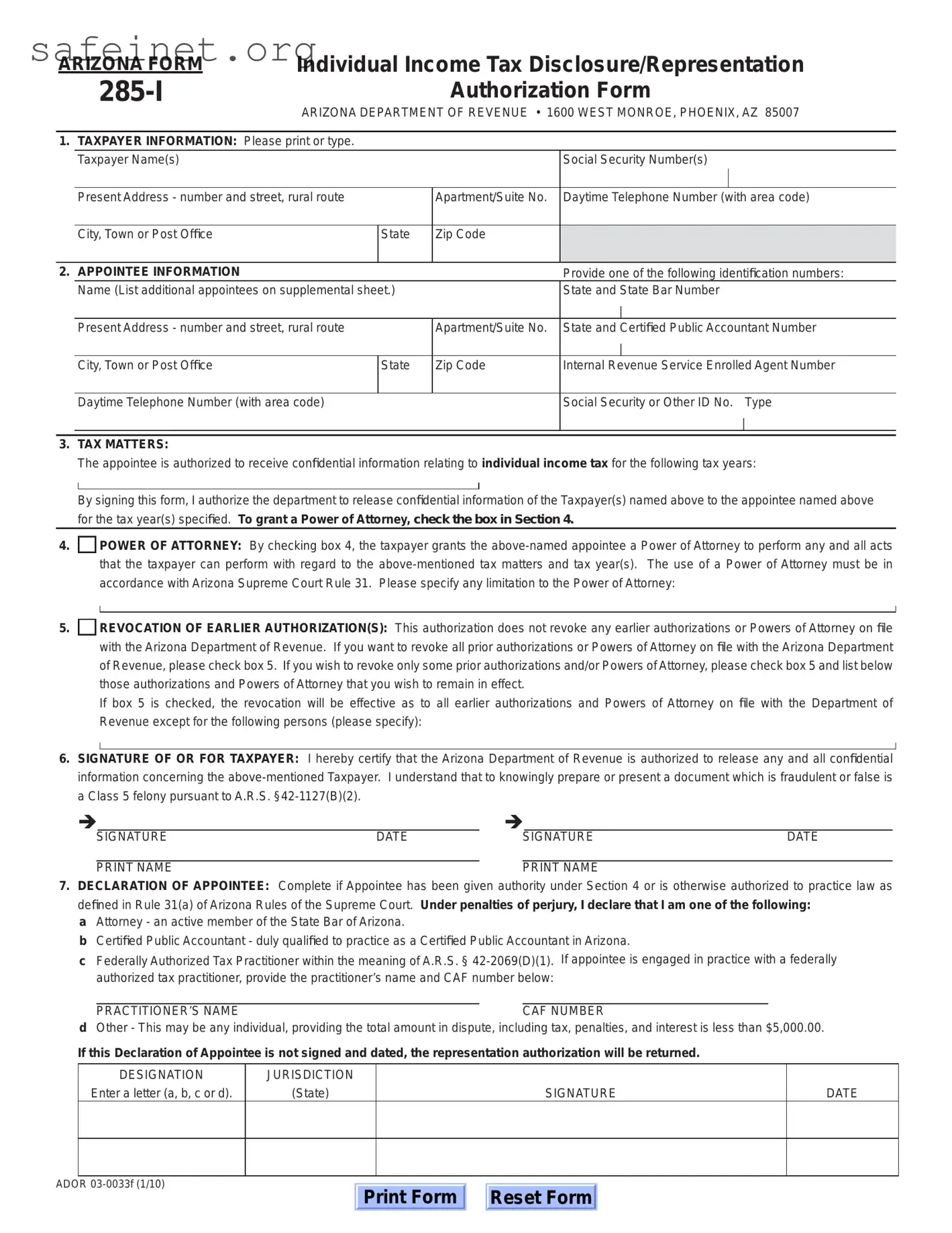

What is the Tax POA 285-I form?

The Tax POA 285-I form is a Power of Attorney form specifically for tax matters. It grants an individual or entity the authority to represent another person before tax authorities. This form is essential for allowing your representative to perform tasks on your behalf, such as managing tax returns, communicating with tax agencies, and resolving issues related to your tax obligations.

Who should use the Tax POA 285-I form?

Individuals who wish to grant someone else the authority to handle their tax affairs should use the Tax POA 285-I form. This may include taxpayers who are unable to manage their tax matters due to time constraints, physical limitations, or other reasons. Additionally, businesses may also use this form to designate representatives for handling tax-related issues.

How do I complete the Tax POA 285-I form?

Completing the Tax POA 285-I form involves several steps. First, fill out your name, address, and Social Security number or Employer Identification Number (EIN). Next, provide the same information for the person you are designating as your representative. Be sure to specify the tax matters and periods for which the authority is granted. Once filled out, the form must be signed and dated by you. Depending on the specific needs, you may also need to provide additional documentation.

Do I need to notify the IRS or state tax agency after submitting the Tax POA 285-I form?

Once you submit the Tax POA 285-I form, there is generally no need to notify the IRS or your state tax agency again. The submission itself serves as notification that you have authorized your representative to act on your behalf. However, it is wise to keep a copy of the submitted form for your records and ensure that your representative is aware of their responsibilities.

Can I revoke the authority granted through the Tax POA 285-I form?

Yes, you can revoke the authority granted by the Tax POA 285-I form at any time. To do this, you must submit a written notice of revocation to your representative and the tax agency. It is advisable to use the same format as the original form and clearly indicate that you are revoking the power of attorney. This action nullifies the representative's authority and ensures that your tax matters are handled according to your wishes going forward.

Is there a fee associated with filing the Tax POA 285-I form?

No fees are typically required when submitting the Tax POA 285-I form to the IRS or state tax agencies. However, you may incur costs for the services of the representative you choose to designate. It's essential to clarify any potential fees with your appointed representative before granting them authority through this form.