What is a Stock Purchase Agreement?

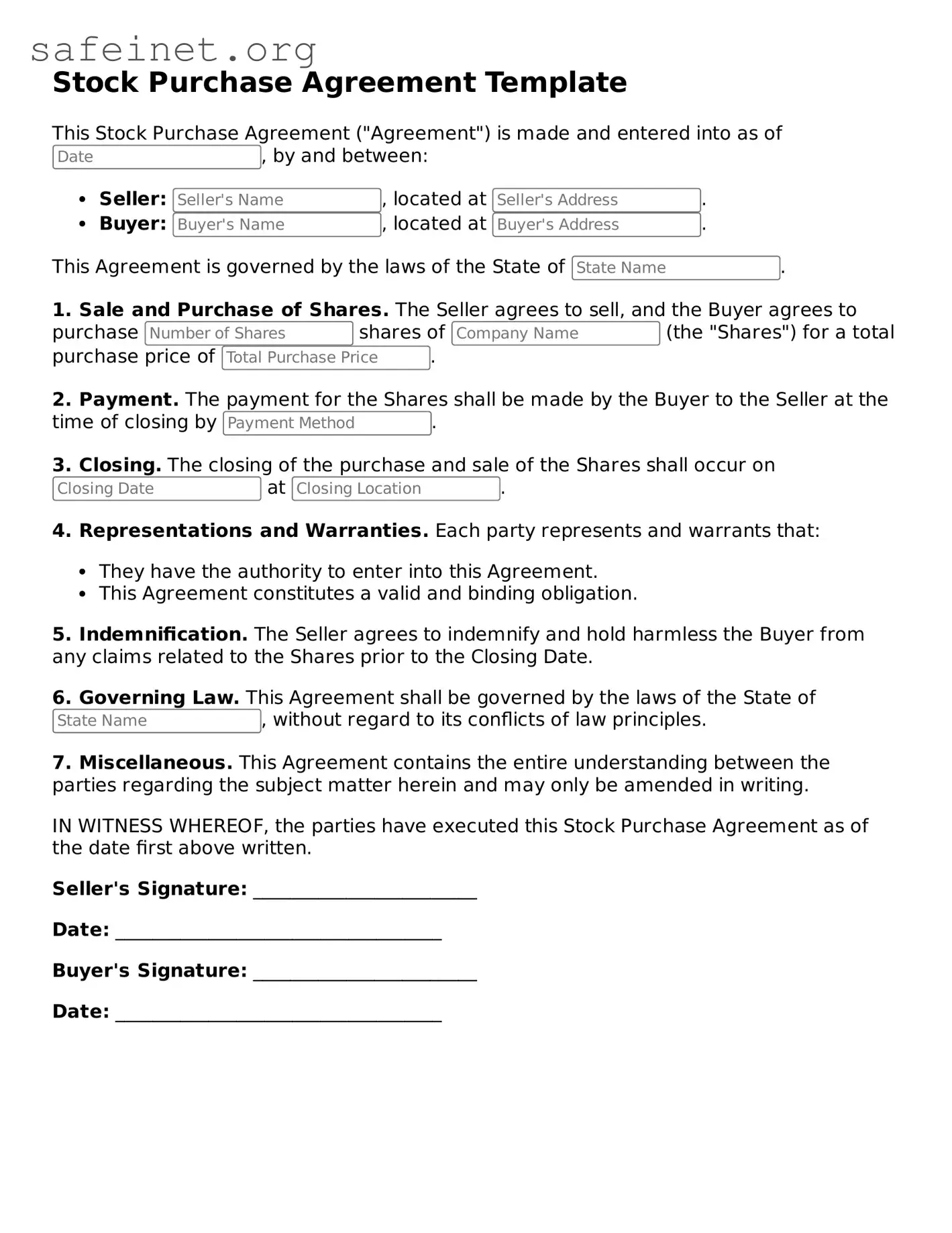

A Stock Purchase Agreement is a legal document that outlines the terms and conditions under which one party agrees to buy shares of stock from another party. This agreement includes details such as the purchase price, the number of shares being sold, and the representations made by both parties regarding the stock being transferred.

Who typically uses a Stock Purchase Agreement?

This agreement is commonly used by companies and investors involved in buying or selling stock. Both individual investors and corporate entities can utilize this form when they enter into a transaction that involves the sale of shares.

What are the key components of a Stock Purchase Agreement?

Important components generally include, but are not limited to, the identification of the buyer and seller, a description of the shares being sold, the purchase price, payment terms, conditions to closing, and representations and warranties made by each party. These elements work together to provide clarity and protection for both the buyer and seller.

Is a Stock Purchase Agreement legally binding?

Yes, once both parties sign the agreement, it becomes a legally binding document. Therefore, both the buyer and seller are obligated to adhere to the terms outlined within the agreement, provided that all legal requirements are met.

What happens if one party fails to comply with the agreement?

If a party fails to comply with the terms of the Stock Purchase Agreement, the other party may have the right to seek legal remedies. This could include seeking damages or enforcing the terms of the agreement in court, depending on the specific circumstances of the breach.

Can the Stock Purchase Agreement be amended after it is signed?

Yes, the agreement can typically be amended if both parties agree to the change. Such amendments should be documented in writing and signed by both parties to maintain clarity and enforceability.

Are there any risks associated with a Stock Purchase Agreement?

Yes, risks include that the value of the stock may fluctuate after the agreement is signed but before completion of the sale. Additionally, if the company faces legal or financial issues, the buyer may encounter complications. Conducting thorough due diligence before finalizing the agreement can help mitigate these risks.

Do I need a lawyer to draft or review my Stock Purchase Agreement?

While legal counsel is not required, consulting with a lawyer can be beneficial. They can help ensure that the agreement complies with applicable laws and addresses all necessary terms to protect your interests.

Where can I obtain a Stock Purchase Agreement form?

You can find a Stock Purchase Agreement form through various online legal document services, or you may use templates available in law books. Ensure you choose one that meets your specific needs and complies with the laws of your jurisdiction.