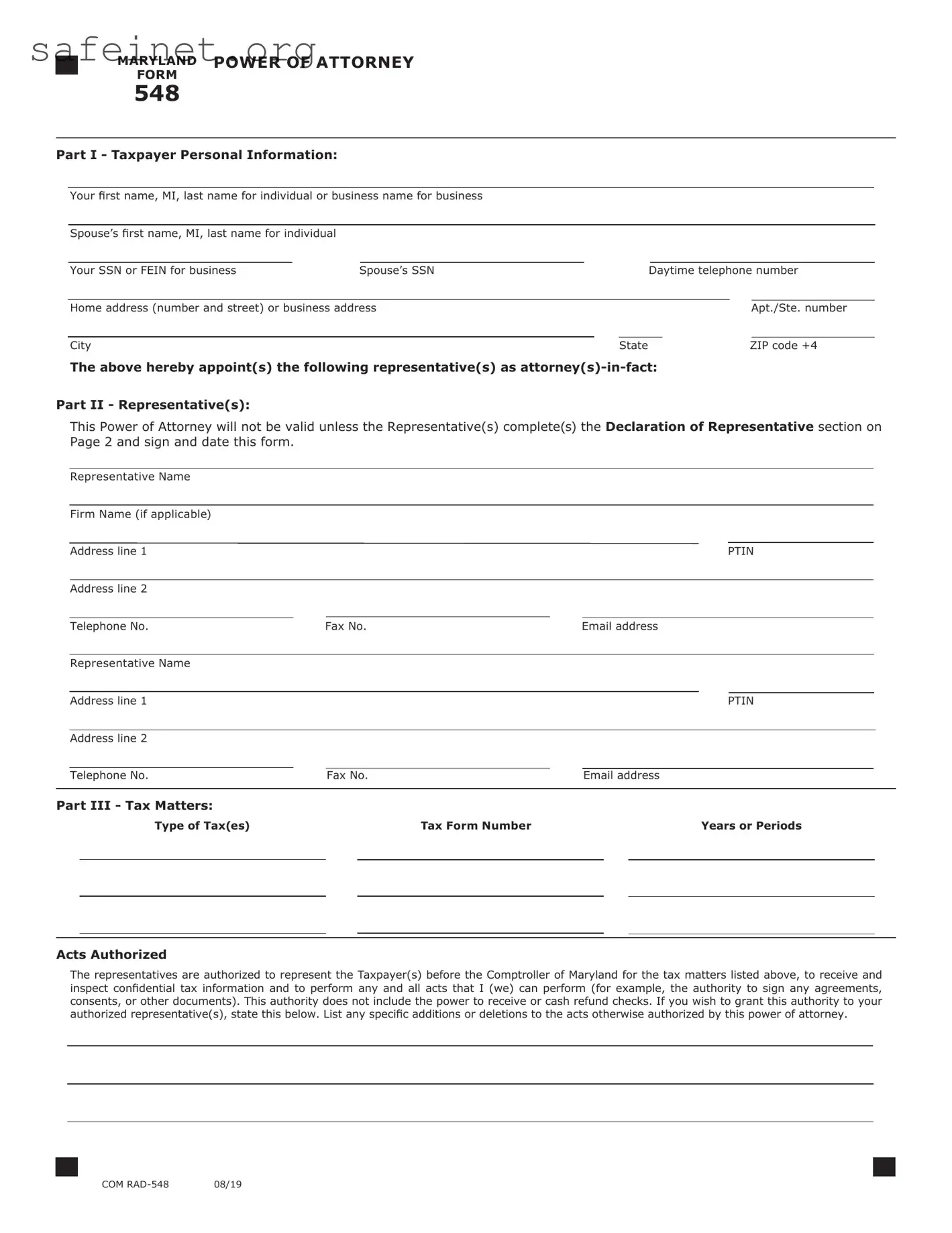

What is the Tax POA Form 548?

The Tax Power of Attorney (POA) Form 548 allows an individual to authorize someone else to handle their tax matters with the IRS. This could be a family member, a tax professional, or an attorney. By completing this form, the taxpayer grants the designated person the authority to act on their behalf in dealings with tax authorities.

Who can be appointed as a representative on Form 548?

Any individual can be appointed as a representative through Form 548, provided they are qualified to represent taxpayers before the IRS. This might include tax preparers, attorneys, or accountants. However, the representative must consent to the arrangement and cannot be a party that would create a conflict of interest.

How long does the power of attorney last?

The power of attorney granted through Form 548 remains in effect until the taxpayer revokes it or passes away. Additionally, the IRS will automatically terminate the authority if the designated representative becomes incapacitated or dies. It is essential for taxpayers to keep their records updated for any changes in representation.

What specific powers does Form 548 grant?

Form 548 permits the appointed representative to perform various tasks on behalf of the taxpayer. This includes discussing tax matters with the IRS, receiving and reviewing tax information, and signing tax documents. However, certain decisions, such as filing a legal course of action, may require separate consent or documentation.

Is there a need for the taxpayer to notify the IRS after submitting Form 548?

No additional notification is necessary once Form 548 is submitted. The IRS processes the form and acknowledges the authority granted to the representative. However, it is wise for the taxpayer to retain copies of the form and any related correspondence for their records.

Can multiple representatives be authorized on the same Form 548?

Yes, multiple representatives can be authorized using Form 548. The taxpayer must provide the names and other required details of each representative. Clear communication among all parties is essential to avoid confusion regarding the scope of authority granted to each representative.

What steps should be taken to revoke the power of attorney?

To revoke the power of attorney, the taxpayer must submit a written notice to the IRS, along with a copy of Form 548 that indicates the revocation. It is also best practice to inform the appointed representative that the authority has been rescinded. Keeping accurate records of this process is crucial.

Where can taxpayers find Form 548?

Form 548 can be obtained directly from the IRS website. It is available for download in PDF format, which can be completed and submitted as instructed. Additionally, taxpayers may seek assistance from a tax professional if they require help in completing the form or have any inquiries about the process.