IDAHO

State Tax Commission

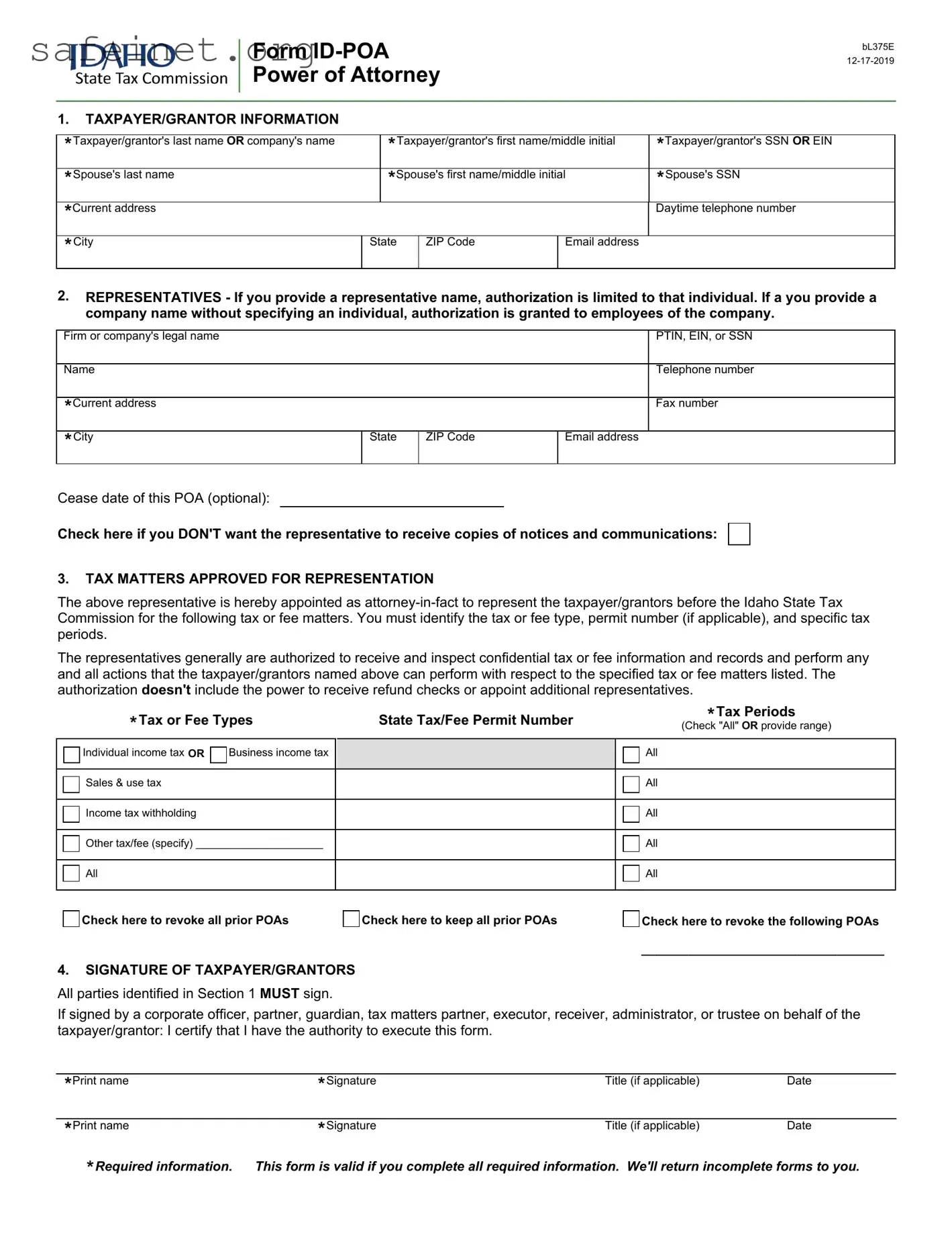

Form ID-POA Power of Attorney

1. TAXPAYER/GRANTOR INFORMATION

|

|

|

|

|

|

|

*Taxpayer/grantor's last name OR company's name |

|

*Taxpayer/grantor's first name/middle initial |

*Taxpayer/grantor's SSN OR EIN |

*Spouse's last name |

|

*Spouse's first name/middle initial |

*Spouse's SSN |

*Current address |

|

|

|

|

Daytime telephone number |

*City |

I |

State |

ZIP Code |

Email address |

|

|

|

|

I |

I |

|

2.REPRESENTATIVES - If you provide a representative name, authorization is limited to that individual. If a you provide a company name without specifying an individual, authorization is granted to employees of the company.

Firm or company's legal name |

|

|

|

PTIN, EIN, or SSN |

|

|

|

|

|

|

Name |

|

|

|

Telephone number |

|

|

|

|

|

|

*Current address |

|

|

|

Fax number |

*City |

I |

State |

ZIP Code |

Email address |

|

|

|

I |

I |

Cease date of this POA (optional):

Check here if you DON'T want the representative to receive copies of notices and communications: □

3.TAX MATTERS APPROVED FOR REPRESENTATION

The above representative is hereby appointed as attorney-in-fact to represent the taxpayer/grantors before the Idaho State Tax Commission for the following tax or fee matters. You must identify the tax or fee type, permit number (if applicable), and specific tax periods.

The representatives generally are authorized to receive and inspect confidential tax or fee information and records and perform any and all actions that the taxpayer/grantors named above can perform with respect to the specified tax or fee matters listed. The authorization doesn't include the power to receive refund checks or appoint additional representatives.

*Tax or Fee Types |

State Tax/Fee Permit Number |

*Tax Periods |

(Check "All" OR provide range) |

□Individual income tax OR □Business income tax |

|

□ All |

□ Sales & use tax |

|

□ All |

□ Income tax withholding |

|

□ All |

□ Other tax/fee (specify) _____________________ |

|

□ All |

□ All |

|

□ All |

□Check here to revoke all prior POAs |

□Check here to keep all prior POAs |

□Check here to revoke the following POAs |

|

|

____________________________________ |

4.SIGNATURE OF TAXPAYER/GRANTORS All parties identified in Section 1 MUST sign.

If signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, or trustee on behalf of the taxpayer/grantor: I certify that I have the authority to execute this form.

*Print name |

|

*Signature |

Title (if applicable) |

Date |

|

*Print name |

|

*Signature |

Title (if applicable) |

Date |

*Required information. This form is valid if you complete all required information. We'll return incomplete forms to you.

JDAJ--JO State Tax Commission |

Form ID-POA — Instructions |

PURPOSE OF FORM

A Power of Attorney (POA) is a legal document authorizing someone to represent you. You, the taxpayer/grantor, must complete, sign, and return this form if you want to grant power of attorney to an accountant, tax return preparer, attorney, family member, or anyone else to act on your behalf with the Idaho State Tax Commission.

SPECIFIC INSTRUCTIONS

SECTION 1 – Taxpayer Information

Individuals. Enter your name, Social Security number (SSN), Individual Taxpayer Identification Number (ITIN), and/or federal Employer Identification Number (EIN), if applicable; your street address or post office box; telephone number; and email address. If you file a tax return that includes a sole proprietorship business (Federal Schedule C) and you're authorizing the listed representatives to represent you for your individual and business tax matters, enter both your SSN (or ITIN) and your business EIN as your taxpayer identification numbers.

Corporations, Partnerships, or Associations. Enter the entity name, EIN, business address, telephone number, and email address.

SECTION 2 – Representatives

Enter the name, mailing address, Paid Preparer Tax Identification Number (PTIN), EIN, or SSN, telephone number, fax number, and email address of your representative. If you're appointing a company (such as a CPA firm) as your representative, the company name is sufficient. You don't need to specify each person who's authorized. If you want to appoint only a specific person in the company as your representative, you must include that person's name.

Cease Date. This form is effective on the date signed and will remain in effect until the cease date or until revoked. If you want to cease the Power of Attorney, provide a specific date on the cease date line provided, such as December 31, 2016. If you don't provide a date, the form is in effect until revoked.

If you don't want your representative to receive copies of notices and communications that we send to you, check the appropriate box under the representative's name and address.

SECTION 3 – Tax Matters Approved for Representation

You can use this form for any matter affecting a tax or fee that the Tax Commission administers, including audit and collection matters. It doesn't apply to matters before other state agencies or federal agencies, including the IRS.

Tax or Fee Types. Check the box for the tax or fee types you're authorizing the representative to discuss. You can check the box for all tax types.

State Tax/Fee Permit Number. Enter the state tax/fee permit number if applicable. If you provide a permit number, authorization is limited to only that account. If you don't provide a number, the form is valid for all accounts the taxpayer has in that tax type.

Tax Periods. Enter the tax periods you're authorizing the representative to discuss. Examples:

•All box – check the box to cover all the tax periods for the past, current and future (Don't provide specific year information)

•Consecutive years – list (2015, 2016, 2017)

•Date range – list year range or month and year (2010–2015 or Jan 2019 – Mar 2019)

•Specific year – list as calendar year (2015)

•Fiscal years - list the ending month and year (07/2019)

Don't use general references (now, present or today). Forms with a general reference or no reference to an end date will be returned.

bL375E |

12-17-2019 |

Page 1 of 2 |

JDAJ--JO State Tax Commission |

Form ID-POA — Instructions |

Replacing a POA. You can appoint or change representatives at any time by submitting a POA. If you've previously filed a POA with the Tax Commission and are submitting another POA, you must check the appropriate box on the POA form to let us know your intent for the previously filed POAs. If no boxes are checked, the form is considered incomplete and will be returned to you. See the box definitions below.

Check here to revoke all prior POAs. Checking this box revokes all prior POAs on file with the Tax Commission for the same tax matters and years or periods covered by this form.

Check here to keep all prior POAs. Checking this box keeps all prior POAs on file with the Tax Commission and adds this POA for the same tax matters and years or periods covered by this form.

Check here to revoke the following POAs. If you check this box, list on the line which specific POAs you want to revoke.

Revoking a POA. You may revoke a POA or the representative may withdraw at any time by submitting a copy of the previously executed POA with "REVOKE" written across the top of the form with your signature and date. You also can submit a written statement specifying your intent to revoke a POA or withdraw as the representative. You must sign and date the statement and include the name, address, and SSN/EIN of the taxpayer/grantor and the name and address of the representatives whose authority is being revoked or withdrawn.

SECTION 4 - Signature of Taxpayer/Grantors

Individuals. You must sign and date the form. If you filed a joint return, your spouse must also sign and date the form.

Corporations. Officers with the legal authority to bind the corporation must sign and enter their exact titles and date the form.

Partnerships/LLCs. If one partner or member is authorized to act in the name of the partnership or LLC, only that partner or member is required to sign and enter his or her title and date the form.

Estates. If there is more than one executor, only one co-executor having the authority to bind the estate is required to sign.

FILING THIS FORM

Mail or fax this completed form to the Tax Commission section OR employee you've been working with. Otherwise, mail or fax the completed form to:

Idaho State Tax Commission Account Registration Maintenance

PO Box 36

Boise, ID 83722-0410 fax: (208) 334-5364

Contact us:

In the Boise area: (208) 334-7660 | Toll free: (800) 972-7660

Hearing impaired (TDD) (800) 377-3529

tax.idaho.gov/contact

bL375E |

12-17-2019 |

Page 2 of 2 |