What is the Tax POA Form 3520-BE?

The Tax POA Form 3520-BE is a Power of Attorney form used in the United States for tax-related matters. It allows a designated representative to act on behalf of a taxpayer when dealing with the IRS. This can include responsibilities such as handling tax returns, responding to IRS inquiries, and managing any notices or correspondence regarding the taxpayer's account.

Who can be appointed as a representative on Form 3520-BE?

You can appoint any individual to represent you, as long as they are eligible to practice before the IRS. This typically includes attorneys, certified public accountants (CPAs), and enrolled agents. However, friends or relatives can also be designated, even if they do not have formal qualifications. Make sure your chosen representative is trustworthy, as they will have access to sensitive financial information.

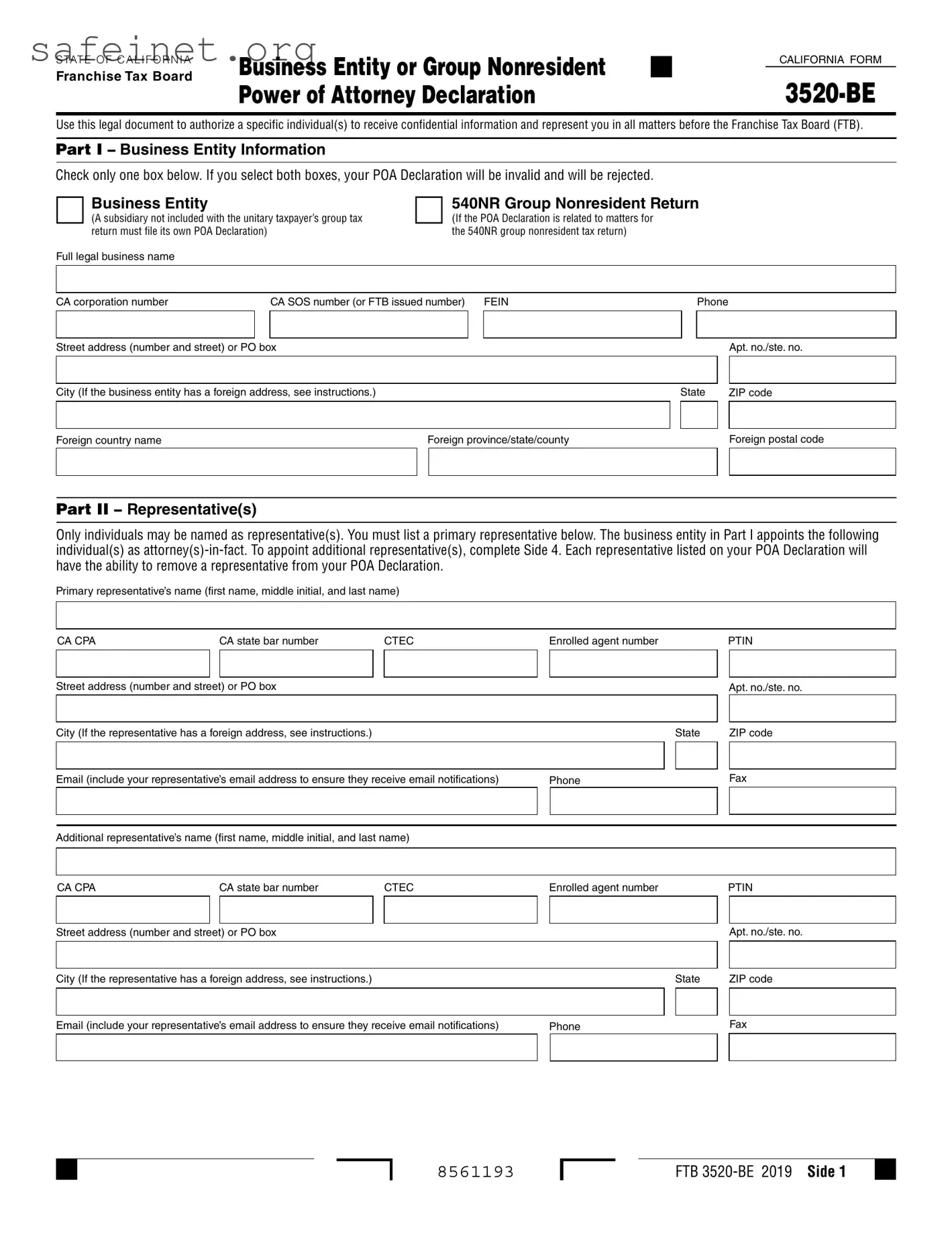

How do I fill out Form 3520-BE?

Filling out Form 3520-BE requires several key pieces of information. Begin with your personal details, including your name, address, and taxpayer identification number (like your Social Security number). Then, specify the representative’s information. Be clear about the scope of authority you are granting—this may be for specific tax matters or more general. It's essential to sign and date the form to validate it.

When should I use Form 3520-BE?

Use Form 3520-BE when you need someone to act on your behalf concerning IRS matters. This may be necessary during tax season, if you receive a notice from the IRS, or when facing an audit. Having a representative can ease the process, allowing you to focus on other important issues while they manage the details with the IRS.

Is there a deadline for submitting Form 3520-BE?

There is no specific deadline for submitting Form 3520-BE; you can submit it at any time during your interactions with the IRS. However, it's a good idea to file it when you anticipate your representative will need to take action on your behalf, especially if it coincides with deadlines for tax filings or responses to IRS notices.

Can I revoke a Power of Attorney once it’s granted?

Yes, a Power of Attorney can be revoked at any time. To do this, you need to submit a written notice of revocation to the IRS and inform your representative of the change. This can give you peace of mind if your situation changes or if you feel a different person would serve your interests better.

What happens if I don't file Form 3520-BE but need representation?

If you don't file Form 3520-BE and require representation, the IRS cannot discuss your tax matters with someone else, even if they are your attorney or CPA. This means they won't have access to your account or be able to help you with any issues. It's advisable to submit the form to ensure your representative can effectively support you.

Where can I find Form 3520-BE?

You can find Form 3520-BE on the IRS website or directly through the IRS forms repository. It is crucial to download the most recent version to ensure it meets current guidelines. If you prefer, local libraries and law offices may also provide copies for public use.