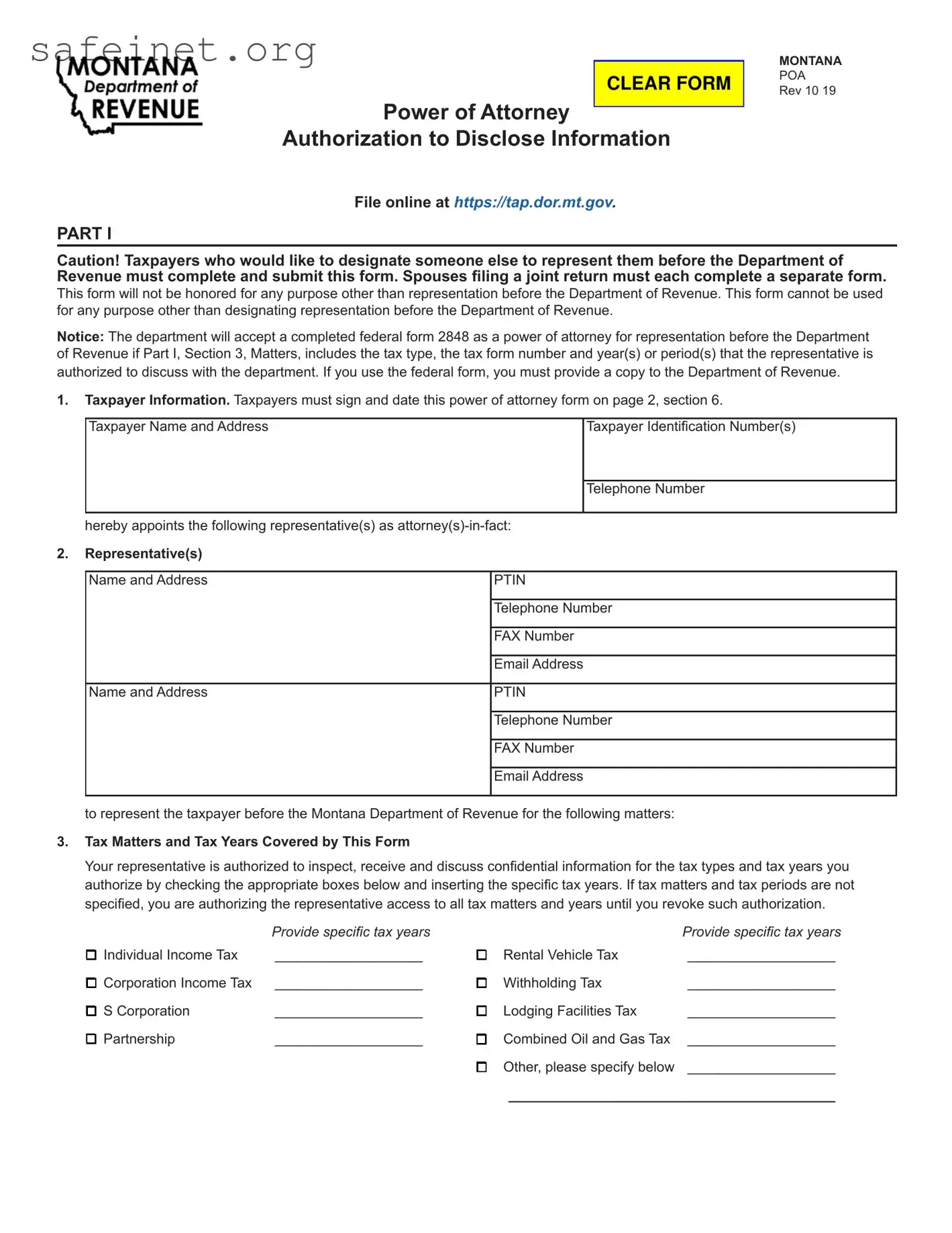

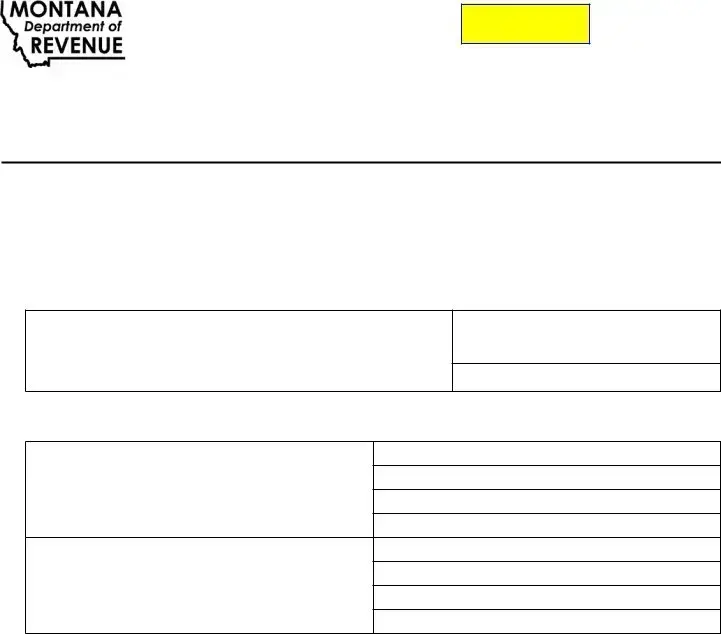

Part I

Section 1. Taxpayer Information

Individual. Enter your name, personal address, social

security number (SSN), telephone number, individual taxpayer identification number (ITIN) and/or federal employee identification number (FEIN) if applicable. Do not use your representative’s address or post office box for your own. If you file a tax return that includes

a sole proprietorship business (federal Schedule C) and the matters for which you are authorizing the listed representative(s) to represent you include your individual and business tax matters, including employment tax liabilities, enter both your SSN (or ITIN) and your business

FEIN as your taxpayer identification numbers. If the tax

matter concerns a joint return, a separate power of attorney form is required for each spouse.

C Corporation, S corporations, partnership, limited

liability company or association. Enter the name, business address, federal employer identification number

(FEIN), and telephone number. If this form is being prepared for C corporations filing a combined tax return, a list of subsidiaries is not required. This power of attorney

applies to all members of the combined tax return.

Trust. Enter the name, title, address of the trustee, the name and FEIN of the trust and telephone number.

Estate. Enter the name of the decedent as well as the name, title and address of the decedent’s personal

representative. Enter the estate’s FEIN for the taxpayer identification number or, if the estate does not have an

FEIN, the decedent’s SSN (or ITIN).

Section 2. Authorization of Representative

Enter your representative’s full legal name. Use the identical full name on all submissions and correspondence.

Enter the representative’s telephone number, address or post office box and e-mail address, if applicable.

If a trust, estate, guardianship or conservatorship wants an

individual other than the personal representative, trustee or other fiduciary to handle tax matters before the Department

of Revenue, the personal representative, trustee or other

fiduciary must complete this form and designate the

other individual with the power of attorney. Otherwise, the personal representative, trustee or other fiduciary has the requisite authority to handle tax matters before the

Department of Revenue and need not complete this form.

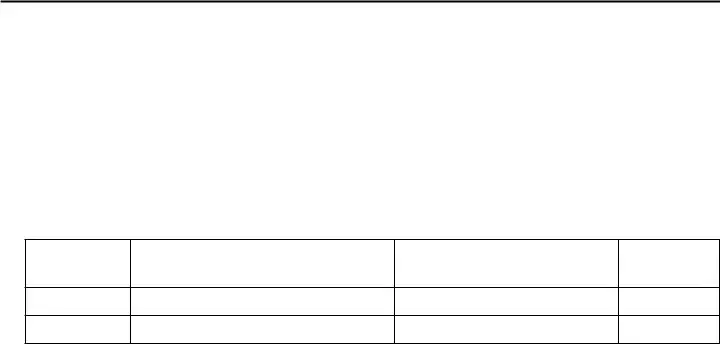

Section 3. Tax Matters and Tax Years Covered by the Form

Indicate, by checking the appropriate boxes, what tax types you are authorizing your representative to inspect, receive and discuss with the Department of Revenue.

You may list any tax years or periods that have already ended as of the date you sign the form.

If the matter relates to estate tax, enter the date of the

decedent’s death instead of a tax year.

If the tax matter and tax periods aren’t specified, you are authorizing the representative access to all tax matters and years until you revoke their authorization.

Section 4. Acts Authorized by This Form

If you are providing authorization to another individual, check one of the three boxes depending on what authorization you are providing to your representative. A disclosure authorized by this form may take place by telephone, letter, facsimile, email or a personal visit.

Note: If you check the “yes” box on the individual tax return next to the question “Do you want to allow another person

(third party designee) to discuss this return with us?” you

authorize Department of Revenue employees to discuss the tax return with the third party designee. They cannot

discuss any other issues, such as outstanding tax liabilities, without a completed power of attorney form.

Section 5. Revocation of Prior Power(s) of Attorney

Taxpayer Revocation. Check the box if you want all prior POAs revoked.

Revocation Withdraw by Representative. If you are a representative and want to revoke an existing POA, write REVOKE across the top of the form and submit the form as indicated on page 4.

Section 6. Signature

Individual. You must sign and date the form. If you file a joint return, your spouse must execute his or her own Montana power of attorney to designate a representative.

Corporation or association. An officer having authority to bind the corporation must sign.

Partnership. All partners must sign unless one partner is authorized to act in the name of the partnership. A partner is authorized to act in the name of the partnership if, under Montana law, the partner has authority to bind the partnership. If there is any doubt whether a partner has the authority to bind the partnership, it is best that all partners sign the form.

Limited Liability Company (LLC). If the LLC is member- managed, all members must sign, unless one member is authorized to act in the name of the LLC. If the LLC is manager-managed, the manager must sign.

Estate, trust or other fiduciary. As discussed in Section 2, if a trust, estate, guardianship or conservatorship wants an

individual other than the personal representative, trustee or other fiduciary to handle tax matters before the Department

of Revenue, the personal representative, trustee or other

fiduciary must complete this form and designate the other individual with the power of attorney. Thus, the personal representative of an estate must sign. The trustee of a trust must sign. If a guardian or conservator has been appointed