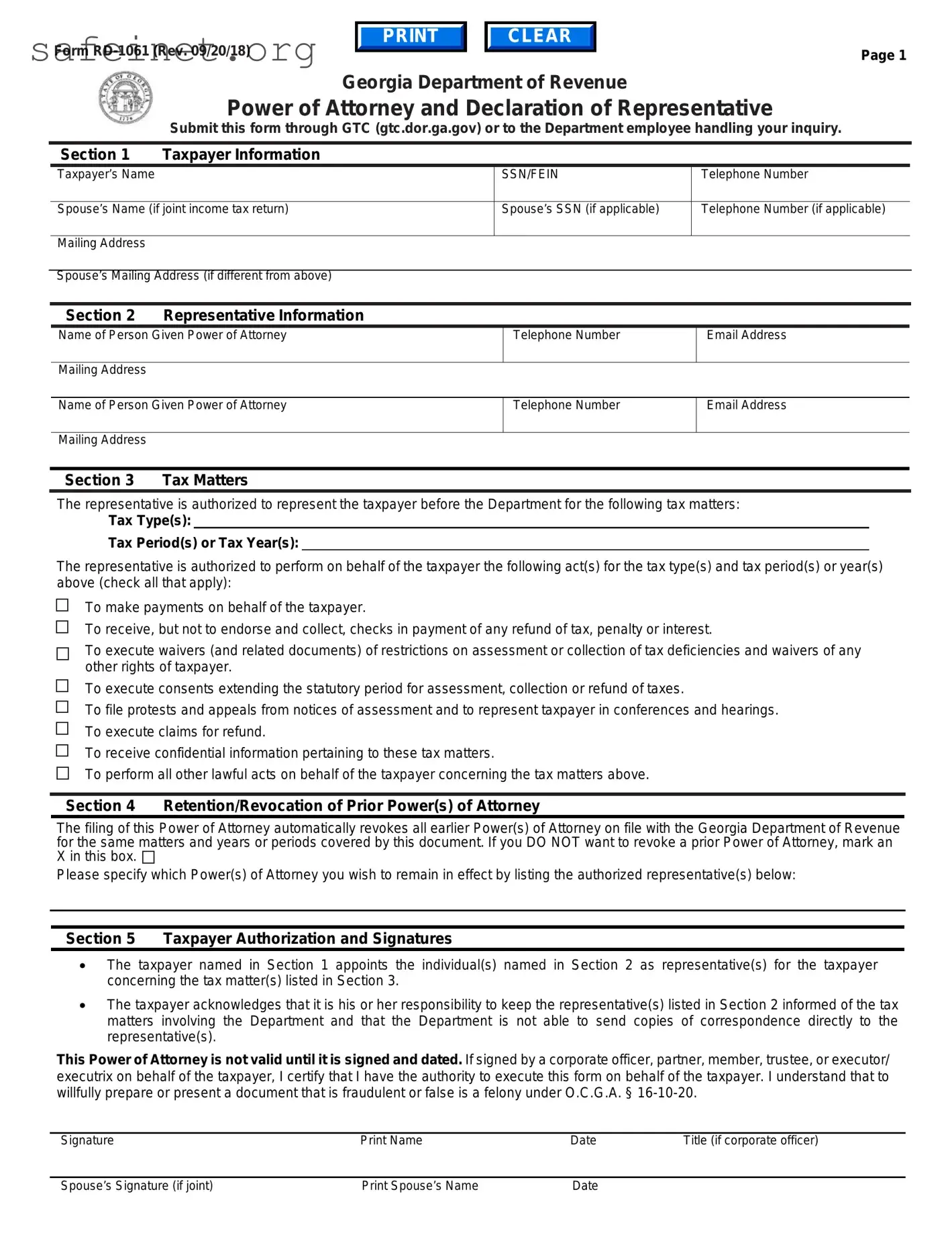

Form RD-1061 (Rev. 09/20/18)

Georgia Department of Revenue

Power of Attorney and Declaration of Representative

Submit this form through GTC (gtc.dor.ga.gov) or to the Department employee handling your inquiry.

Section 1 |

Taxpayer Information |

|

|

|

Taxpayer’s Name |

|

SSN/FEIN |

Telephone Number |

|

|

|

|

|

Spouse’s Name (if joint income tax return) |

Spouse’s SSN (if applicable) |

Telephone Number (if applicable) |

Mailing Address

Spouse’s Mailing Address (if different from above)

Section 2 Representative Information

Name of Person Given Power of Attorney

Mailing Address

Name of Person Given Power of Attorney

Mailing Address

The representative is authorized to represent the taxpayer before the Department for the following tax matters:

Tax Type(s):

Tax Period(s) or Tax Year(s):

The representative is authorized to perform on behalf of the taxpayer the following act(s) for the tax type(s) and tax period(s) or year(s) above (check all that apply):

To make payments on behalf of the taxpayer.

To receive, but not to endorse and collect, checks in payment of any refund of tax, penalty or interest.

To execute waivers (and related documents) of restrictions on assessment or collection of tax deficiencies and waivers of any other rights of taxpayer.

To execute consents extending the statutory period for assessment, collection or refund of taxes.

To file protests and appeals from notices of assessment and to represent taxpayer in conferences and hearings.

To execute claims for refund.

To receive confidential information pertaining to these tax matters.

To perform all other lawful acts on behalf of the taxpayer concerning the tax matters above.

Section 4 Retention/Revocation of Prior Power(s) of Attorney

The filing of this Power of Attorney automatically revokes all earlier Power(s) of Attorney on file with the Georgia Department of Revenue for the same matters and years or periods covered by this document. If you DO NOT want to revoke a prior Power of Attorney, mark an X in this box.

Please specify which Power(s) of Attorney you wish to remain in effect by listing the authorized representative(s) below:

Section 5 Taxpayer Authorization and Signatures

•The taxpayer named in Section 1 appoints the individual(s) named in Section 2 as representative(s) for the taxpayer concerning the tax matter(s) listed in Section 3.

•The taxpayer acknowledges that it is his or her responsibility to keep the representative(s) listed in Section 2 informed of the tax matters involving the Department and that the Department is not able to send copies of correspondence directly to the representative(s).

This Power of Attorney is not valid until it is signed and dated. If signed by a corporate officer, partner, member, trustee, or executor/ executrix on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer. I understand that to willfully prepare or present a document that is fraudulent or false is a felony under O.C.G.A. § 16-10-20.

Signature |

Print Name |

Date |

Title (if corporate officer) |

Spouse’s Signature (if joint) |

Print Spouse’s Name |

Date |

|

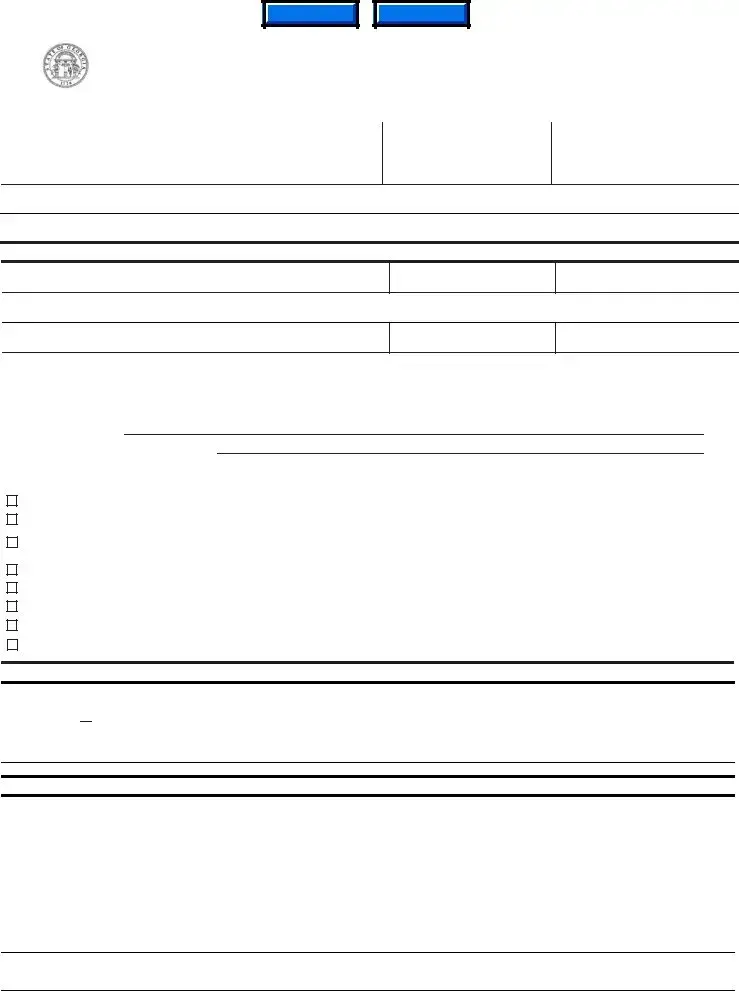

Form RD-1061 (Rev. 09/20/18)/18) |

Page 2 |

Section 6 Acknowledgment of the Power of Attorney

This Power of Attorney must be acknowledged by the taxpayer before a notary public, unless the appointed representative(s) is licensed to practice as an attorney-at-law, certified public accountant, registered public accountant, or is enrolled as an agent to practice before the Internal Revenue Service. If the appointed representative(s) is licensed to practice as an attorney-at-law, certified public accountant, registered public accountant, or is enrolled as an agent to practice before the Internal Revenue Service, skip Section 6 and continue to Section 7.

Acknowledgement of Power of Attorney. The person(s) signing as the taxpayer in Section 5 above appeared this day before a notary public and acknowledged this Power of Attorney as a voluntary act and deed.

Sworn and subscribed before me this __________ day of ______________________, 20_______.

Signature of Notary

Section 7 Declaration of Representative

Under penalties of perjury, I declare that:

• I am authorized to represent the taxpayer identified in Section 1 for the matter(s) specified in Section 3 of this form; and

•I am one of the following (indicate all thatapply):

1.An attorney-at-law licensed to practice in and a member in good standing of the Bar of the jurisdiction indicated below.

2.A certified public accountant duly qualified to practice in the jurisdiction indicated below.

3.Enrolled as an agent to practice before the Internal Revenue Service under the requirements of Circular 230.

4.A registered public accountant.

Designation – use number(s) from above list

(1 - 4)

Licensing jurisdiction (state) or other licensing authority (if applicable)

Bar, license, certification,

registration, or enrollment number

Form RD-1061 (Rev. 09/20/18)/18) |

Page 3 |

Purpose of Form

A taxpayer may use Form RD-1061 to authorize an individual or individuals to represent the taxpayer before the Georgia Department of Revenue, to discuss and/or access confidential information, and to perform certain acts on behalf of the taxpayer for certain tax matters and periods. This Power of Attorney (POA) only authorizes the listed representative(s) to perform the acts indicated in this Form RD-1061. Representatives are not authorized to endorse or otherwise negotiate any check (including accepting payment by any means) issued by the Department. However, the representative(s) may make payments on behalf of the taxpayer if specifically authorized on the Form RD-1061.

Filing Instructions

Taxpayers should submit Form RD-1061 by uploading through Georgia Tax Center (GTC) (gtc.dor.ga.gov) or by sending to the Department employee handling your inquiry.

To upload to GTC: (1) Login, (2) Under “I Want To” select “See More Links”, (3) Select “Submit Power of Attorney", and (4) Follow the prompts to upload the Form RD-1061.

Revocation

If you have a valid Form RD-1061 on file with the Department, the filing of a new Form RD-1061 revokes the authority of the prior representative for the same matters and periods covered by the new Form RD-1061 unless Section 4 is completed. The prior representative is still an authorized representative and retains any previously granted authority for the matters and periods not covered by the new Form RD-1061 unless specifically revoked.

If the taxpayer or representative merely wants to revoke an existing authorization, upload a copy of the previously executed Form RD-1061 on GTC with “REVOKE” clearly written on the form. If you do not have a copy of the authorization you want to revoke, upload a statement of revocation to GTC. The statement of revocation must indicate the name of each representative whose authority is revoked. To upload a revocation on GTC follow the same steps outlined above.

Specific Instructions

Section 1 – Taxpayer Information

Enter the name, address, and contact information of the taxpayer. If the taxpayer is an individual, enter the full Social Security number (SSN). If the taxpayer is a business entity, enter the Federal Employer Identification Number (FEIN). If the taxpayer is granting access to a joint return, enter the spouse’s name, address, and full SSN.

Section 2 – Representative Information

Enter the representatives’ names, addresses and any applicable contact information. A representative must be an individual, not a business entity. If designating authority to more than two representatives, please attach a schedule similar in form to Section 2 signed by the taxpayer.

Section 3 – Tax Matters

Enter the tax type(s) and specific period(s) or year(s) for which the authorization is being granted. The Department will only discuss and/or disclose taxpayer information for the type(s) and period(s) listed. Notices and communications will be sent to the taxpayer, not the representative. The representative may access copies of taxpayer notices and communications via third party access to the taxpayer’s account through GTC.

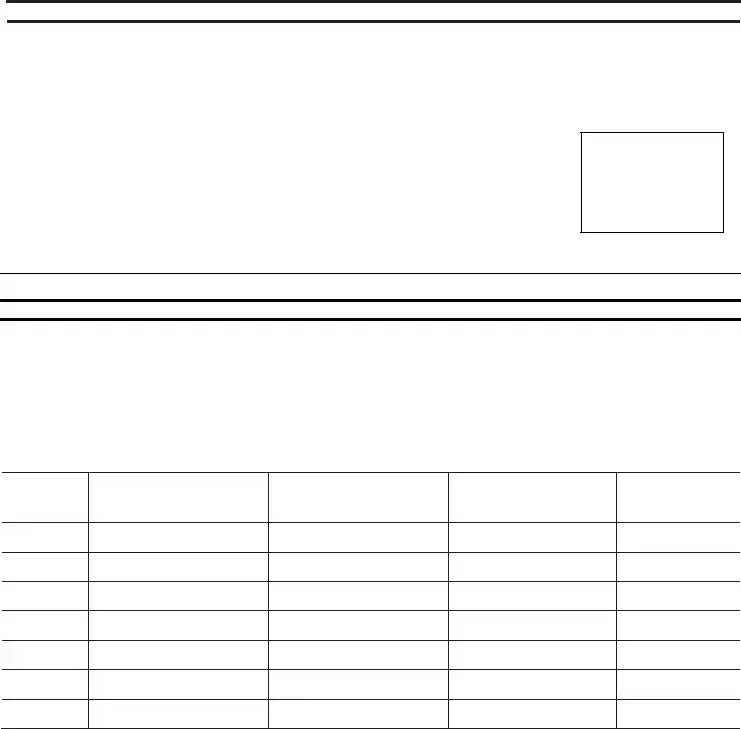

Form RD-1061 (Rev. 09/20/18)/18) |

Page 4 |

Section 4 – Retention/Revocation of Prior Power(s) of Attorney

All existing Form RD-1061s effective for the same matters and periods covered by this document previously filed by the taxpayer will be revoked unless the taxpayer checks the box on this line. If the taxpayer checks this box, the taxpayer must list the representative(s) previously authorized whose Form RD-1061 they wish to remain in effect. If you check the box, but do not specify a previously authorized representative, all existing Form RD-1061s will remain in effect.

Section 5 – Taxpayer Authorization and Signature

The taxpayer must sign in Section 5 for Form RD-1061 to be effective. The table below shows who should sign for each type of taxpayer:

|

Taxpayer |

Who Must Sign |

|

|

|

|

Individuals |

The individual/sole proprietor must sign (if granting access to a joint return, |

|

spouse must also sign). |

|

|

|

Corporations |

A corporate officer with authority to sign. |

|

|

|

|

Partnerships |

A partner having authority to act in the name of the partnership must sign. |

|

|

|

|

Limited Liability |

A member having authority to act in the name of the company must sign. |

|

Companies |

|

|

|

Trusts |

A trustee must sign. |

|

|

|

|

Estates |

An executor/executrix or the personal representative of the estate must sign. |

|

|

|

Section 6 – Acknowledgment of the Power of Attorney

This POA must be acknowledged by the taxpayer before a notary public, unless an appointed representative is an attorney-at-law, certified public accountant, registered public accountant, or is enrolled as an agent to practice before the Internal Revenue Service. If an appointed representative is an attorney-at-law, certified public accountant, registered public accountant, or is enrolled as an agent to practice before the Internal Revenue Service, then Section 7 should be filled out completely instead of Section 6, which may be left blank.

Section 7 – Declaration of Representative

If an appointed representative is licensed to practice as an attorney-at-law, certified public accountant, registered public accountant, or is enrolled as an agent to practice before the Internal Revenue Service, then they may fill out Section 7 in lieu of being acknowledged by a public notary in Section 6.