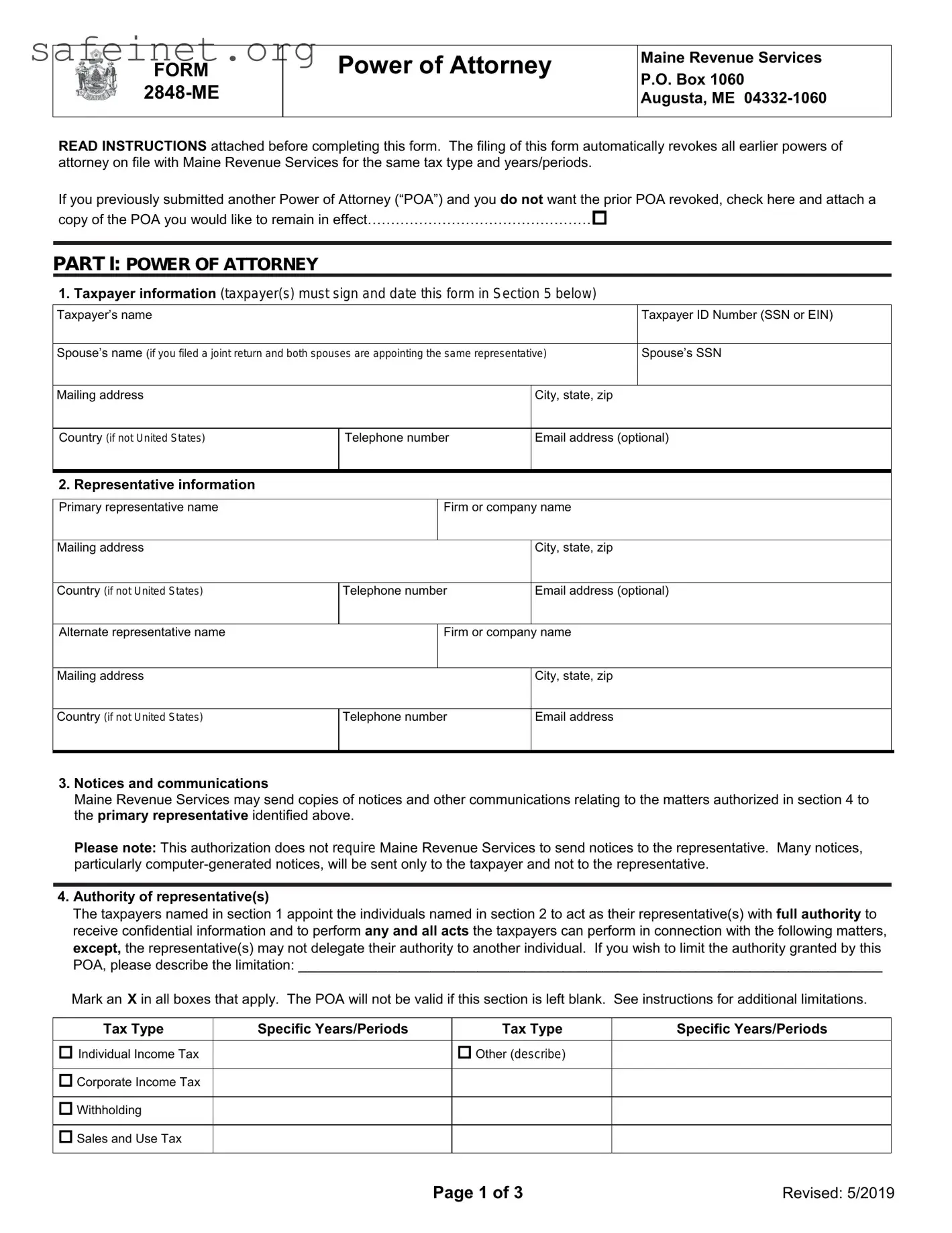

What is the Tax POA form 2848-ME?

The Tax Power of Attorney (POA) form 2848-ME allows individuals to authorize another person, such as an attorney or accountant, to represent them before the tax authorities on specific matters. This form is crucial when seeking assistance with tax issues, audits, or filings.

Who needs to fill out the form 2848-ME?

Any taxpayer who wishes to grant authority to someone else to handle their tax matters should complete this form. This includes individuals who may be busy or unable to manage their taxes directly and need assistance from a trusted professional.

What information is required to complete the form?

The form will require personal identification details such as your name, address, taxpayer identification number, and the specific tax matters you are authorizing your representative to handle. Accurate information is essential to avoid any delays or issues in processing.

How do I submit the 2848-ME form?

You can submit the completed form to the appropriate tax authority by mail or electronically, depending on the requirements of your specific jurisdiction. Ensure that you check the guidelines for submission to ensure proper processing.

Does the form have an expiration date?

The authorization granted under the form 2848-ME remains in effect until you revoke it, the representative withdraws, or the matter is resolved. However, it is good practice to review and renew the authorization periodically.

Can I revoke the power of attorney once it is granted?

Yes, you can revoke the power of attorney anytime by submitting a written statement to the tax authority that originally received the 2848-ME form. Ensure that you also notify your representative of the revocation, so they cease acting on your behalf.

What if I need to appoint multiple representatives?

You can indeed appoint more than one representative using the 2848-ME form. Just provide their details in the respective sections of the form, ensuring that each representative’s qualifications are clearly stated.

How can I ensure my form is processed quickly?

To expedite processing, double-check that all required fields are completed accurately and that you provide any necessary supporting documentation. Submitting your form electronically, if permitted, may also help speed up the process.

Is there a fee associated with filing form 2848-ME?

No, there is no fee for submitting the form 2848-ME. However, fees may apply if you hire a professional to assist with your taxes, which is a separate consideration.

Where can I find more information or assistance regarding the 2848-ME form?

You can find additional information about the Tax POA form 2848-ME on the official tax authority website. For specific questions or concerns, contacting a tax professional is advisable to ensure all aspects of the form and its implications are understood thoroughly.