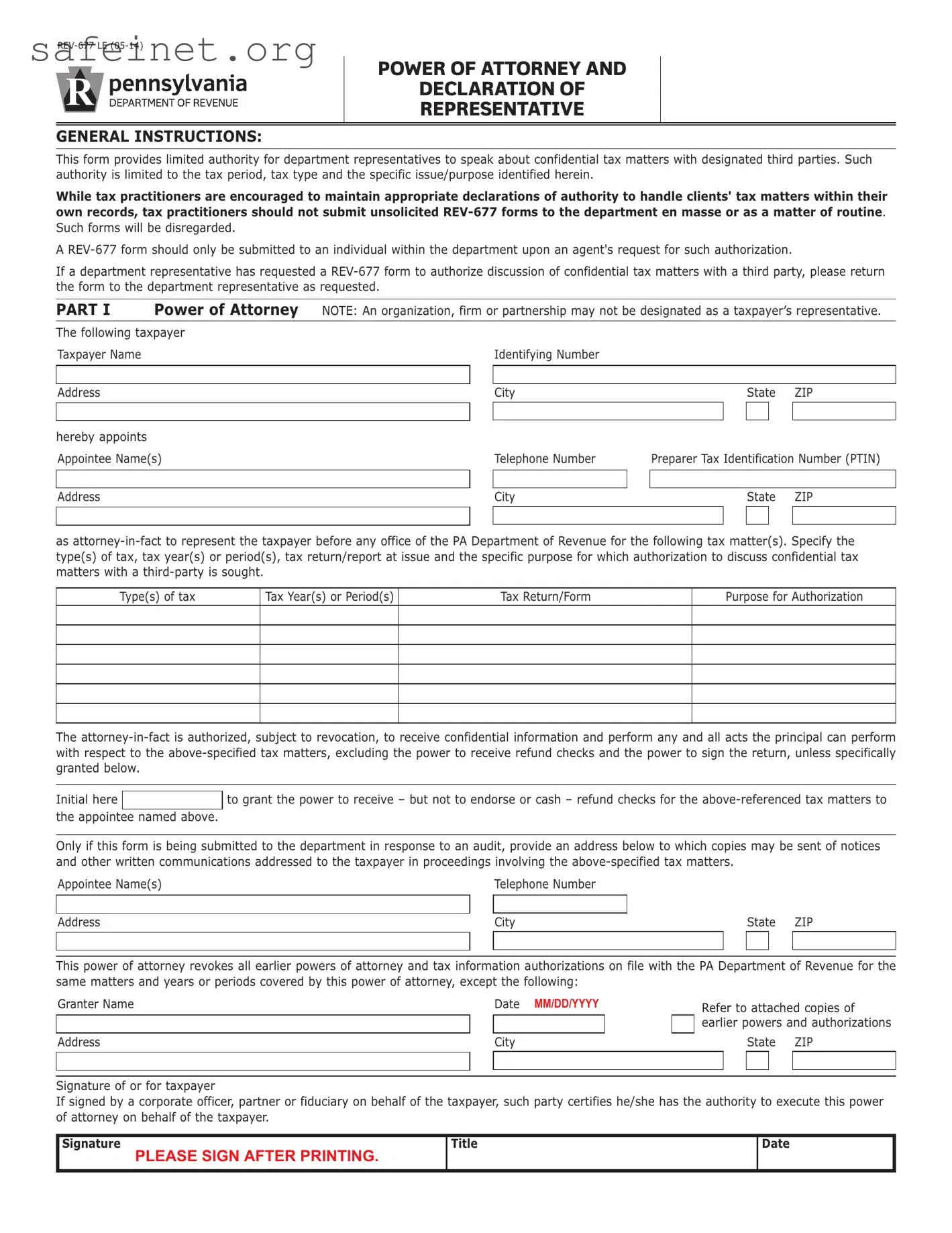

What is a Tax POA form?

A Tax Power of Attorney (POA) form allows an individual to designate another person to act on their behalf concerning tax matters. This can include filing tax returns, accessing tax records, and communicating with the IRS or state tax authorities. It is an essential document for anyone who needs assistance with their tax obligations.

Who can be a representative on a Tax POA form?

The representative can be a family member, friend, or professional, such as an accountant or attorney. There are no specific qualifications required for a family member or friend, while professionals must meet certain criteria to act in that capacity legally.

How do I fill out a Tax POA form?

To fill out a Tax POA form, you need to provide personal information about yourself, including your name, Social Security number, and address. Next, include the details of the person you are granting power of attorney. Finally, you must sign and date the document to make it valid. Ensure that all information is accurate to avoid issues with the IRS or tax authorities.

Do I need to submit the Tax POA form to the IRS?

Yes, after filling out the Tax POA form, you need to submit it to the IRS or your state tax authority, depending on your jurisdiction. This submission formally establishes the representative's authority to act on your behalf in tax matters. Keep a copy of the form for your records.

Can I revoke a Tax POA form?

Yes, you can revoke a Tax POA at any time. To do this, you must provide a written notice to the IRS or state tax authority indicating that you are revoking the power of attorney. It is important to inform the representative as well, especially if they were assisting you with tax matters.

Is a Tax POA form valid in all states?

Generally, a Tax POA form is recognized throughout the United States, given that the document is completed correctly. However, state-specific rules may apply. It’s advisable to check if there are any additional requirements based on your location.

How long does a Tax POA form last?

The Tax POA remains in effect until either you revoke it, the representative resigns, or you pass away. Always keep your document updated to reflect any significant life changes that may affect your tax situation.

What if I need to make changes to the Tax POA form after submission?

If you need to make changes to the Tax POA after submission, you will need to complete a new form that reflects those changes. This may include updating the representative's information or revoking previous authorizations.

Can more than one person be designated as a representative on a Tax POA form?

Yes, you can designate multiple representatives. Each must be identified clearly on the form. However, be aware that allowing multiple individuals to act on your behalf could lead to confusion. Ensure all parties understand their roles to prevent potential conflicts.

What are the consequences of not having a Tax POA form?

Without a Tax POA form, you may struggle to have someone effectively manage your tax matters on your behalf. This could result in missed filings, late payments, or an inability to respond adequately to tax inquiries. It is advisable to establish this form if you anticipate needing assistance with your taxes.

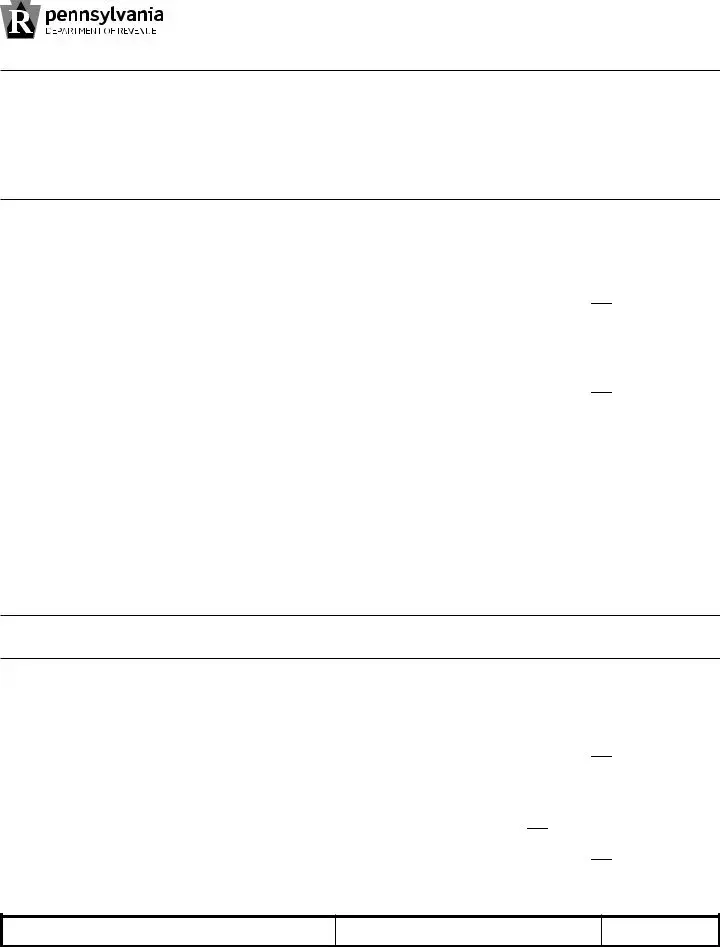

is known to and signed in the presence of the two disinterested witnesses whose signatures appear here:

is known to and signed in the presence of the two disinterested witnesses whose signatures appear here:

appeared this day before a notary public and acknowledged this power of attorney as a voluntary act and deed.

appeared this day before a notary public and acknowledged this power of attorney as a voluntary act and deed.