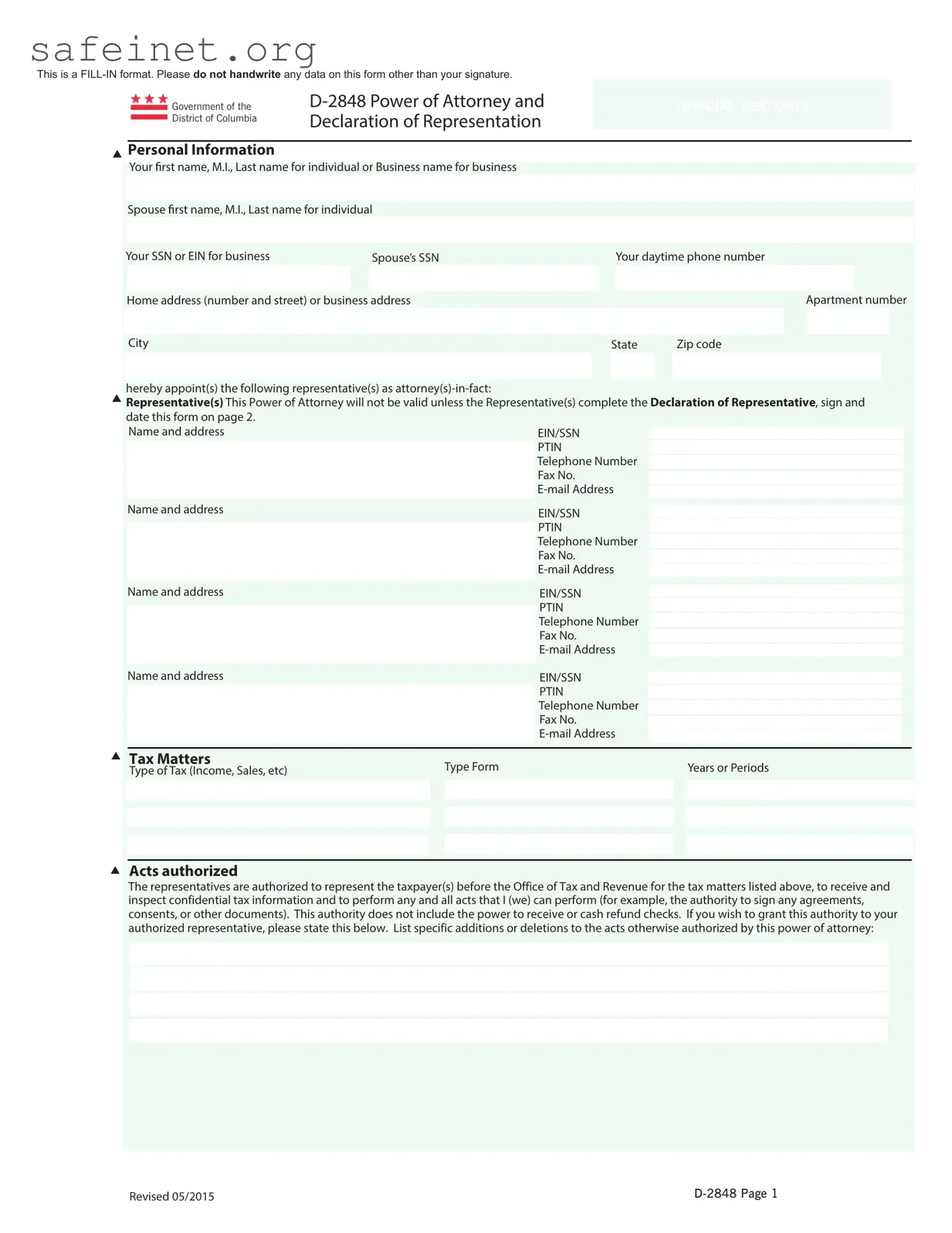

What is the Tax POA D-2848 form?

The Tax POA D-2848 form, also known as the Power of Attorney for Tax Matters, is a document that allows an individual to authorize someone else to represent them in front of tax authorities. This representation can include managing tax disputes, filing tax returns, or making inquiries about the taxpayer’s account. It is commonly used in the context of federal and state tax issues.

Who can I designate as my representative using the D-2848 form?

You can designate individuals such as attorneys, accountants, or any person you trust to handle your tax matters. The representative must be someone who is eligible to practice before the tax authority in question. For example, they could be a certified public accountant (CPA), enrolled agent, or attorney.

How do I complete the Tax POA D-2848 form?

To complete the form, provide your personal information, including your name, address, and taxpayer identification number. Then clearly list the name and contact information of your representative. It's vital to indicate the specific tax matters and the tax years covered by the Power of Attorney. Always ensure that the form is signed and dated to validate it.

Do I need to submit the D-2848 form to my tax authority?

Yes, once the form is completed and signed, it must be submitted to the tax authority you are dealing with. Some agencies might allow it to be submitted electronically, while others may require a mailed copy. Check the specific requirements of the agency involved.

How long is the D-2848 form valid?

The Power of Attorney granted through the D-2848 form generally remains in effect until you revoke it in writing or until the tax matter is resolved. It is advisable to review the terms annually or when circumstances change, as you may need to update the appointment or the authority granted.

Can I revoke the D-2848 form once it is submitted?

Yes, you have the right to revoke the Power of Attorney at any time. To do this, you must provide written notice to the tax authority along with a copy of the revocation letter to your former representative. This action effectively terminates their authority to act on your behalf.

Are there any fees associated with the D-2848 form?

Generally, there are no fees for submitting the D-2848 form itself to the tax authority. However, if you choose to hire a representative such as a CPA or attorney to assist you, there may be fees associated with their services. It’s important to clarify any potential costs with your chosen representative beforehand.

What should I do if I need to change my representative after submitting the D-2848 form?

If you need to change your representative, you should file a new D-2848 form with the updated information for your new representative. You should also revoke the previous Power of Attorney unless the change is being made simultaneously. Clear communication about these changes with both the tax authority and your representatives is crucial to avoid confusion.

Where can I find the D-2848 form?

The D-2848 form is typically available on the website of the tax authority you are dealing with. You can find it as a downloadable PDF document. Ensure you are looking at the most current version of the form, as templates and requirements may change over time.