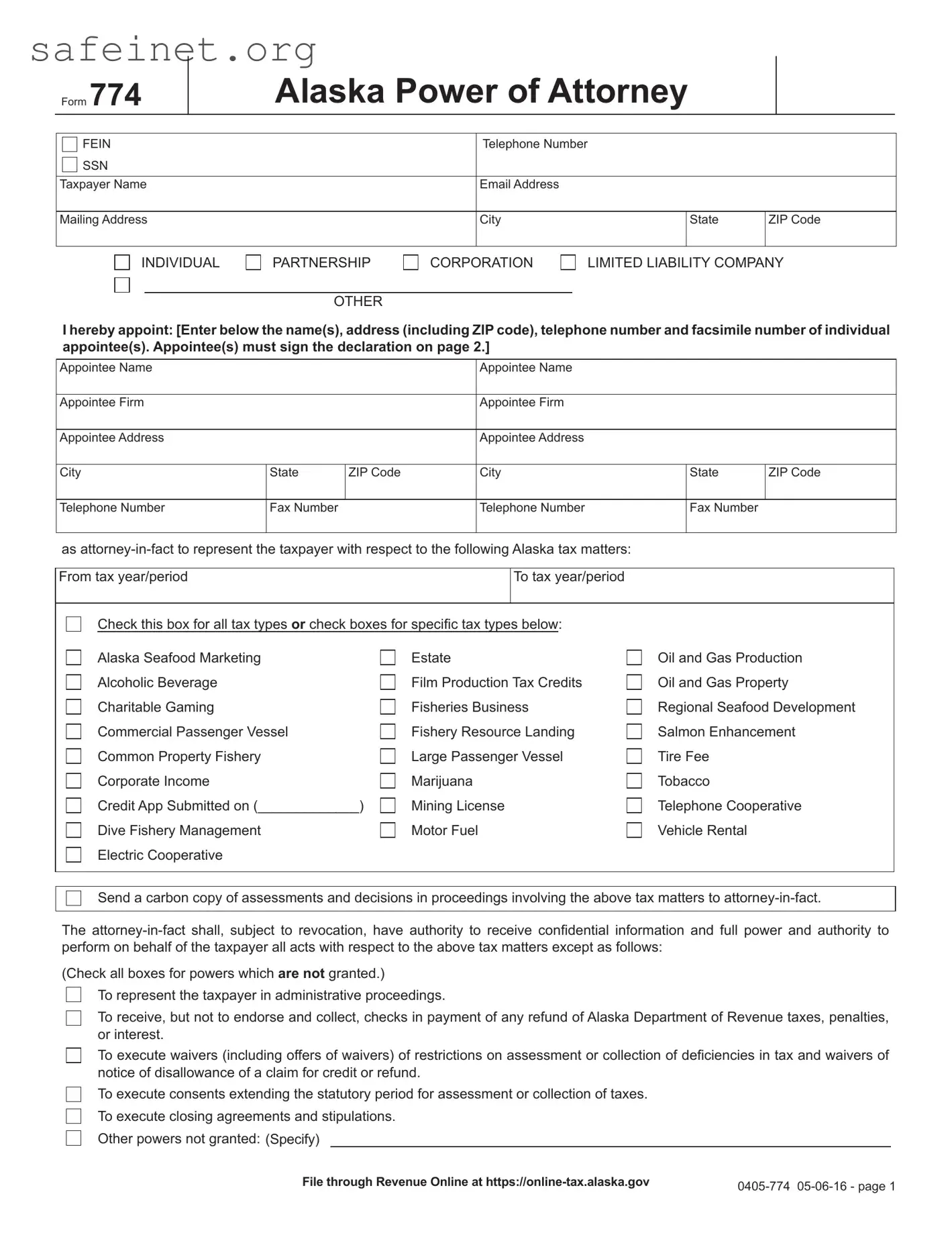

What is the Tax POA 774 form?

The Tax POA 774 form, also known as the Power of Attorney for Tax Matters, allows you to authorize someone else to represent you before the IRS or state tax authorities. It is crucial for delegating tax responsibilities while ensuring that your interests are handled professionally.

Who should use the Tax POA 774 form?

This form is beneficial for individuals or business owners who need to appoint a trusted representative, such as an accountant or tax attorney, to manage tax-related issues. If you find the tax process overwhelming or simply want expert assistance, using this form is a good choice.

How do I fill out the Tax POA 774 form?

Filling out the Tax POA 774 form involves providing your personal information, the details of your representative, and any specific tax matters that your representative will handle. It's essential to ensure all the information is accurate. Clear and complete details will help avoid delays in processing.

Can I revoke the Tax POA 774 form once it's filed?

Yes, you have the right to revoke the Tax POA 774 form at any time. If you decide to revoke it, you need to submit a written statement to inform the IRS or state tax authorities. This statement should include your name, the name of your representative, and a clear statement of revocation.

Do I need to submit the Tax POA 774 form to the IRS?

Yes, you must submit the form to the IRS if you want your representative to act on your behalf regarding federal tax matters. For state tax authorities, you should check their specific requirements, as they might have different submission guidelines.

How long does it take for the Tax POA 774 form to be processed?

Processing times can vary depending on the IRS or state agency workload. Generally, it can take up to four to six weeks to process. If you need fast action, consider following up with the agency after submitting the form.

Is there a fee to file the Tax POA 774 form?

There is no fee associated with filing the Tax POA 774 form itself. However, if you are hiring a professional to assist you, they might charge a fee for their services. Always clarify any potential costs upfront.

What if my representative needs to sign documents on my behalf?

Your authorized representative can sign documents related to the tax matters specified in the Tax POA 774 form. Make sure that the form includes the specific tax years and types of tax issues you are allowing them to address. This ensures they can act without needing additional approval for each transaction.

Can I use the Tax POA 774 form for state taxes?

Yes, the Tax POA 774 form can be used for both federal and state tax matters, but you should verify if the state tax authority requires a specific format or additional documentation. Each state may have different rules regarding power of attorney forms.

This power of attorney revokes all prior powers of attorney filed with respect to the same matters and years or periods covered by this instrument, except the following: (Specify and attach copies of the powers of attorney)

This power of attorney revokes all prior powers of attorney filed with respect to the same matters and years or periods covered by this instrument, except the following: (Specify and attach copies of the powers of attorney)