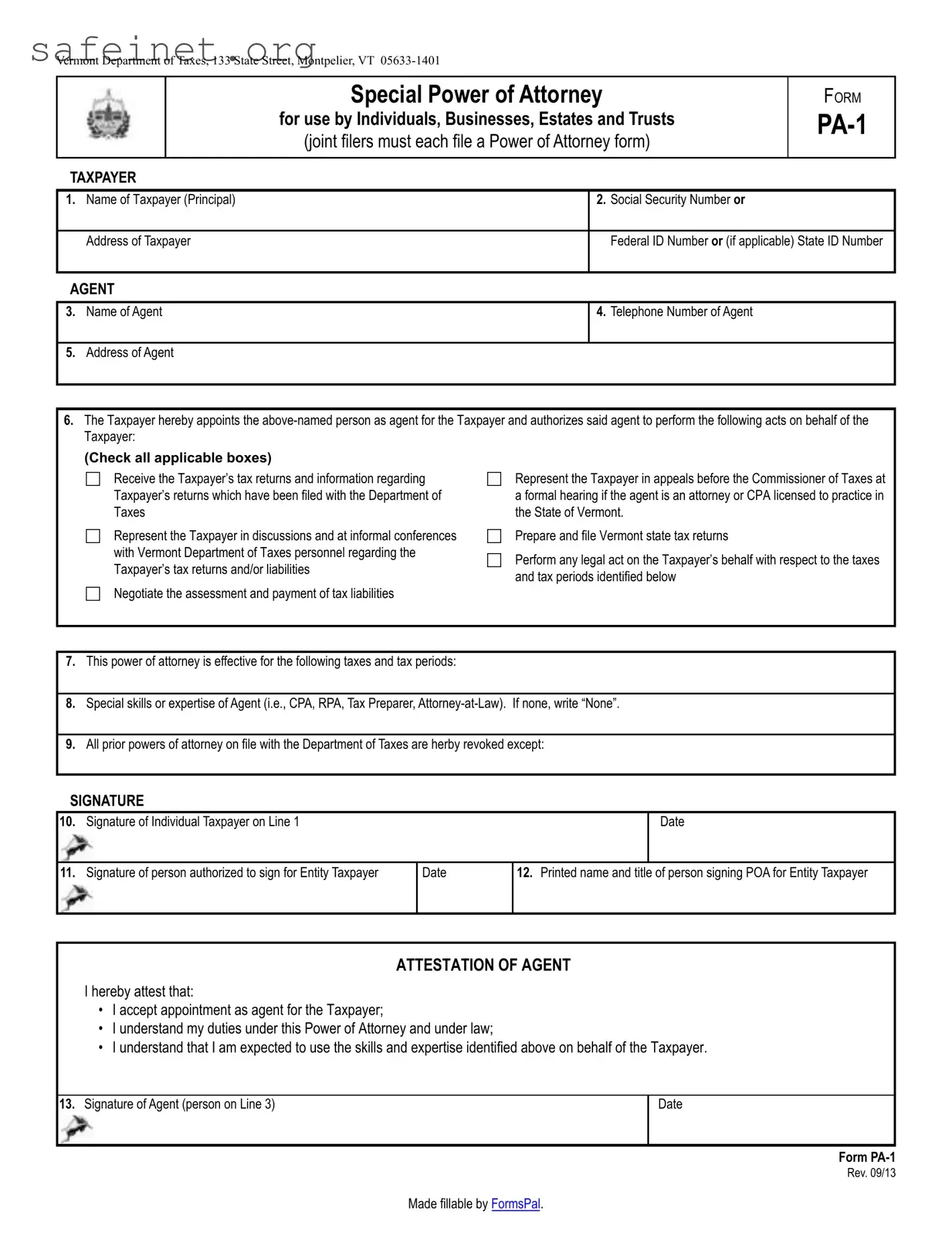

What is the Tax POA Form PA-1?

The Tax POA Form PA-1 is a Power of Attorney form specifically designed for taxpayers in Pennsylvania. This form allows you to designate another individual, such as a family member or a tax professional, to act on your behalf in tax matters concerning the Pennsylvania Department of Revenue. By granting this authority, you enable your representative to communicate with the tax authorities and make decisions regarding your tax situation.

Who can be appointed as my representative?

You can choose any individual as your representative as long as they are not disqualified by the Pennsylvania Department of Revenue. Typically, people select tax preparers, accountants, lawyers, or trusted family members. Just ensure that the person you appoint is willing to accept this responsibility and is knowledgeable about your tax issues.

How do I fill out the PA-1 form?

To complete the PA-1 form, you'll need to provide basic information such as your name, address, Social Security number or EIN, and details about the person you are appointing. You will also specify the scope of the authority you are granting and sign the form to confirm your decision. Pay attention to the instructions included with the form for guidance on each section.

Is there a fee to file the PA-1 form?

There is no fee associated with filing the PA-1 form. This form is designed to facilitate efficient communication between you and the Pennsylvania Department of Revenue. Therefore, you can submit it without incurring any costs.

Where should I send the completed PA-1 form?

Once you have completed and signed the PA-1 form, you can submit it to the Pennsylvania Department of Revenue. Generally, you can send the form by mail or, in certain cases, submit it electronically through the department's online services. Check the Pennsylvania Department of Revenue’s official website for the most current submission options and addresses.

How long does it take for the PA-1 form to be processed?

Processing times can vary based on the current workload of the Pennsylvania Department of Revenue. Typically, it may take anywhere from a few days to several weeks for the department to process your submitted PA-1 form. Once processed, you and your representative will receive confirmation of the authorization.

Can I revoke the POA once it is granted?

Yes, you have the right to revoke the Power of Attorney at any time. To do this, you must submit a written notice of revocation to the Pennsylvania Department of Revenue. It’s best to inform your representative as well, so they are aware that their authority has been terminated.

What should I do if my representative and I disagree about tax matters?

If a disagreement arises between you and your appointed representative, it's important to communicate openly. You can also choose to revoke their authority using the process outlined earlier. If necessary, you might consider consulting a different professional or contacting the Pennsylvania Department of Revenue for guidance on your specific situation.

Do I need to attach any additional documents with the PA-1 form?

In most cases, you do not need to attach any documents when submitting the PA-1 form. However, if your tax situation is particularly complex or involves additional forms, it might be helpful to include any relevant documentation. Refer to the form's instructions for any specifics regarding additional attachments.