN). Next, provide the agent's information, including their name and address. You'll also need to select the specific tax matters and tax years for which you are granting authority. Lastly, sign and date the form to make it official.

Do I need to have my signature notarized?

No, the Tax POA gen-58 form does not require notarization. However, it must be signed by you as the principal. It’s important that all information is accurate to ensure the form is processed correctly.

How does the Tax POA gen-58 form affect my rights?

By using the Tax POA gen-58 form, you grant specific rights to your agent to act on your behalf. This means that the agent can communicate with tax authorities and handle certain tax matters. However, the principal still retains ultimate responsibility for their tax obligations. You can revoke this authority at any time if needed.

What should I do if I want to revoke the Tax POA gen-58 form?

If you wish to revoke the Tax POA gen-58 form, you must submit a written notice of revocation to the agent and the relevant tax authority. This notice should include your name, the agent’s name, and a statement that you are revoking the Power of Attorney. Additionally, submitting another POA form that does not list the agent will also serve to revoke the previous authority.

How long is the Tax POA gen-58 form valid?

The Tax POA gen-58 form remains valid until you revoke it, or until the specific tax matters and years indicated on the form have been resolved. If you choose to cancel the POA or if the agent no longer needs the authority, the form can be terminated at any time.

Can I designate more than one agent using the Tax POA gen-58 form?

The Tax POA gen-58 form allows you to designate one primary agent. However, you can include additional agents if you wish to grant shared authority. It is important to clearly outline the roles each agent will play in the management of your tax matters.

Where can I find the Tax POA gen-58 form?

You can find the Tax POA gen-58 form on the official website of the IRS or state tax authority. It is often available as a downloadable PDF that you can fill out and print. Make sure to use the most recent version of the form to ensure compliance.

Is there a fee associated with filing the Tax POA gen-58 form?

There is typically no fee associated with filing the Tax POA gen-58 form. However, if an agent is a tax professional, they may charge for their services in preparing and submitting the form, as well as for their assistance in handling your tax matters.