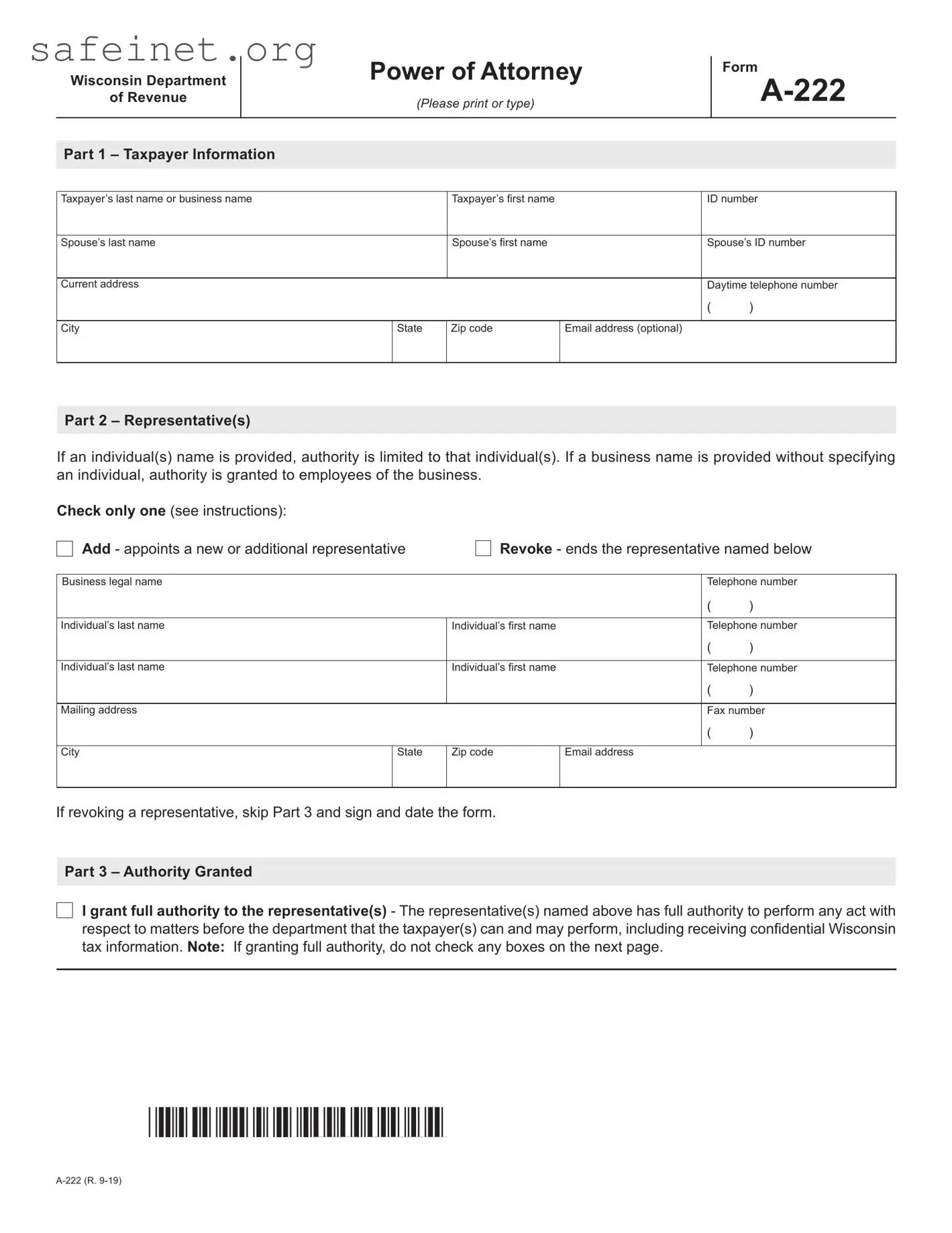

What is the Tax POA A-222 form?

The Tax Power of Attorney (POA) A-222 form allows a taxpayer to designate a representative to manage their tax-related matters with the state tax authority. This enables the appointed individual to receive confidential information and correspond with the tax agency on behalf of the taxpayer.

Who can be appointed as a representative using the A-222 form?

Any individual or entity that has permissible authority can serve as a representative. This often includes tax professionals such as accountants or attorneys, but it may also be a family member or friend. The key aspect is that the representative must have the capacity to act on behalf of the taxpayer in tax matters.

What information do I need to provide on the A-222 form?

The A-222 form requires several pieces of information, including the taxpayer’s name, address, Social Security number or Employer Identification Number, and specific details about the representative being appointed. You should also include the scope of authority you are granting and the duration for which the power of attorney is valid.

Is there a fee associated with submitting the A-222 form?

Typically, there is no fee to submit the Tax POA A-222 form. However, some tax authorities might have specific policies or require the payment of additional fees for related services. Always check with your state tax agency for the most current information.

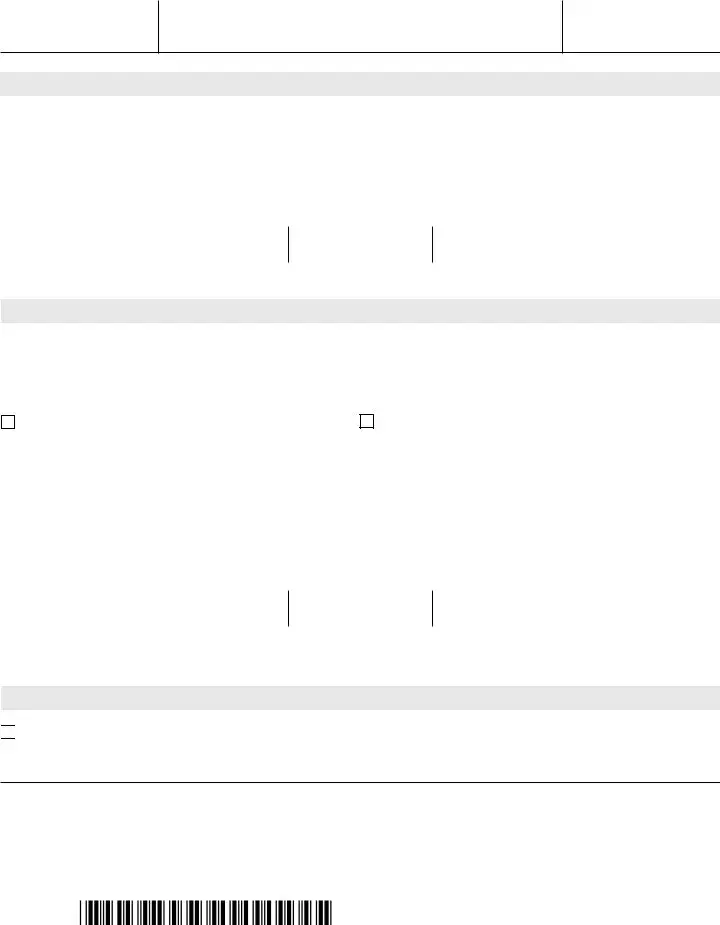

Can I limit the powers granted in the A-222 form?

Yes, you can specify the kinds of authority your representative will have. For instance, you might limit their powers to certain tax years or specific actions, such as discussing your tax matters or signing documents on your behalf. Clearly define any limitations in the form.

How do I revoke a Power of Attorney once it has been issued?

To revoke the A-222 form, you must submit a written notice of revocation to the appropriate tax authority. This document should include your identification information and details about the power of attorney you wish to rescind. It's important to do this in a timely manner to prevent any unauthorized actions by your previously appointed representative.

What happens if the A-222 form is not properly completed?

If the form is incomplete or contains errors, it may be rejected by the tax authority. Consequently, this could result in delays in processing your request or deny your representative’s ability to act on your behalf. It is advisable to carefully review the form before submission to ensure that all necessary details are accurately provided.

How long is the A-222 form valid?

The A-222 form remains effective until you revoke it, the representative resigns, or the tax matter is resolved, whichever comes first. Therefore, it is essential to monitor your tax situations and update the form as needed if circumstances change.

Where can I obtain the A-222 form?

The A-222 form is typically available on your state tax authority's website. You can download it directly or request a hard copy if needed. Make sure to use the most current version of the form to avoid complications.

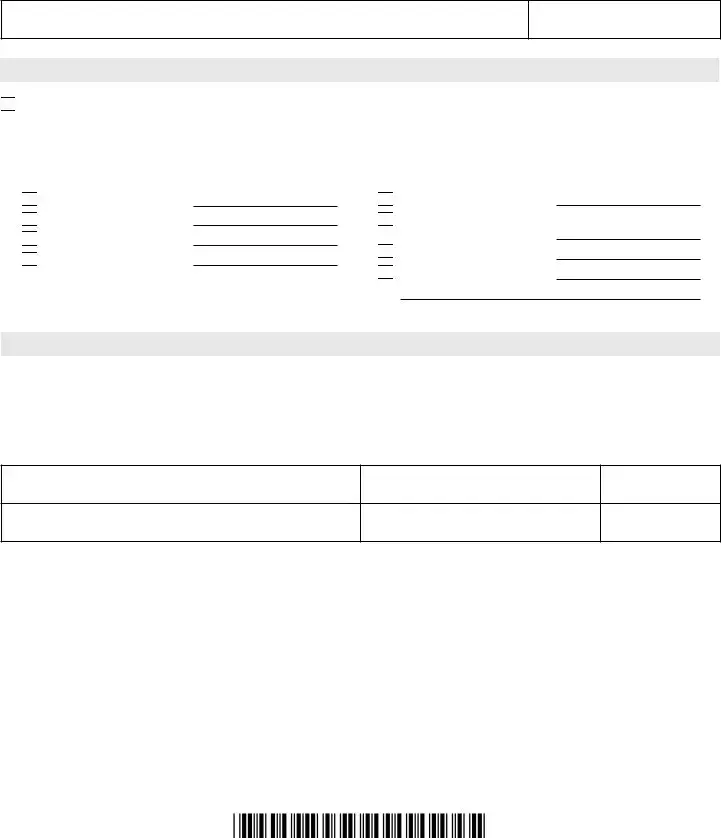

Income or Franchise Taxes

Income or Franchise Taxes

Sales and Use Taxes

Sales and Use Taxes

Excise Taxes

Excise Taxes

Property Taxes

Property Taxes

Employer Withholding Taxes

Employer Withholding Taxes

Nontax Debt

Nontax Debt