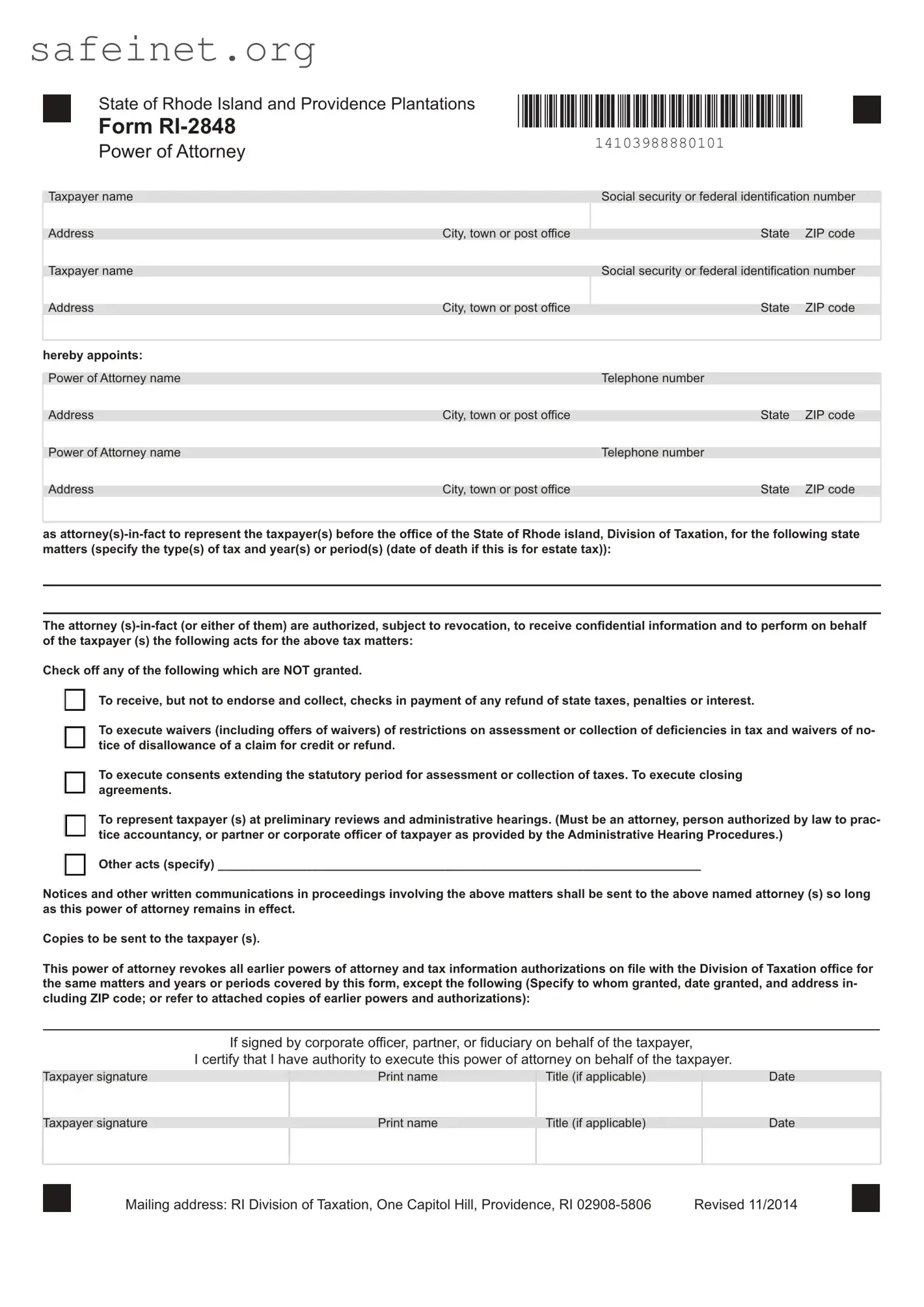

What is the RI-2848 form?

The RI-2848 form is a Power of Attorney (POA) document specifically for tax purposes in Rhode Island. It allows you to designate an individual or organization to represent you before the Rhode Island Division of Taxation regarding your tax matters.

Who should use the RI-2848 form?

This form is suitable for anyone who needs assistance with their Rhode Island taxes. Individuals, business owners, and entities seeking help from a tax professional can benefit from appointing an authorized representative through this form.

How do I complete the RI-2848 form?

To fill out the RI-2848 form, provide your contact information, the representative’s details, and specify the tax matters for which the authorization applies. It’s essential to ensure all sections are completed accurately to avoid delays in processing.

Do I need to file the RI-2848 form with the state?

Once completed, the RI-2848 form does not need to be filed with the state. Instead, it should be given to your representative, who will present it as needed when communicating with the tax authority on your behalf.

Can I revoke the RI-2848 form?

Yes, you can revoke the RI-2848 form at any time. To do so, complete a new form indicating the revocation, or submit a written statement to the Rhode Island Division of Taxation specifying your intent to cancel the authorization.

Is there a fee for using the RI-2848 form?

No fee is associated with completing and submitting the RI-2848 form. However, if you hire a tax professional to assist you, they may charge for their services.

How long does the RI-2848 authorization last?

The authorization granted through the RI-2848 form remains valid until revoked by you, or until the scope of the tax matters is completed. Always check with your tax representative for specific details related to your situation.

Can I change my representative after submitting the form?

Yes, you can change your representative. You will need to fill out a new RI-2848 form designating a new representative, effectively superseding any previous designations.

What should I do if I have more questions about the RI-2848 form?

If you have more questions, consider contacting the Rhode Island Division of Taxation directly. They can provide guidance specific to your situation and help clarify any uncertainties regarding the form.

Where can I obtain the RI-2848 form?

The RI-2848 form is available on the Rhode Island Division of Taxation’s website. You can download the form, print it, and fill it out easily. Ensure you have the most current version for your use.