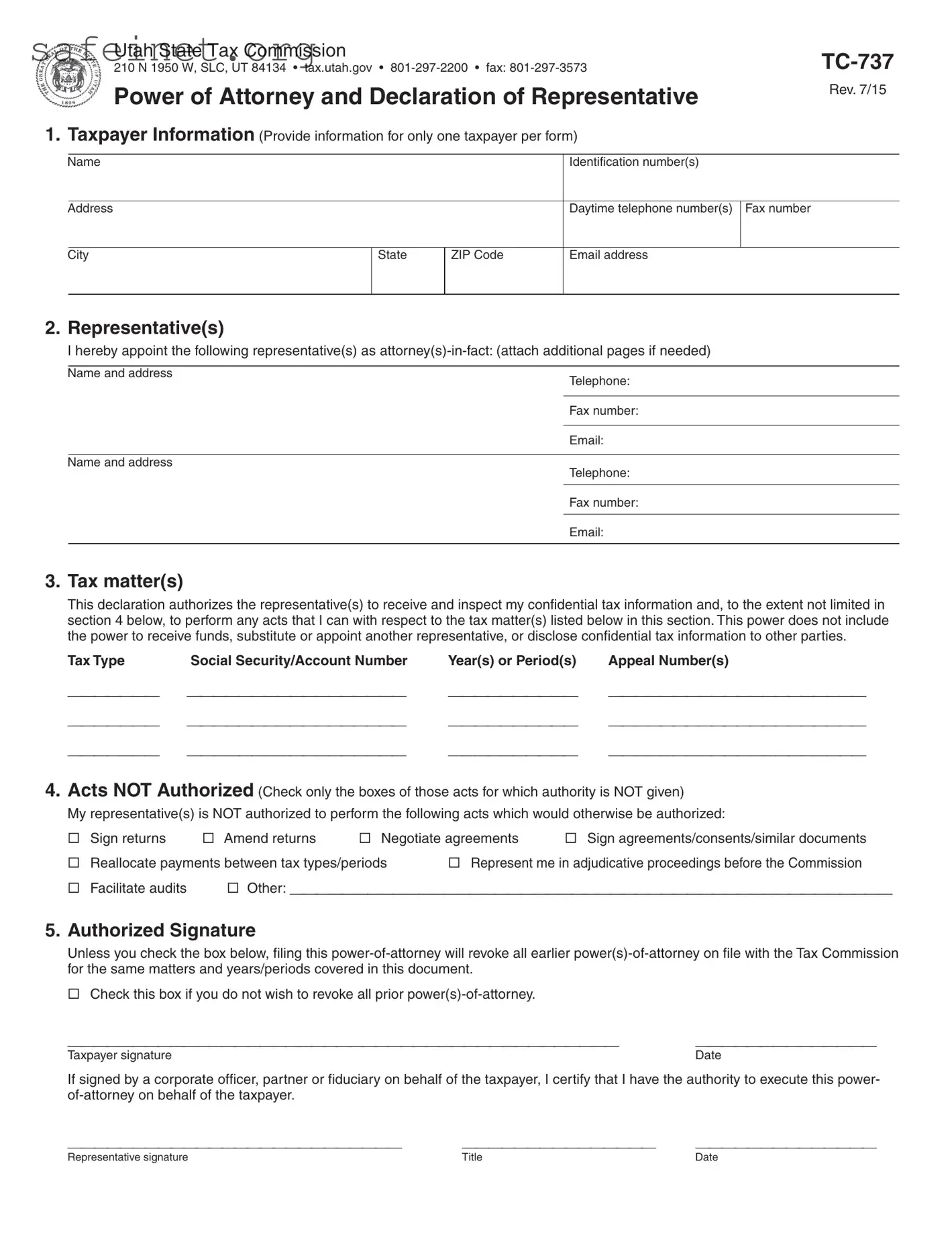

What is the Tax POA form TC-737?

The Tax POA form TC-737, or Power of Attorney, allows an individual to appoint someone else to handle their tax matters on their behalf. This form gives the designated representative the authority to speak with the tax authorities, access tax records, and take actions related to the taxpayer's accounts.

Who can be appointed as a representative using TC-737?

The representative can be a trusted friend, family member, accountant, or attorney. The key is that the person you choose should be knowledgeable about tax matters and trustworthy, as they will have access to sensitive financial information.

How do I fill out the TC-737 form?

You will need to enter your personal information, such as your name, address, and Social Security number. Then, provide the same information for the person you are appointing. Lastly, you must sign and date the form to make it valid.

Is there a fee for submitting the TC-737 form?

Typically, there is no fee for submitting the TC-737 form. However, it is advisable to check with your local tax authority, as procedures and policies can vary by state.

How long does it take for the TC-737 to become effective?

The TC-737 generally becomes effective as soon as the tax authority processes it. This can vary in timeframe depending on the specific tax agency's workload, so it's best to submit the form well in advance of any deadlines.

Can I revoke a Power of Attorney submitted on the TC-737?

Yes, you can revoke the Power of Attorney at any time by submitting a new form that clearly states your intention to revoke the previous authorization. Make sure the new document is properly signed and dated.

What if I need to make changes to the TC-737 form after submitting it?

If changes are needed, you should submit a new TC-737 form with the updated information. It's essential to clearly indicate that this new form replaces the previous one. Communicating this to the tax authorities can prevent confusion.

Can I use the TC-737 form for corporate tax matters?

The TC-737 form is primarily designed for individual taxpayers. If you need to appoint a representative for a business, you may need to use a different form specific to corporate tax matters. Check with the relevant tax authority for guidance.

What happens if my representative makes a mistake?

If your representative makes a mistake, you may still be held liable for any tax obligations. It's essential to choose a knowledgeable representative to avoid potential issues. You may want to periodically review their actions to ensure everything is handled correctly.

How can I check the status of the TC-737 after submission?

To check the status of your submission, it's best to contact the tax authority directly. Provide them with the relevant identification details so they can assist you. They will let you know whether your form has been processed and if your representative has the authority to act on your behalf.