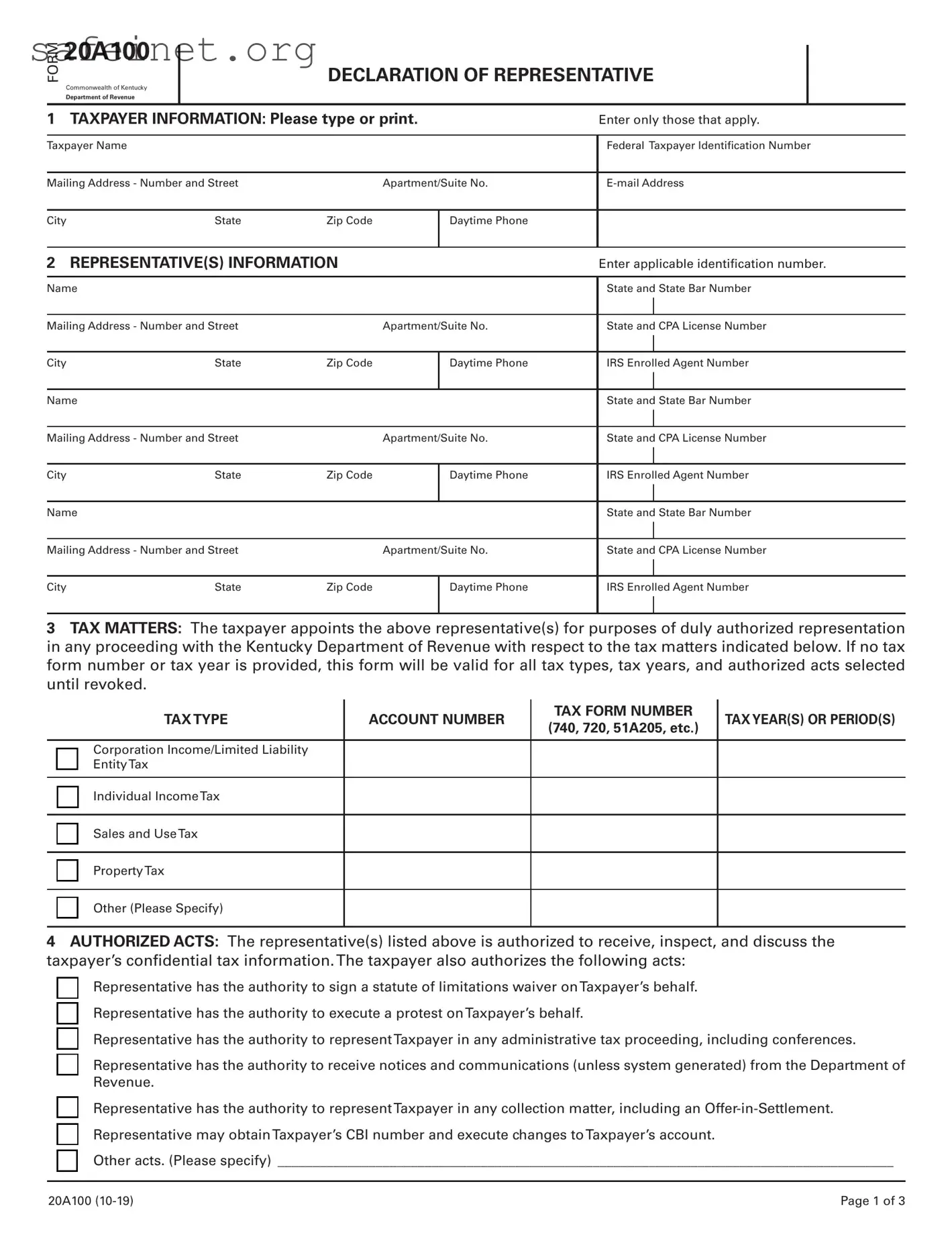

What is the Tax POA form 20a100?

The Tax POA form 20a100, also known as the Power of Attorney (POA) for Tax Matters, is a document that allows individuals to appoint an official representative to handle their tax affairs. This form is particularly useful for taxpayers who may need assistance with tax issues, such as filing returns, receiving tax information, or communicating with tax agencies on their behalf. By filling out this form, taxpayers provide their designated representative the authority to act in their stead regarding specific tax matters.

Who can I appoint as my representative using the 20a100 form?

You have the flexibility to appoint various individuals as your representative using the Tax POA form 20a100. This can include a family member, a friend, or a qualified tax professional, such as an accountant or tax attorney. It's crucial to choose someone who you trust and who understands your tax situation, as they will have access to sensitive information and the authority to act on your behalf.

What are the specific powers granted to my representative?

The representative you appoint using the 20a100 form can perform several important tasks related to your tax matters. These tasks may include preparing and filing returns, receiving information from tax authorities, and discussing your tax situation with tax officials. However, it's important to note that the exact powers granted can vary based on the options you select on the form. Therefore, it's vital to understand which powers you wish to confer to your representative before submitting the form.

Do I need to file the 20a100 form annually?

No, the Tax POA form 20a100 does not need to be filed annually. Once you appoint a representative using this form, the power remains in effect until you revoke it or until the circumstances change. It’s important, however, to keep your representative and tax authorities updated if any changes occur in your situation or if you wish to designate a different representative.

What happens if I change my mind about my representative?

If you decide to revoke or change your representative, you can do so by submitting a new 20a100 form with the updated information. Make sure to inform your former representative of the change, as they may still have access to your tax information if the prior form isn’t formally revoked. Clarity and communication are key to ensuring that your tax matters are handled as you prefer.

Where can I obtain the Tax POA form 20a100?

The Tax POA form 20a100 can usually be obtained from the official website of your state’s Department of Revenue or equivalent tax authority. Most tax agencies provide downloadable and printable versions of the form. If you prefer not to access it online, you can often request a hard copy by contacting your local tax office directly.