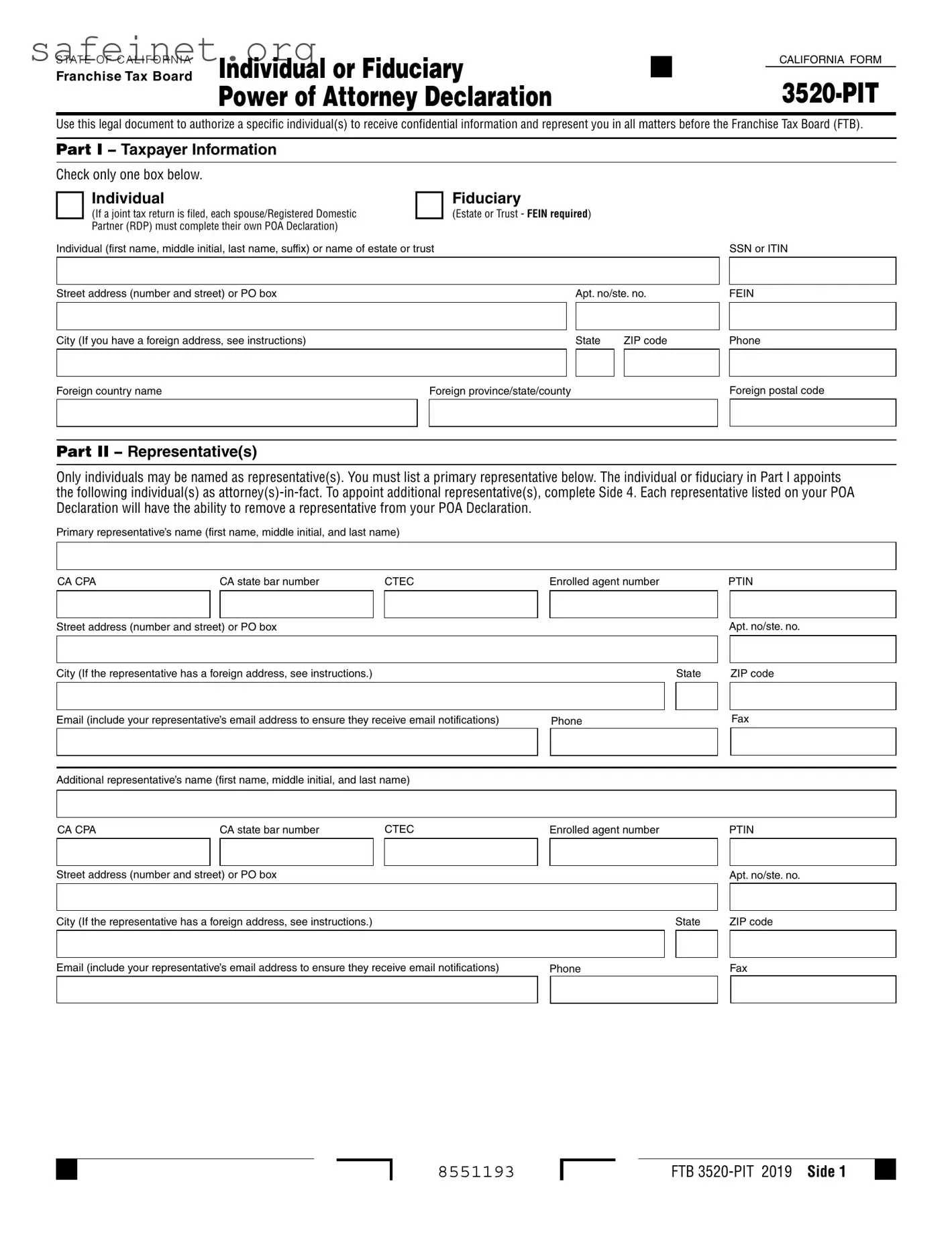

What is the Tax POA 3520-PIT form?

The Tax POA 3520-PIT form is a document that individuals use to designate someone else to represent them before the tax authorities. This form grants authority to the designated person to discuss and manage tax matters on behalf of the taxpayer.

Who can file the Tax POA 3520-PIT form?

Any individual or entity that needs assistance with tax-related issues can file this form. This includes individuals, businesses, or professionals handling tax matters for others. The person being authorized must agree to the representation.

What information is required to complete the form?

To properly fill out the form, you will need to provide your name, contact information, and tax identification number. Details of the authorized representative, including their name, contact information, and any relevant identification number, are also necessary.

How do I submit the Tax POA 3520-PIT form?

The completed form must be submitted to the appropriate tax authority. This can typically be done by mailing the form to the specified address provided by the tax department. Some jurisdictions may allow electronic submission.

Is there a fee associated with the Tax POA 3520-PIT form?

Generally, there is no fee to file the Tax POA 3520-PIT form. However, it is important to verify with your specific tax authority, as different jurisdictions may have varying policies.

How long does it take for the form to be processed?

Processing times can vary by tax authority. Typically, it may take a few weeks to receive confirmation of the authorization. It is advisable to check with the specific agency to get current processing timeframes.

Can I revoke the Tax POA 3520-PIT form after it has been submitted?

Yes, you can revoke the authorization granted by the Tax POA 3520-PIT form. This usually requires submitting a written notice of revocation to the same tax authority where the original form was filed.

What happens if the authorized representative does not act in my best interest?

If an authorized representative fails to act in your best interest or you believe they are misusing their authority, you can revoke their power using the revocation process. You may also want to consult with a tax professional or seek legal advice.

Where can I find more information about the Tax POA 3520-PIT form?

For additional information, you can visit the official website of your local tax authority. They often provide resources, downloadable forms, and answers to frequently asked questions regarding tax representation.