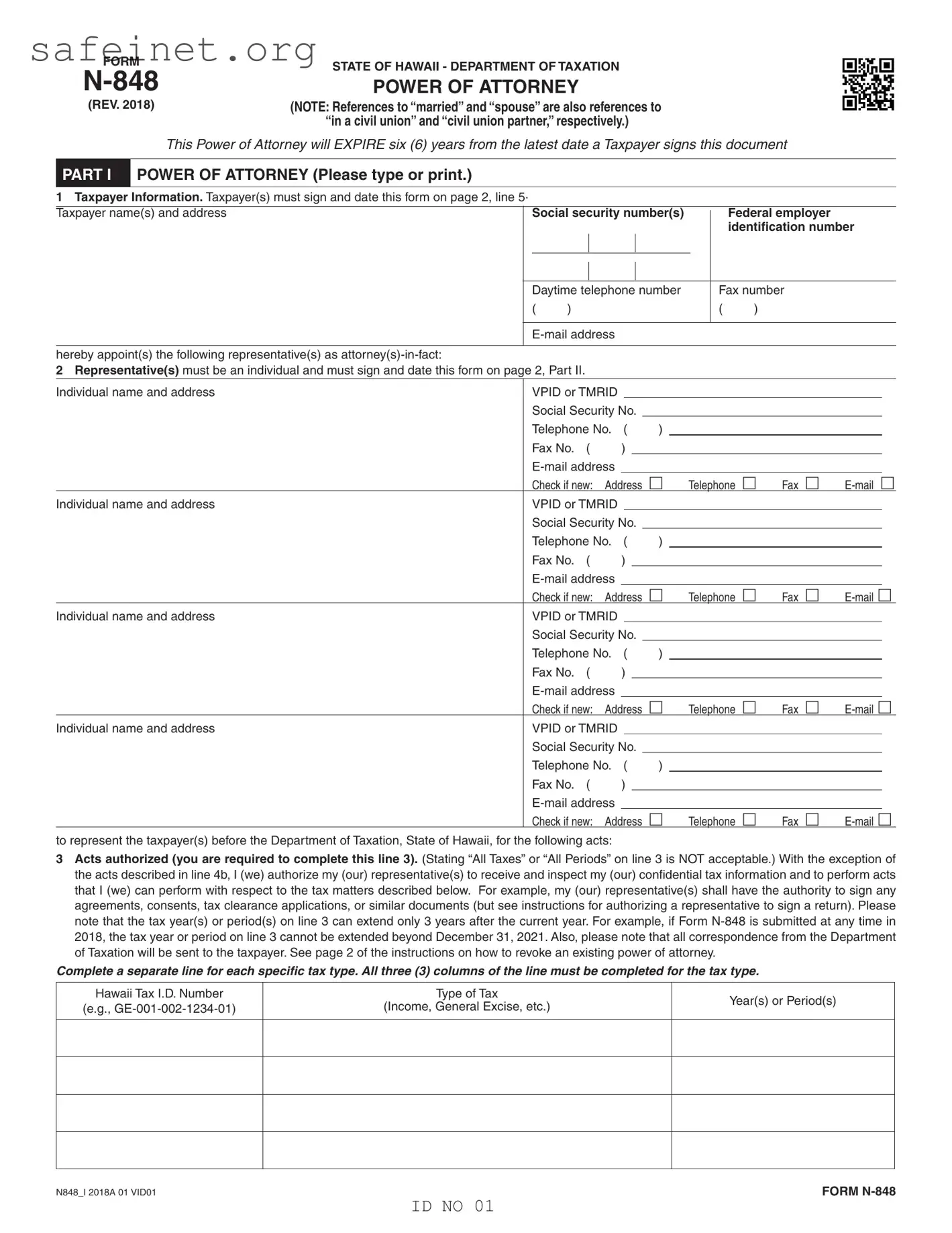

The IRS Form 2848 is known as the Power of Attorney and Declaration of Representative. Like the Tax POA form N848, this document allows taxpayers to authorize an individual to represent them before the IRS. It grants the designated representative the power to receive confidential tax information and provide assistance regarding tax matters. Both forms serve the same essential purpose, empowering an agent to act on behalf of the taxpayer in communications with tax authorities.

Form 8821, Tax Information Authorization, is another document that shares similarities with the Tax POA form N848. This form allows you to designate an individual to receive certain tax information from the IRS. While it does not grant representation rights like a POA, it enables the authorized individual to access the taxpayer's records. This provides insight into the taxpayer's affairs without full representation rights, thus serving a slightly different but related function.

The State Power of Attorney forms, which are often used in various states, are quite similar to the Tax POA form. These forms allow individuals to appoint someone to handle different matters, including tax issues, on their behalf at the state level. Each state may have specific requirements and variations, but the fundamental concept of granting authority remains consistent with the N848 form.

Financial Power of Attorney documents allow individuals to authorize a trusted person to manage their financial affairs. While these forms can encompass a wider range of financial matters, they can also address tax liabilities and filings. Similar to the Tax POA form N848, a Financial Power of Attorney ensures that someone can act in the taxpayer's best interest and handle their obligations efficiently.

Durable Power of Attorney forms are similar in that they allow an agent to act on behalf of the principal even if the principal becomes incapacitated. This arrangement can cover various aspects, including tax responsibilities. Thus, like the N848 form, these durable documents ensure that tax matters are addressed continuously, even in challenging times.

Health Care Power of Attorney documents, while primarily focused on medical decisions, can share procedural similarities with the Tax POA form N848. In both instances, individuals appoint someone to act on their behalf. Although the primary focus is different, both forms require explicit consent and can involve sensitive information, showcasing the necessity of trust in both situations.

Form 201, the Business Power of Attorney, serves as a means for business owners to appoint someone to handle business affairs, including tax matters. This form, like the Tax POA form N848, allows individuals to grant authority for someone to act in their name regarding business taxes. Understanding both forms helps clarify representation options whether for personal or business tax affairs.

Form 4506, Request for Copy of Tax Return, allows taxpayers to authorize someone else to obtain copies of their tax returns from the IRS. Though it's distinct from the Tax POA form N848, it also requires an individual to designate a representative. The two documents facilitate access to tax documents but differ in the scope of authority granted.

Form 8962, Premium Tax Credit, While primarily used to claim a tax credit related to health insurance premiums, it can require an authorization similar to that of the N848 form. Taxpayers may need to appoint individuals to assist with this process, thus showing how tax-related forms can intersect in support of a specific financial benefit.

Lastly, Form W-9, Request for Taxpayer Identification Number and Certification, allows individuals to authorize another party to access their tax identification information. Though focusing on information collection rather than representation, it shares the commonality of requiring explicit consent and trust in the appointed party, akin to the Tax POA form N848.