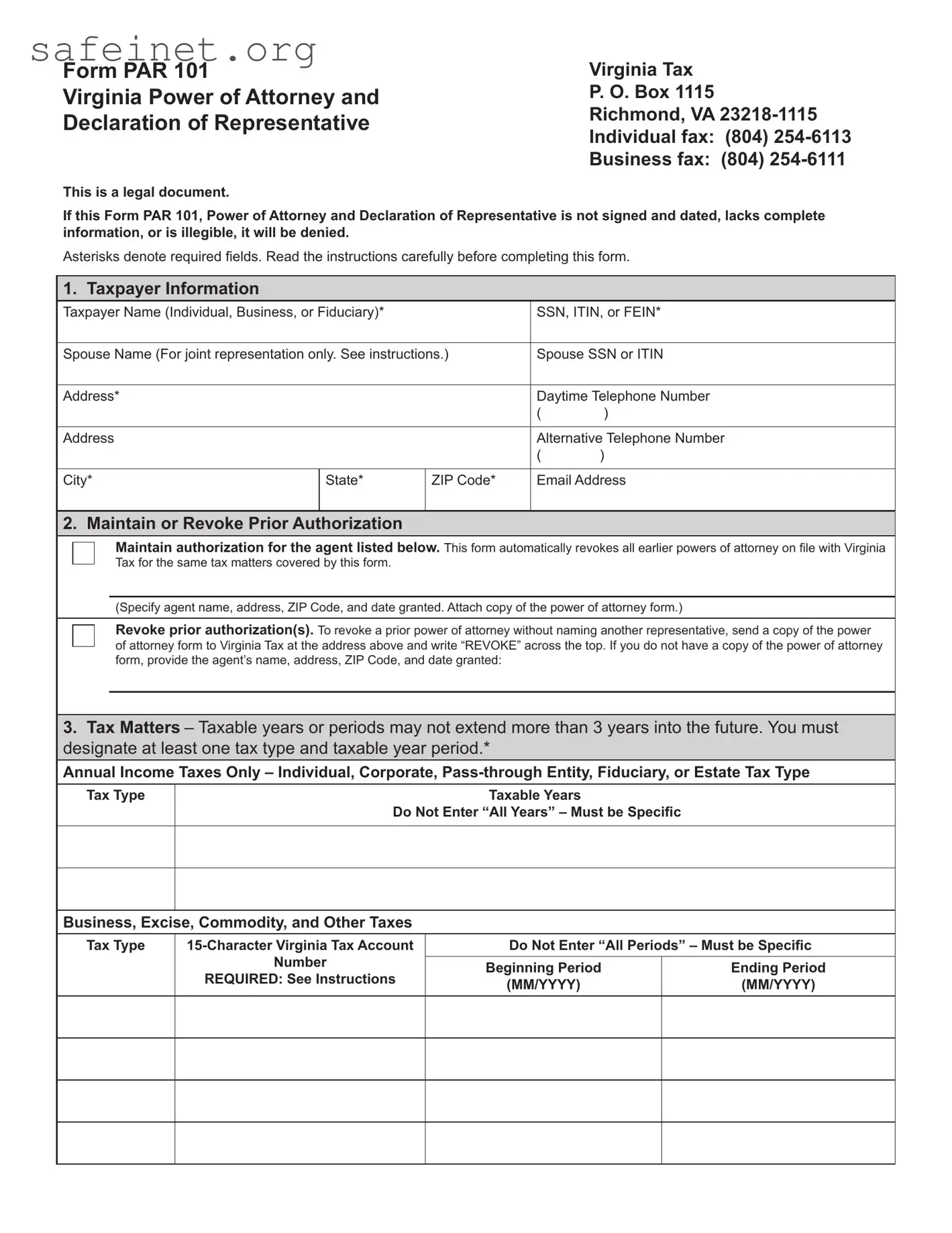

Section 3 - Tax Matters

Be specific. You should only grant a person your power of attorney for taxable periods for which you have a tax matter.

You may specify taxable periods no more than 3 years into the future. Future periods are determined starting after Dec. 31 of the year in which we receive Form PAR 101. You may list the current taxable year or period and any taxable years or periods that have already ended as of the date you sign Form PAR 101.

Annual Income Taxes - If the tax matter involves individual, corporate, pass-through entity, or fiduciary income tax, enter the name of the tax under “Tax Type.” Also use this section for composite/unified filing tax matters. If the tax matter involves estate tax or inheritance tax for a taxpayer whose date of death was prior to July 1, 2007, enter the date of death of the taxpayer in the taxable year field.

Business, Excise, Commodity, and Other Taxes - You must enter the tax type and the beginning and ending periods covered by this form. For each tax type, you must also provide your assigned 15-character Virginia Tax Account Number. If you have multiple locations, be sure to list the account number for each location. If you do not enter your account number(s), the form will be returned.

Exceptions - For the following tax types, leave the Virginia Tax Account Number field blank: Apple Excise Tax, Bank Franchise Tax, and Rolling Stock Tax on Railroads and Freight Car Companies.

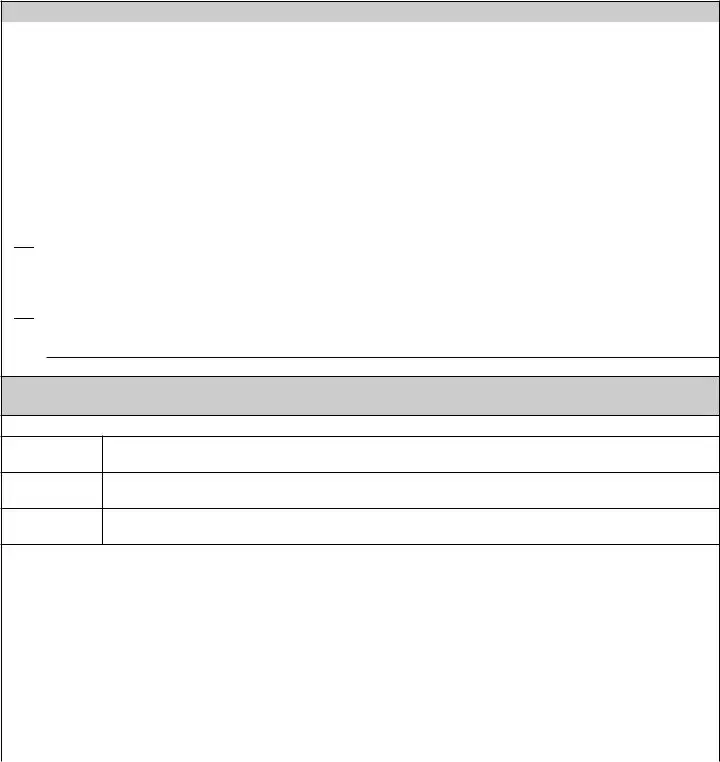

Section 4 - Authorized Agent/Representative Information

You must provide complete information for each representative listed on the form. You cannot name a business as your representative. Your representative must be a person. In addition, each representative must sign and date the form. The signature must be an actual signature and cannot be an electronic signature or rubber stamp.

Virginia Tax will automatically mail copies of all outgoing correspondence sent to you regarding the tax matters listed in Section 3 to your Authorized Agent provided that:

•Your Authorized Agent is registered with Virginia Tax, and

•You provide the Authorized Agent’s number, a unique 9-character identification number assigned by us that begins with “A.”

Virginia Tax will not automatically mail correspondence to your Authorized Agent in the following situations:

•You do not provide your Authorized Agent’s number, or

•You check the box indicating that you do not want correspondence automatically mailed to your Authorized Agent.

We will automatically mail copies of secure email to your Authorized Agent if you have opted to have copies of email communications sent to your agent.

Taxpayers may use secure email to discuss specific questions related to their account. The authorized representative(s) will receive copies of this secure email communication through the U.S mail. To use secure email on Virginia Tax’s website at www.tax.virginia.gov, log in to iFile (business or individual) or iReg, select Secure Message to send and receive secure email.

To register as an Authorized Agent, your representative must submit Virginia Form R-7. If Form R-7 is submitted with Form PAR 101, enter “Applied For” in the Registered Authorized Agent Number field. Form R-7 is available at

www.tax.virginia.gov.

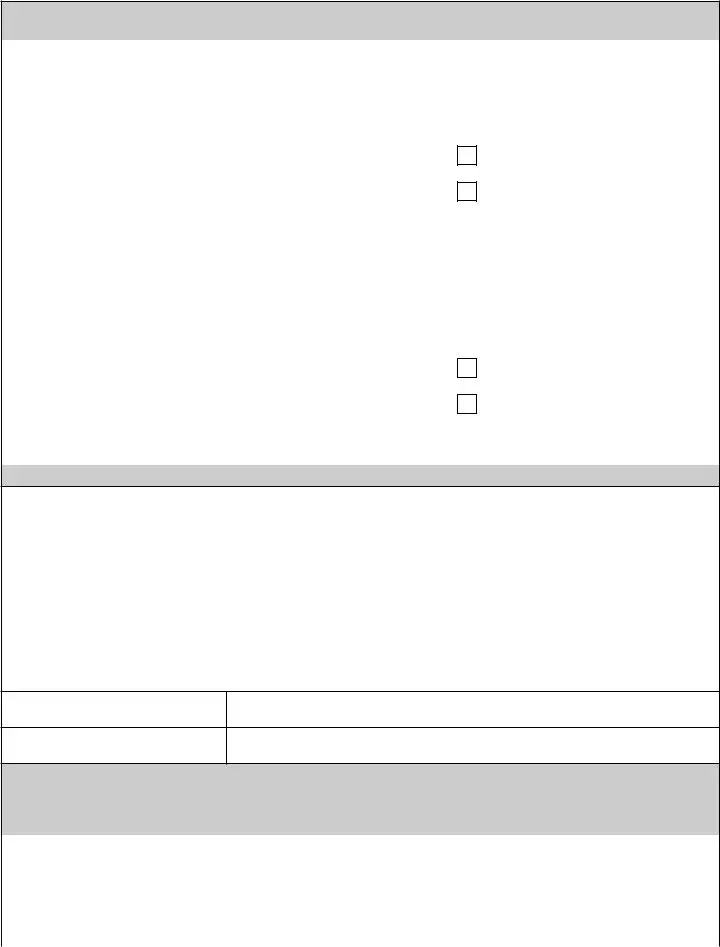

Sections 5 and 6 - Signature of Taxpayer(s),

Acknowledgment of Authorized Acts, and

Representative Signature

Individuals - You must sign and date the form. If the tax matter involves a joint return and you and your spouse are designating the same Authorized Agent(s), your spouse must also sign and date the form.

Corporations or Associations - An officer having authority to bind the taxpayer must sign and date the form.

Partnerships - All partners should sign unless only one partner is authorized to act in the name of the partnership. A partner is authorized to act in the name of the partnership if, under state law, the partner has authority to bind

the partnership. A copy of such authorization should be attached. For dissolved partnerships, see 26 CFR 601.503(c)(6).

All others - If the taxpayer is a dissolved corporation, decedent, insolvent, or a person for whom or by whom a fiduciary (a trustee, guarantor, receiver, executor, or administrator) has been appointed, see 26 CFR 601.503(d).

The representative(s) must sign and date the form.

Note - Generally, the taxpayer signs first, granting the authority and then the Authorized Agent signs, accepting the authority granted. The date for both the taxpayer and the representative must be within 45 days for domestic authorizations and within 60 days for authorization from taxpayers residing abroad. If the taxpayer signs last, then there is no timeframe requirement.

All signatures on the form must be actual and cannot be electronic or rubber stamps.

* * * * *

Mail or fax the completed form and enclosures to:

Virginia Tax

P.O. Box 1115

Richmond, Virginia 23218-1115

Business fax: (804) 254-6111

Individual fax: (804) 254-6113

For individual assistance call: (804) 367-8031

For business assistance call: (804) 367-8037