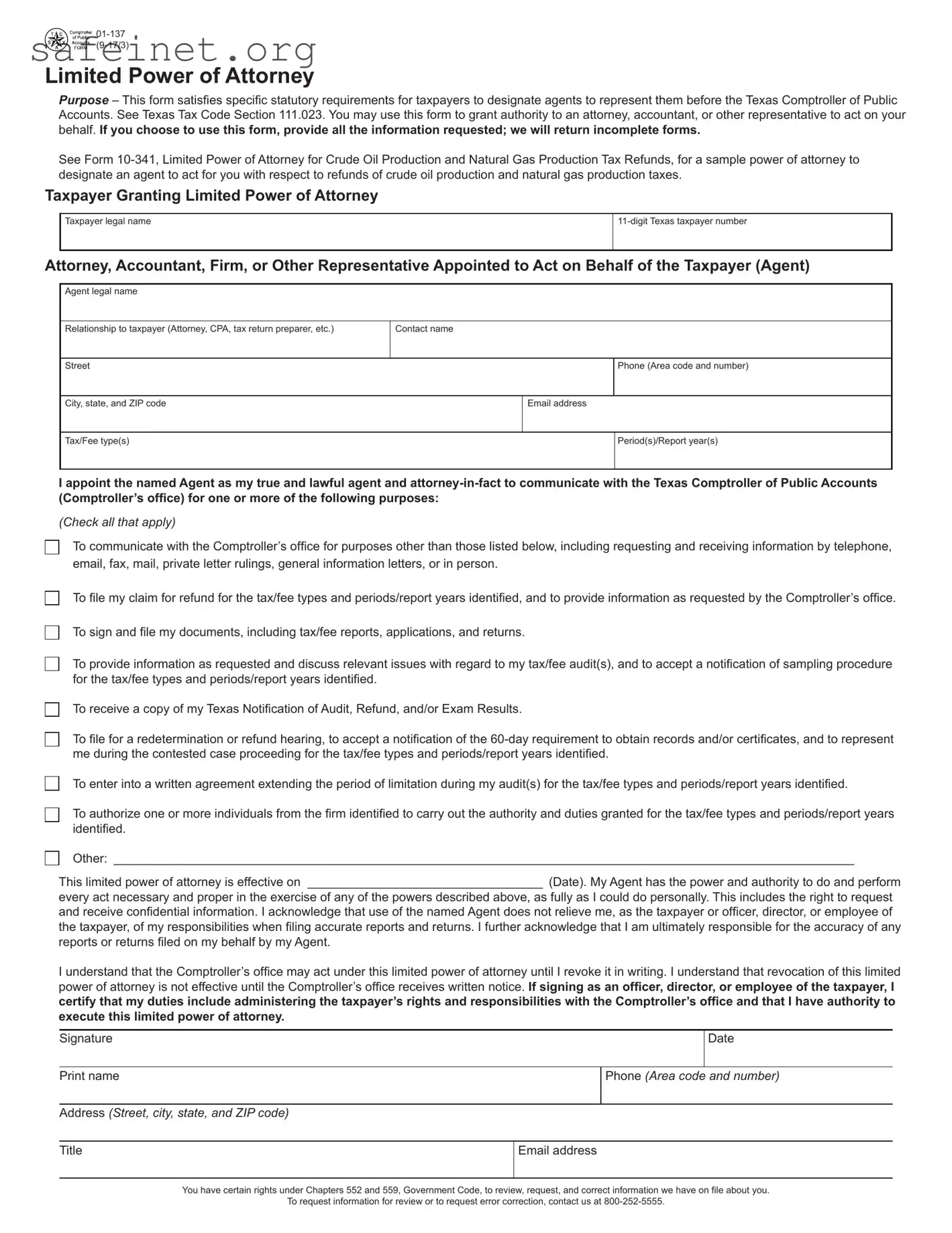

What is the Tax POA Form 01-137?

The Tax POA Form 01-137, also known as the Power of Attorney for tax matters, allows a taxpayer to designate an individual or organization to act on their behalf when dealing with tax-related issues. This can include discussions with the IRS and state tax authorities, filing documents, or receiving confidential tax information.

Who should use the Tax POA Form 01-137?

This form is ideal for individuals who may require assistance in managing their tax affairs. It could be beneficial for those who are busy professionals, those needing help from tax professionals, or individuals who may have difficulty understanding tax regulations. Essentially, anyone who wants someone else to handle their tax matters can use this form.

How do I complete the Tax POA Form 01-137?

Completing the form is straightforward. Start by providing your personal information, including your name, address, and Social Security number. Next, specify the representative’s details—this is the person you are granting authority to. It is crucial to sign and date the form at the bottom to ensure it is valid. Double-check that all entries are correct to avoid future complications.

Where do I send the completed Tax POA Form 01-137?

After completing the form, you should send it directly to the tax authority that requires it. For federal matters, this typically involves submitting it to the IRS. For state taxes, consult your state’s tax agency for the appropriate submission process. Sometimes, you may need to keep a copy for your records.

Does the Tax POA Form 01-137 expire?

The Tax POA Form 01-137 does not have a set expiration date, but it can be revoked by the taxpayer or the representative at any time. If you change your mind about whom you want to represent you, it is essential to submit a new form and ensure the prior authorization is effectively terminated.

Can I authorize more than one representative using the Tax POA Form 01-137?

Yes, you can designate multiple representatives. However, each individual must be listed clearly on the form. If you choose to have multiple representatives, be specific about the powers each will have. This clarity helps prevent misunderstandings about who is responsible for specific actions on your behalf.

What if I need to make changes after submitting the form?

If changes are needed after submission, you can file a new Tax POA Form 01-137 with the desired updates. You should also consider notifying any tax authorities involved, so they are aware of the changes and can adjust their records accordingly. Keeping communication open helps maintain clarity in your representation.

Is there a fee for using the Tax POA Form 01-137?

Generally, there is no fee associated with filing the Tax POA Form 01-137 itself. However, if you hire a tax professional or consultant to assist you in this process or to handle your tax matters, they may charge fees for their services. It’s always a good practice to discuss potential costs upfront with any representative you choose.

Other: ___________________________________________________________________________________________________________

Other: ___________________________________________________________________________________________________________