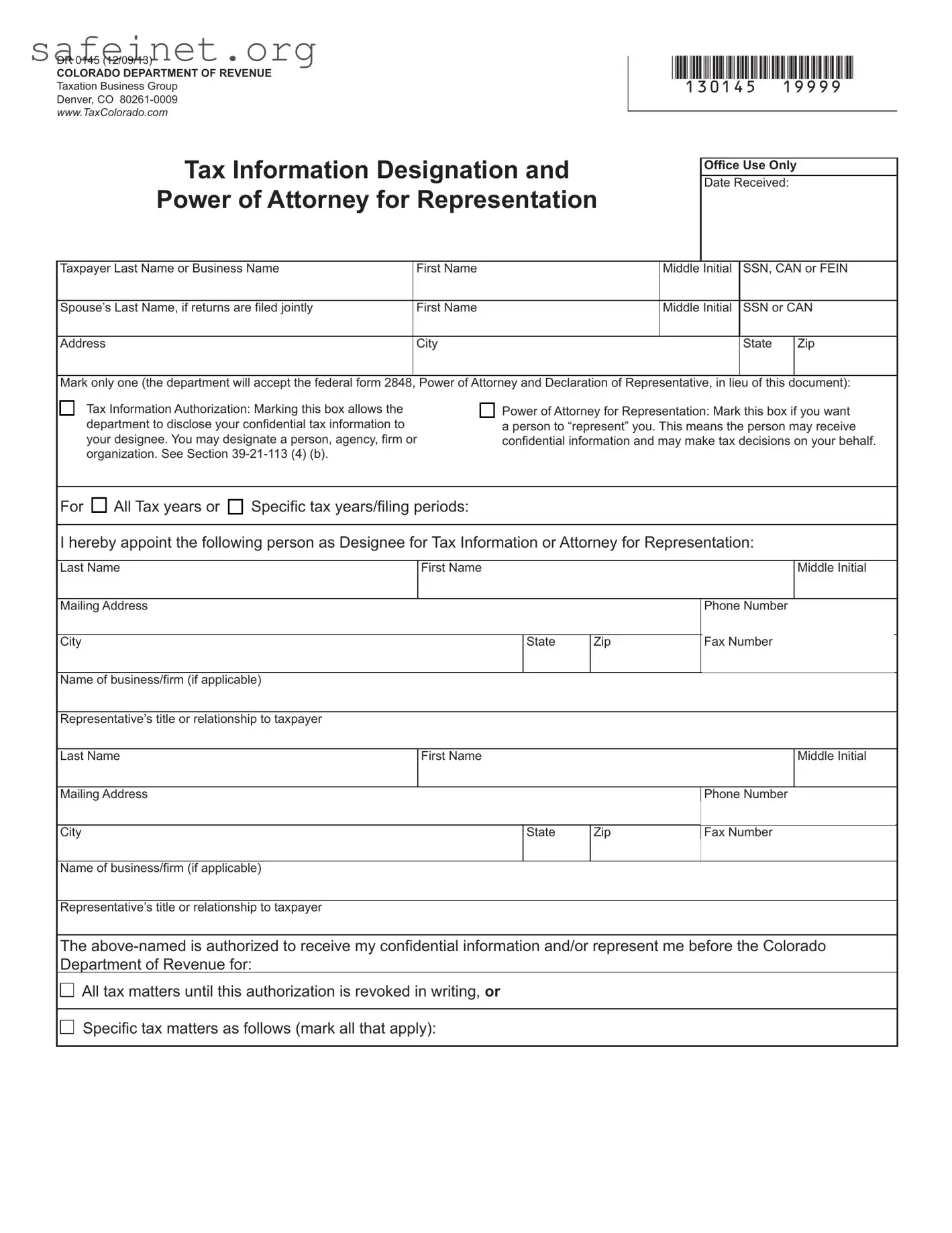

What is the Tax POA Form DR 0145?

The Tax POA Form DR 0145 is a Power of Attorney form used in the state of Florida. This form allows individuals to designate another person, typically a tax professional or lawyer, to represent them before the Florida Department of Revenue. This representation can include handling tax matters, filing tax returns, and responding to any inquiries or notifications related to taxes.

Who can I designate as my representative using Form DR 0145?

You can designate anyone you trust to act on your behalf as your representative. This can include accountants, attorneys, or tax preparers. Ensure that the person you select is knowledgeable about tax matters and can competently manage your affairs with the Department of Revenue.

Do I need to provide any personal information to complete the form?

Yes, completing the form requires you to provide specific personal information. Typically, this includes your name, address, and Social Security number or taxpayer identification number. The representative's details must also be included, ensuring clarity about whom you are authorizing to act for you.

Is there a specific reason to use Form DR 0145 rather than other forms?

Using Form DR 0145 is crucial for tax representation specifically in Florida. It grants your designated representative the authority to engage directly with the Department of Revenue on your behalf, ensuring efficient communication and action regarding your tax matters. While other POA forms may exist, they may not cover state-specific tax issues adequately.

How do I submit Form DR 0145 after completing it?

Once you have filled out the form, you should submit it directly to the Florida Department of Revenue. While you can often submit it electronically, mailing a physical copy is also acceptable. Always check the latest submission guidelines, as procedures may evolve over time.

How long is my Power of Attorney effective once I file this form?

The Power of Attorney granted through Form DR 0145 remains in effect until you revoke it or until the job for which it was created is completed. You can revoke it at any time by filing a revocation form with the Department of Revenue. It is crucial to communicate any changes to your representative to avoid misunderstandings.

Can I also act on my own behalf while my representative is authorized?

Yes, even after designating a representative using Form DR 0145, you maintain the right to act on your own behalf. It is wise to coordinate communication with your representative and keep them informed of any actions you take to ensure consistency in your tax matters.

Will filing this form ensure that my representative has full access to my tax information?

The form does grant your representative access to your tax information within the scope defined. However, it is vital to understand that the authority granted may not always cover every aspect of your tax matters. You may want to specify the limits of the authority on the form if you have particular areas of concern.

What should I do if my representative is no longer able to act on my behalf?

If your representative becomes unable to act for any reason—be it illness, relocation, or any other circumstance—it is essential to notify the Florida Department of Revenue. Consider revoking the existing Power of Attorney and appointing a new representative as needed to ensure your tax affairs continue to be managed smoothly.

Can I obtain assistance in completing Form DR 0145?

Absolutely. If you find filling out Form DR 0145 challenging, reach out for help. Tax professionals, such as accountants or tax attorneys, can guide you through the process. Additionally, resources are often available through the Florida Department of Revenue to assist taxpayers in fulfilling their obligations and understanding the forms.