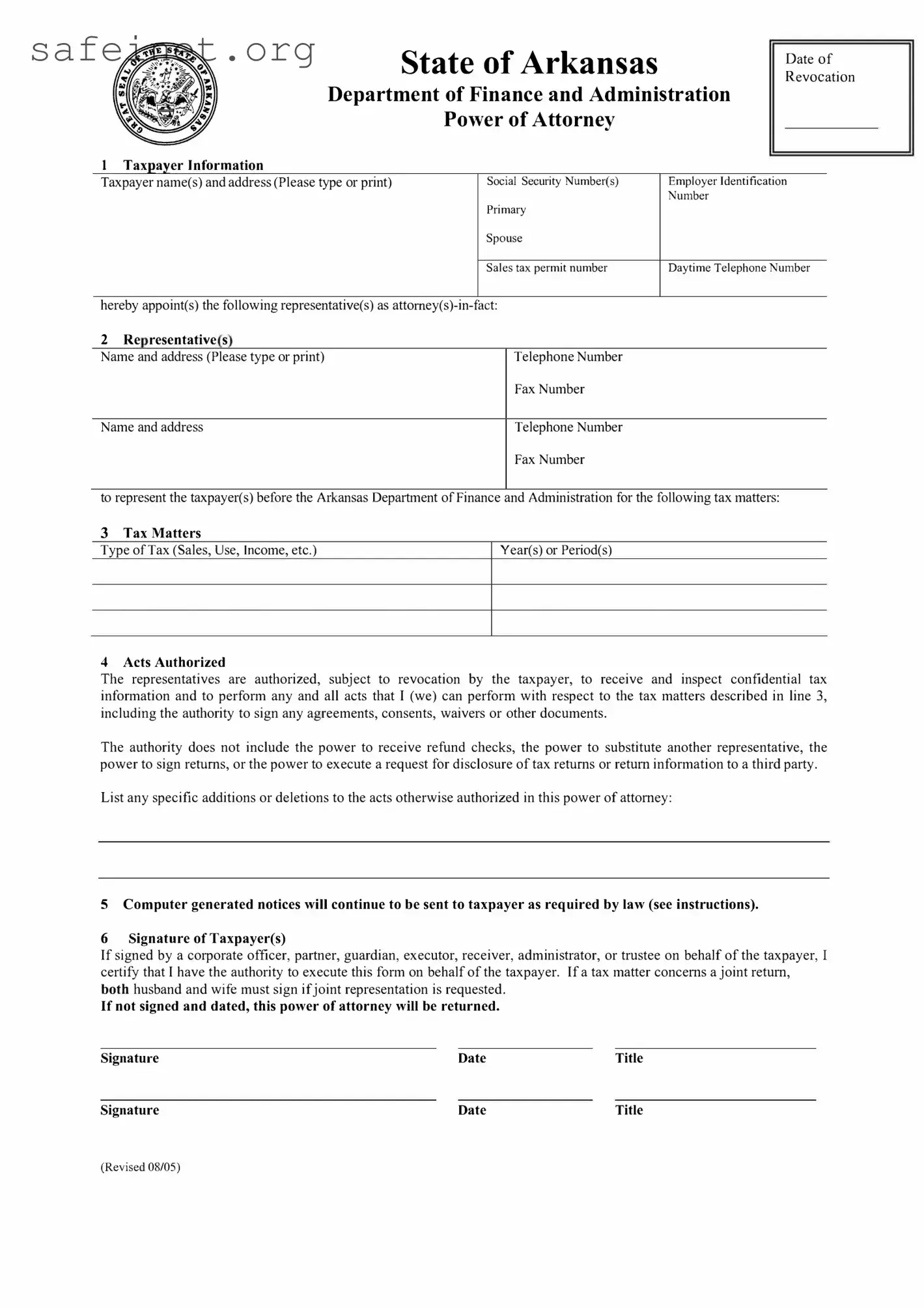

What is the Tax POA DFA POA form?

The Tax POA DFA POA form, also known as the Power of Attorney for tax matters, allows you to authorize another person to act on your behalf in dealings with the tax authorities. This authorization can include filing returns, discussing your tax situation, and handling inquiries with the IRS or your state's tax department.

Who can I designate as my representative on the Tax POA form?

You can appoint a wide range of representatives on the Tax POA form, including attorneys, accountants, or any individual you trust. It’s crucial that the person you choose is competent and understands your tax issues, as they will have significant authority over your tax matters.

How do I complete the Tax POA form?

To complete the Tax POA form, start by providing your personal information, including your name, address, and taxpayer identification number. Next, clearly identify the individual you wish to appoint, including their name and contact details. Review the form to ensure all sections are accurately filled out before submitting it to the relevant tax authority.

Do I need to sign the form?

Yes, your signature is essential. By signing the form, you confirm that you are granting the designated individual authority to act on your behalf. Your signature verifies the authenticity of the document, so it's important that it matches what the tax authority has on record.

Once I submit the Tax POA form, how long does it take to process?

The processing time may vary depending on the tax authority involved and their workload. Typically, it may take anywhere from a few days to several weeks for the form to be processed. You may want to follow up after submission to ensure everything is in order and your representative has the necessary access.

Can I revoke the Tax POA authorization after I submit it?

Absolutely. You have the right to revoke the Tax POA at any time. To do so, you need to complete a revocation form, which might be available through the tax authority's website. After you submit this revocation, ensure the authorized representative is notified and no longer has access to your tax matters.

Is there a fee associated with filing the Tax POA form?

Generally, there is no fee for submitting the Tax POA form itself. However, fees might be associated with the services provided by the representative you designate, particularly if they are professionals such as attorneys or accountants. Always inquire about any potential costs before proceeding.

What should I do if my representative is not acting in my best interest?

If your representative is not acting in your best interest, you can revoke their authority using the revocation process mentioned earlier. It's advisable to closely monitor your tax situation and maintain communication with your representative to ensure your interests are being prioritized.

Can I be represented by multiple individuals on the Tax POA form?

You can designate multiple individuals, but they will need to be listed separately on the form. It's important to clearly outline their respective areas of authority, as overlapping responsibilities can lead to confusion. Make sure to communicate effectively with each representative to avoid any misunderstandings.