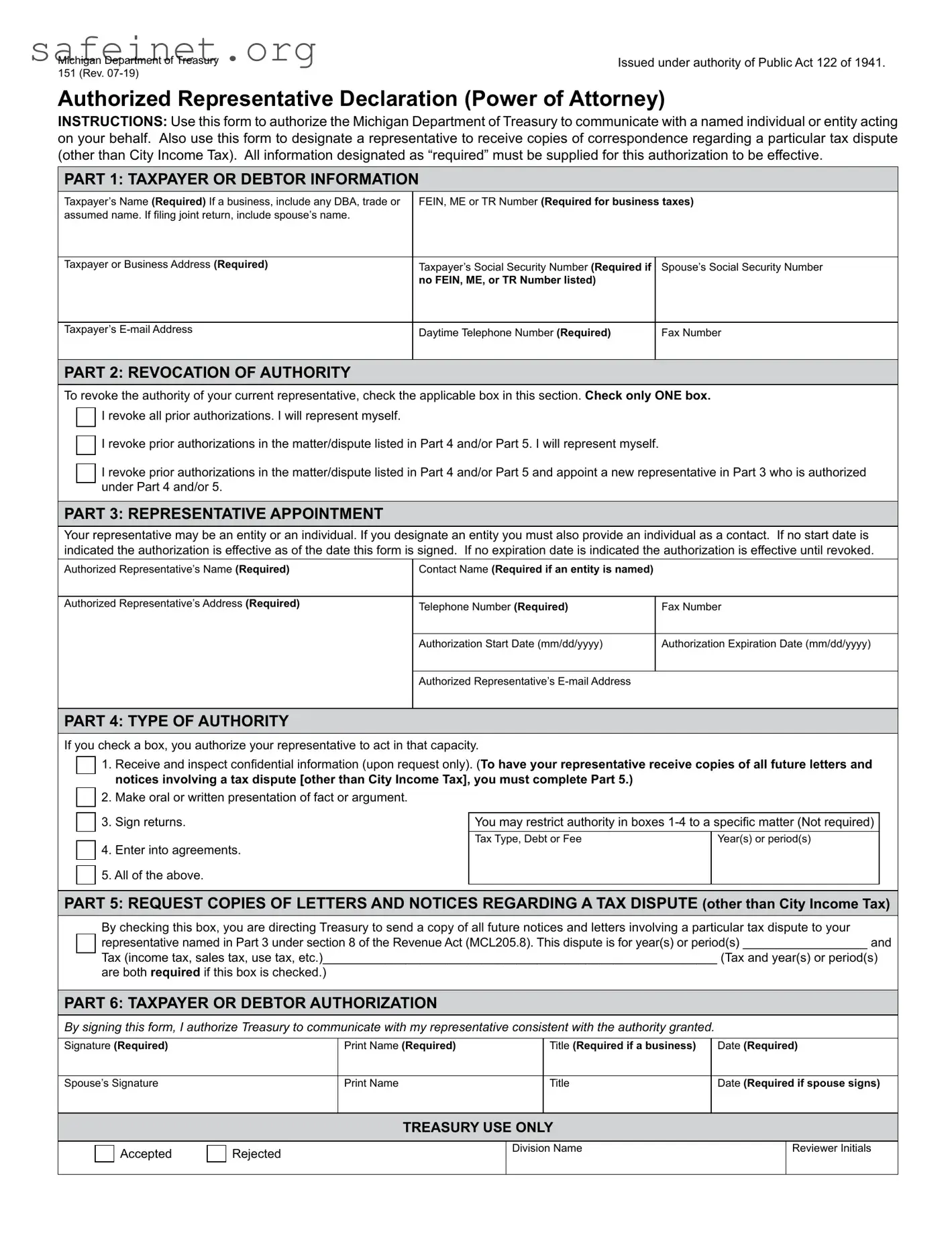

What is the Tax POA 151 form?

The Tax POA 151 form is a Power of Attorney document that allows you to designate someone else to represent you in tax matters before the Internal Revenue Service (IRS). This individual can be an accountant, attorney, or another trusted person. By granting this authority, you enable them to handle communication with the IRS on your behalf, which can simplify the tax process for you.

Who can I appoint using the Tax POA 151 form?

You can appoint any individual who is eligible to represent you before the IRS. This includes licensed attorneys, certified public accountants (CPAs), and enrolled agents. If you choose a friend or family member, they should have a good understanding of your tax situation to effectively assist you.

What kind of authority does the Tax POA 151 form grant?

This form grants the designated representative the ability to deal with the IRS on a variety of tax matters. Your representative can receive confidential tax information, discuss your tax account, and sign documents related to your tax return, among other responsibilities. However, the specifics of the authority can vary depending on your preferences, which can be indicated on the form.

How do I complete the Tax POA 151 form?

To complete the Tax POA 151 form, you will need to provide your personal information, including your name, Social Security number, and address. Next, you will need to enter the details of the person you wish to appoint as your representative. Be sure to review the authority you are granting to ensure it aligns with your needs. It is always advisable to double-check the information for accuracy before submitting the form.

Do I need to submit this form every year?

Generally, the Tax POA 151 form does not need to be submitted annually. Once executed, it remains valid until you revoke it or the IRS processes a termination. However, if you want to change your representative or if there’s a significant change in your tax situation, you will need to complete a new form.

Where should I send the Tax POA 151 form?

The Tax POA 151 form should be sent to the appropriate IRS office that handles your tax returns. The specific address can depend on your location and the nature of your tax matters. It’s prudent to verify the correct mailing address based on your circumstances, and always keep a copy of the submitted form for your records.

Can I revoke the Tax POA 151 form?

Yes, you can revoke the Tax POA 151 form at any time. To do so, you must send a written notice to the IRS. This notice should clearly state your intent to revoke the power of attorney and include your identifying information, as well as the information about the person you previously appointed. Maintaining control over your tax matters is important, and revocation is straightforward.

Is there a filing fee for the Tax POA 151 form?

No, there is no fee for filing the Tax POA 151 form. It is a necessary document for compliance with tax regulations, and the IRS does not charge for its submission. Therefore, you can appoint someone to assist you without incurring any additional costs.

What happens if I do not file the Tax POA 151 form?

If you do not file the Tax POA 151 form and require representation for your tax matters, the IRS will not recognize anyone else as having the authority to communicate on your behalf. This can lead to complications and misunderstandings regarding your tax obligations. It’s advisable to complete this form if you foresee needing assistance with your tax situation.

I revoke all prior authorizations. I will represent myself.

I revoke all prior authorizations. I will represent myself.

I revoke prior authorizations in the matter/dispute listed in Part 4 and/or Part 5. I will represent myself.

I revoke prior authorizations in the matter/dispute listed in Part 4 and/or Part 5. I will represent myself.